How Lazy Summer Unlocks the Best DeFi Yields

The Lazy Summer Protocol gives you access to DeFi’s best yields, optimized and automated by advanced AI-powered keepers. But what makes these yields the best? And more importantly, where does the yield come from?

Not All Yields Are Created Equal

In DeFi, yield opportunities are everywhere, but not all are worth your time—or your trust. Some offer high returns but come with excessive risk while others might not be sustainable.

The Lazy Summer Protocol is built to solve these problems by:

- Selecting only the best yields: Yields that are transparent and sustainable.

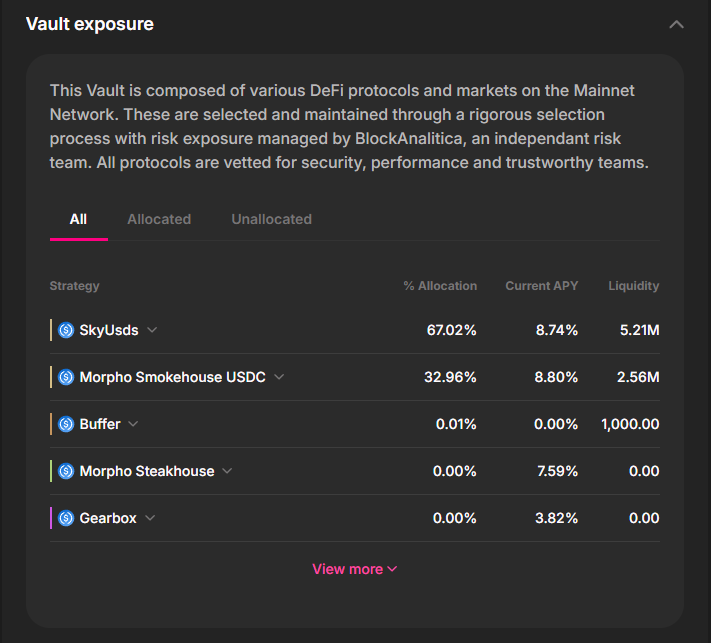

- Curating high-quality protocols: Verified by governance ($SUMR holders) and expert risk managers like Block Analitica.

This ensures that you earn optimal returns without needing to spend hours researching or worrying about unreliable strategies.

The Six Core Sources of DeFi Yield

DeFi yield doesn’t appear out of thin air. It comes from specific strategies tied to real crypto-economic activity. The Lazy Summer Protocol currently focuses on six of the proven yield sources:

- Tokenized Basis Trading: Capturing profits from the price differences between spot and futures markets.

Where the yield comes from: Traders maintaining futures positions pay fees, which are passed on to you.

- Leveraged Yield Looping: A strategy that involves borrowing and re-supplying assets to amplify returns.

Where the yield comes from: The difference between borrowing costs and lending rewards, often enhanced by additional incentives from protocols.

- Staking: Locking up tokens to secure blockchain networks and support their operations.

Where the yield comes from: Rewards distributed by the network, often reinvested for additional returns.

- Liquidity Providing: Contributing assets to liquidity pools on decentralized exchanges (DEXs).

Where the yield comes from: Trading fees collected from users who swap assets in these pools.

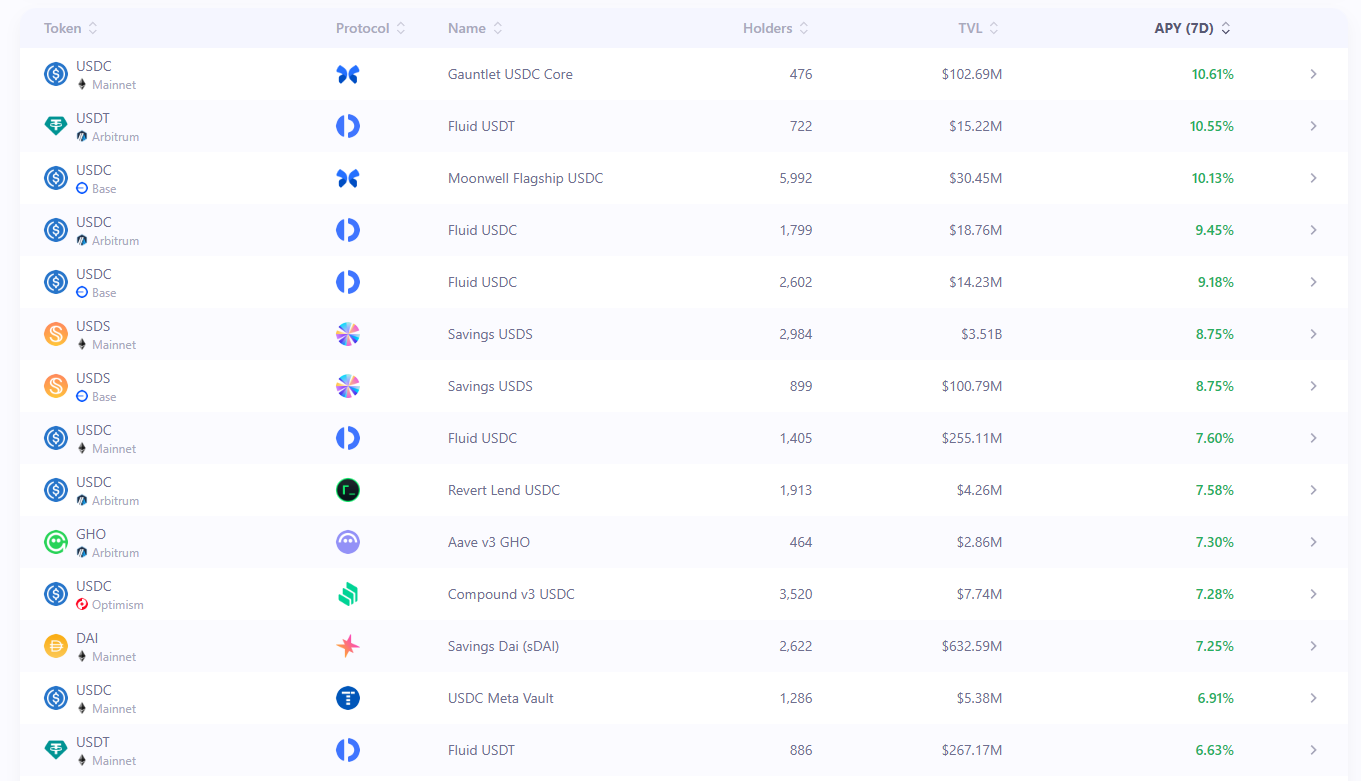

- Lending Protocols: Allowing your assets to be borrowed through decentralized lending platforms.

Where the yield comes from: Interest paid by borrowers, sometimes supplemented by protocol incentives.

- Yield Farming: Allocating assets to different protocols to take advantage of temporary rewards.

At this point the Lazy Summer Protocol is focused on Lending Protocols, while the other sources of yield will be added soon

What Makes Lazy Summer Protocol Different?

The Lazy Summer Protocol is not just about finding yield; it’s about ensuring that yields meet the highest standards. Here’s how:

Transparency: You’ll always know which strategy or protocol is generating your yield, clearly visible via the user interface on the Summer.fi app.

Sustainability: Yields are derived from real economic activity, avoiding the traps of short-lived or predatory schemes.

Security: Governance ensures that only protocols with strong technical integrity, credible teams, and proven track records are selected.

This combination ensures you achieve optimal returns without accepting unnecessary risk.

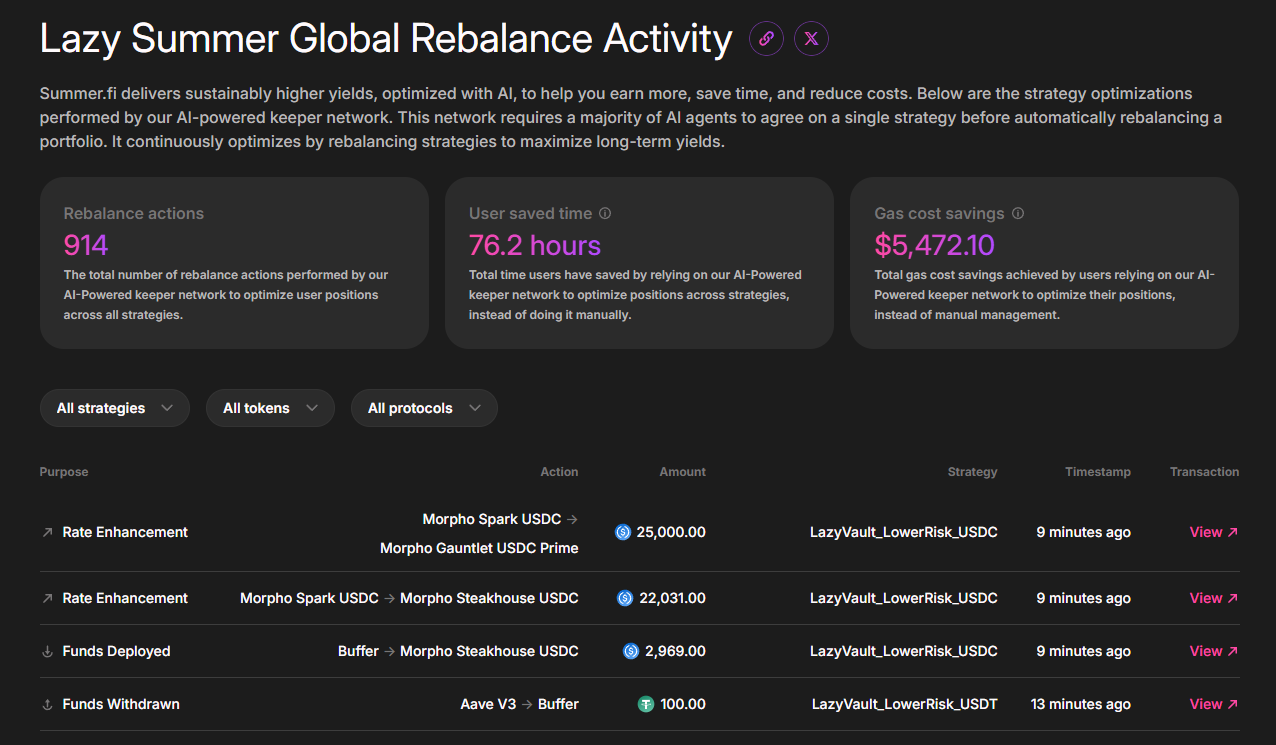

AI-Powered Optimization: Yield Without the Hassle

One of the biggest challenges in DeFi is that yield opportunities continuously fluctuate across strategies and protocols. The Lazy Summer Protocol’s AI-powered keepers continuously monitor the market and:

- Identify the top-performing opportunities.

- Automatically rebalance your capital to capture the highest sustainable returns.

This means your assets are always working at peak efficiency without the need for constant intervention or monitoring.

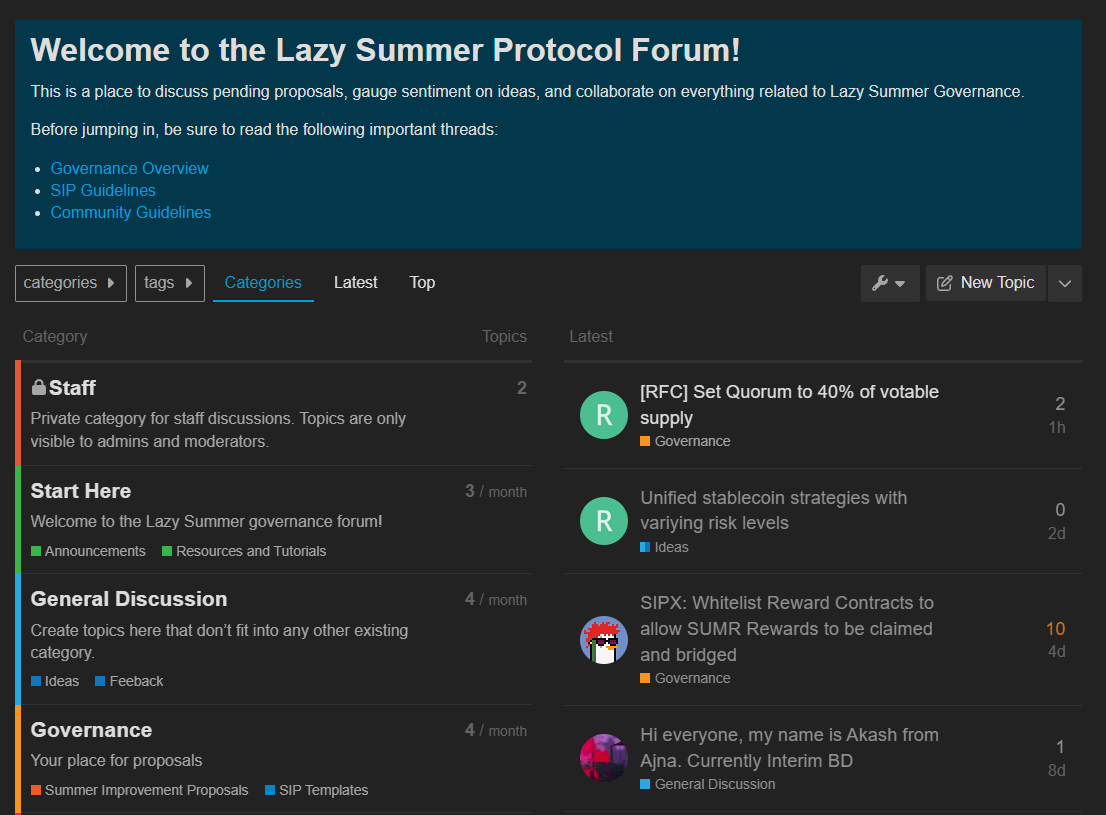

Governance and Continuous Improvement

The Lazy Summer Protocol is governed by $SUMR token holders and curated by expert risk teams. Together, they:

- Adjust core strategies and risk parameters to adapt to changing market conditions.

- Select only the most reliable and innovative yield strategies as they emerge.

- Ensure that the system remains transparent, secure and profitable over time.

Lazy Summer ensures its strategies are always risk-optimized for safety and growth by aligning incentives with governance.

Ready to get started?

Visit Summer.fi to see how effortless earning in DeFi can be.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.

Oazo Apps Limited functions solely as a front-end interface provider and does not launch, operate, or issue tokens for the Lazy Summer Protocol. The information provided is for informational purposes only and does not constitute investment advice. Users interact with the protocol at their own risk.