How to Get Started with a Borrow Vault: From Beginners to DeFi Experts

There is more than one reason you might want to get some liquidity but still hold your crypto; this is where lending protocols come into the game, and Summer.fi, as an aggregator of the most trusted ones, is the place to go. Whether you’re just getting started or looking to up your game, Summer.fi’s Borrow is your go-to tool. Beginner or expert? Doesn’t matter; this article is for everyone.

Step 1: Getting Started

All right, beginners, let’s keep it simple and smooth.

Set Up Your Wallet

First things first, you’ll need a wallet. MetaMask is a crowd favorite, but there are other alternatives, such as Rabby or Rainbow. Just install the extension on your browser and follow the setup instructions. Don’t forget to store your seed phrase securely, it’s your lifeline for wallet recovery.

Deposit Funds

Next up, deposit some funds into your wallet. Most users start with Ethereum (ETH) since it’s one of the bones of DeFi, and you will need it to pay for gas later. You can grab some ETH on exchanges like Coinbase or Binance, then transfer it to your MetaMask wallet.

Connect to Summer.fi

Head over to Summer.fi and connect your wallet.

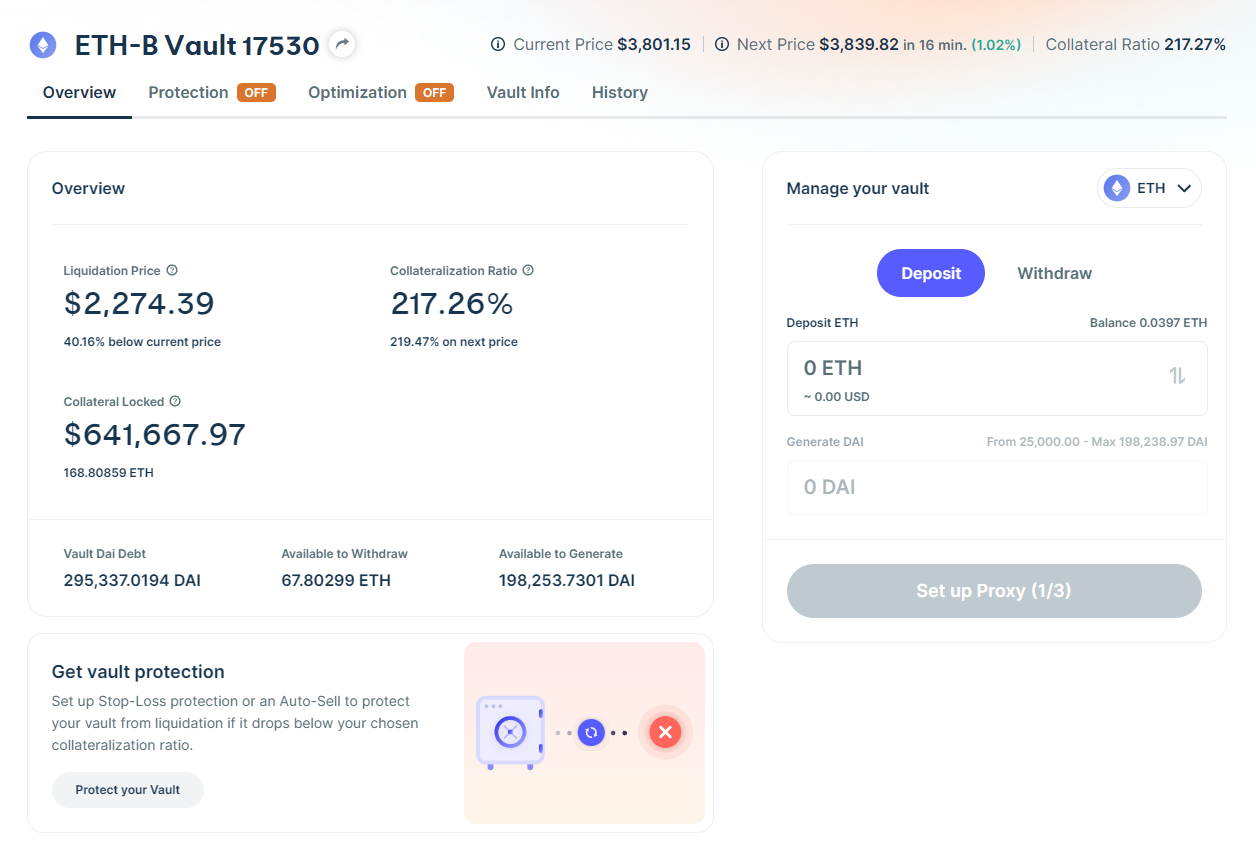

Deposit and Borrow

Here’s where the magic happens. Deposit your ETH into the Borrow Vault as collateral. Then, borrow against it. The UI is designed to be super user-friendly—just enter your deposit and borrow amounts, confirm the transaction, and you’re good to go!

Step 2: Monitor the vault

Effective monitoring is crucial to avoid liquidation; let's go over some bullet points you need to take care of:

- Collateral Value: Regularly check the market value of your collateral. Since crypto is volatile, the value of your collateral can fluctuate significantly, which will have an effect on your LTV.

- Monitor Borrowed Amounts: Keep an eye on the interest accruing on your borrowed assets. This will help you manage repayments and understand your debt's growth over time.

- Vault Overview: Use the Overview tab of your position to get a comprehensive view of your vault's status, including vault debt, collateral value and liquidation price.

Step 3: Managing the vault

It's crucial to monitor your vault's Collateralization Ratio (or LTV for non-Maker vaults) closely. This key ratio indicates the safety margin of your collateral compared to the borrowed amount. A higher CR means a lower liquidation risk, so maintaining it is vital. To do this, you might need to periodically add more collateral or repay part of your borrowed assets, especially during market volatility.

On the other hand, you can also generate more debt or withdraw some collateral, which will drive your CR lower and closer to liquidation.

Extra features for your vault

Summer.fi has a suite of automation tools that can seriously level up your strategy. You can set up Stop-Loss and Trailing Stop-Loss to protect your position. These automations will sell off your assets if their value drops minimizing your losses.

You can also use Take-Profit and Auto Take-Profit to lock in your gains. These tools automatically sell your assets when they hit a certain profit level, so you can capture profits without constantly watching the market.

Combining Automations

The real magic happens when you combine these automations. For example, you could pair a Stop-Loss with a Take-Profit to manage risk and maximize profits. If the market goes against you, the Stop-Loss kicks in. If it goes your way, the Take-Profit locks in those sweet gains.

Things You Can Use a Borrow Vault For

You would like to use a Borrow vault for many reasons instead of selling your crypto for liquidity.

- Leverage: Borrow assets to trade, increasing your exposure to potential gains. However, this also increases risk, so it's important to manage it carefully.

- Yield Farming: Borrow assets to participate in yield farming. Staking these assets in liquidity pools or other DeFi protocols for more tokens!

- Hedging: If you believe the value of your collateral might decrease, you can borrow against it and use the borrowed assets to hedge your position.

- Arbitrage Opportunities: Borrow assets to exploit price differences across DeFi. This can help you profit from market inefficiencies.

With all this info, you're no longer a beginner and can start exploring the power of borrowing against your crypto on Summer.fi!

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.