How you can adapt to the evolving DeFi yield ecosystem… don’t

The never-ending search for yield in DeFi

DeFi’s biggest strength, its endless innovation…is also its curse. Every day, new yield strategies launch, new risk curators appear on Morpho or Euler, and OG protocols like Sky (fka Maker) decide to roll out rewards for the first time.

The pace is impossible for any individual to keep up with.

The purveyors of yield

This problem is so widespread that entire media series exist just to help people track the chaos:

- DeFi Dad and the Edge podcast publish “Yields of the Week.”

- The Calculator Guy highlights top yields and breaks them down.

- Yannis DeFi even runs a newsletter dedicated to yield changes.

Clearly, yield in DeFi is a hot commodity that is constantly evolving and adapting.

Knowledge is great, but why chase it?

Learning about strategies can be fun, but if your goal is to earn on your assets, chasing yields is a distraction.

Ask yourself: in just the last 30 days across Morpho, Euler, Sky, and Maple, how many new opportunities came online? And how much yield did you miss because you weren’t in the right place at the right time?

On Morpho alone, users have to navigate 14 pages of yield opportunities.

With the Lazy Summer Protocol, you don’t need to chase. Deposit once, and your capital is automatically rotated into the best risk-adjusted yields available.

Lazy Summer evolves with the market

Lazy Summer protocol continuously adapts as DeFi grows. The protocol has just added 25 new yield sources across Morpho, Euler, and Gearbox, so depositors always benefit from the latest opportunities and the highest yields.

The power of automated earning

DeFi yield isn’t slowing down, it’s accelerating. New vaults and strategies launch daily across chains and protocols, making it harder for individuals to stay ahead.

With Lazy Summer Protocol, you don’t have to.

- One deposit → automatic exposure to DeFi’s best yields.

- Continuous updates → new yield sources are added as they launch.

- Risk-managed allocation → curated by top partners, so you don’t have to worry about strategy selection.

Stop chasing yield. Start earning it—automatically.

👉 Deposit into Lazy Summer today

New USDC Yield Sources

Morpho USDC Gauntlet Prime

Protocol: Morpho

Curated vault optimized for risk-adjusted yield across large, liquid collateral markets.

Silo Swap Lend susdx 127 USDC

Protocol: Silo

Isolated-risk USDC lending routed through Silo, tied to Swap market 127.

Morpho USDC Gauntlet Core

Protocol: Morpho

Higher-risk Core vault, whitelisting liquid markets and optimizing across them.

Euler Arbitrum USDC

Protocol: Euler

USDC lending on Euler’s Arbitrum deployment with isolated market design.

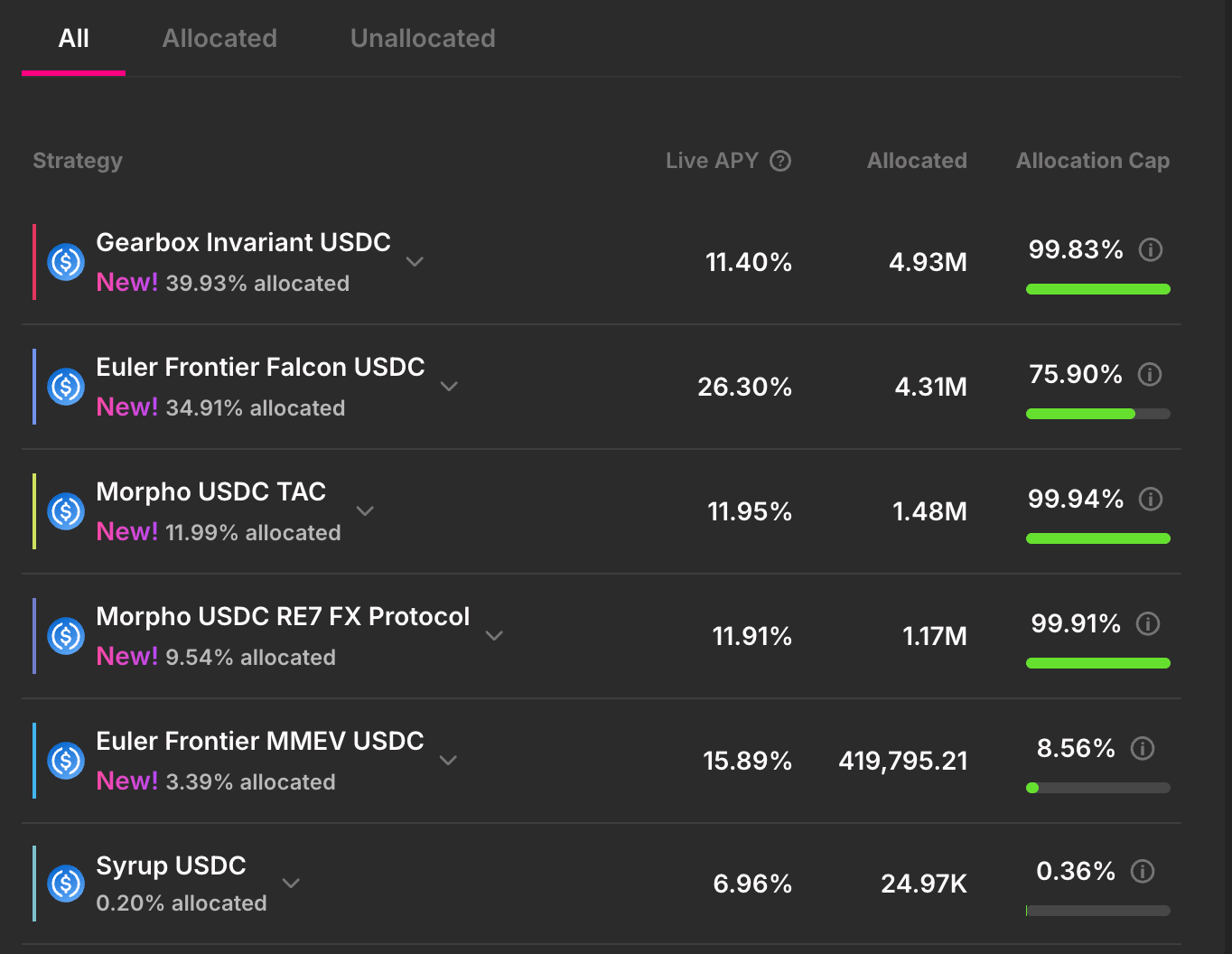

Gearbox Invariant USDC

Protocol: Gearbox

Managed by Invariant Group; it combines structured credit, leverage, and lending yield.

Euler Frontier MMEV USDC

Protocol: Euler Frontier

Experimental USDC market designed by MEV Capital.

Euler Frontier Falcon USDC

Protocol: Euler Frontier

High-risk/high-reward USDC market curated as “Falcon.”

Euler Frontier Hyperwave USDC

Protocol: Euler Frontier

Volatile USDC market “Hyperwave,” under Frontier curation.

Euler Frontier YieldFi USDC

Protocol: Euler Frontier

Research-oriented “YieldFi” market for USDC.

Morpho USDC TAC

Protocol: Morpho (TAC)

TAC-managed vault allocating across liquid assets for optimized yield.

Morpho USDC Steakhouse InfiniFi

Protocol: Morpho (Steakhouse)

Steakhouse-curated vault lending against InfiniFi ecosystem collateral.

Morpho USDC RE7 FX Protocol

Protocol: Morpho (RE7)

Partners with Aladdin DAO; lends against assets in the f(x) ecosystem.

Morpho USDC Avantgarde Core

Protocol: Morpho (Avantgarde)

Dynamic allocation across liquid collateral markets for risk-adjusted yields.

Morpho USDC ExtraFi XLend

Protocol: Morpho (Extrafi)

Curated vault targeting high-demand collateral markets on Base.

Silo Managed Vault Varlamore Growth USDC

Protocol: Silo Managed Vault

Growth-oriented USDC strategy using Silo’s isolated lending rails.

Morpho USDC Vault Bridge

Protocol: Morpho

Bridge vault optimizing USDC yield while lending against curated collateral.

New ETH Yield Sources

Morpho WETH ExtraFi XLend

Protocol: Morpho (Extrafi)

Curated WETH vault for high-demand collateral markets on Base.

Morpho WETH Yearn OG

Protocol: Morpho (Yearn)

Yearn-curated WETH vault across moderate-risk markets, algorithmically optimized.

Morpho WETH SingularV

Protocol: Morpho (SingularV)

Vault is designed for maximized return with careful collateral/oracle risk checks.

Euler Alterscope LRT WETH

Protocol: Euler / Alterscope

WETH vault with liquid restaking exposure and Alterscope risk management.

Euler Frontier Upshift WETH

Protocol: Euler Frontier

“Upshift” isolated WETH market; higher risk/reward.

Morpho WETH Avantgarde Core

Protocol: Morpho (Avantgarde)

Dynamic WETH allocation across liquid markets for risk-adjusted yield.

Morpho WETH Alpha Core

Protocol: Morpho (Alpha)

Blue-chip DeFi strategy with proven earnings; prioritizes safety and long-term value.

Morpho WETH TAC

Protocol: Morpho (TAC)

TAC-managed vault allocating WETH across liquid assets.

Morpho WETH Indexcoop HyETH

Protocol: Morpho/Index Coop

High-yield ETH index curated by Gauntlet; allocates across diverse lending opportunities above staking yield.

Euler Frontier Puffer WETH

Protocol: Euler Frontier / Puffer

Combines Euler’s isolated lending with Puffer’s liquid restaking.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.