How Aave is Better on Summer.fi

Aave is one of the leading protocols in terms of borrowing and lending. With over 20B in assets and a presence across 8 networks, it is a well-known DeFi protocol. Even though you can access Aave through its front end, Summer.fi front end adds a series of features on top that make Aave #BetterOnSummer.

Let’s go over a few of them:

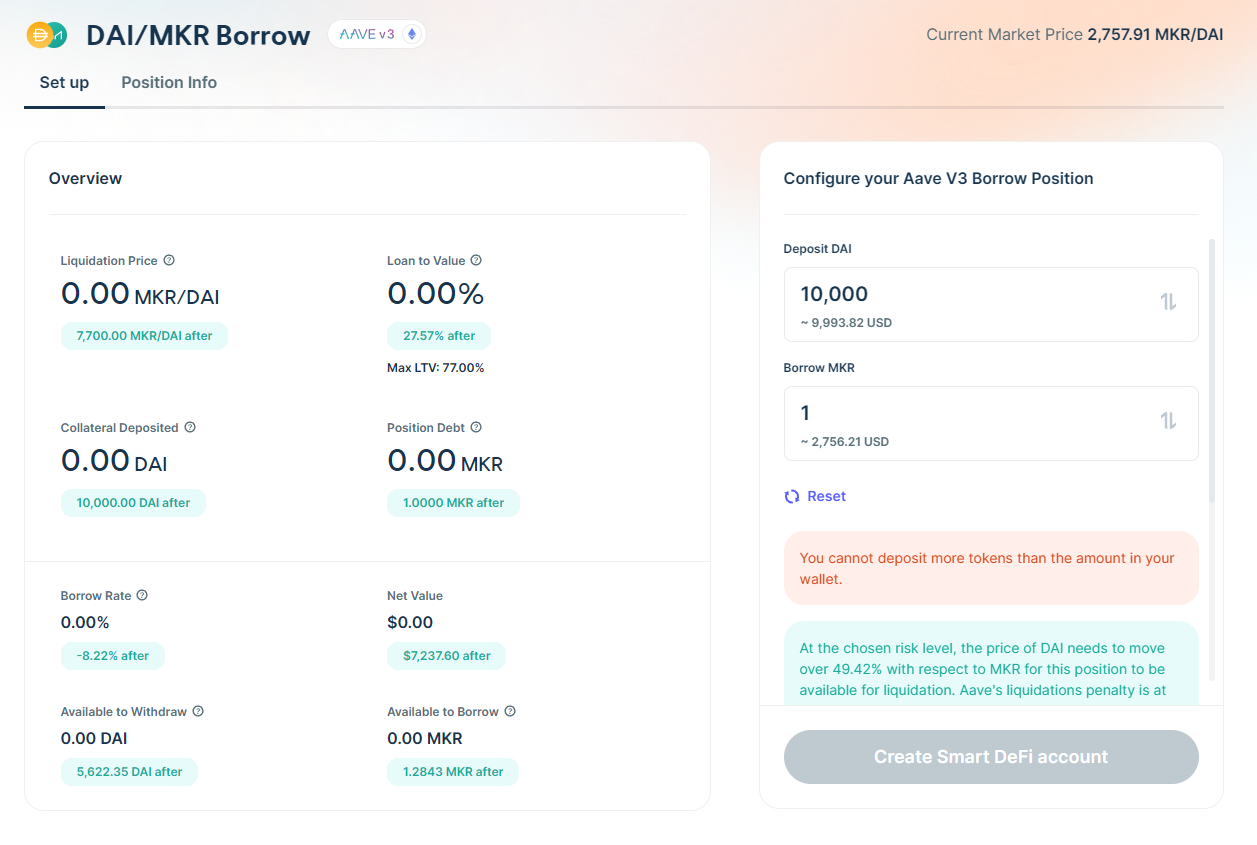

Deposit and Borrow in one transaction.

Instead of using Aave’s front end to deposit funds and then borrow separately, Summer.fi makes it way easier by letting you do both in one go. Just enter your deposit and borrow amounts; all the details will appear in the interface before you confirm. Simple as that!

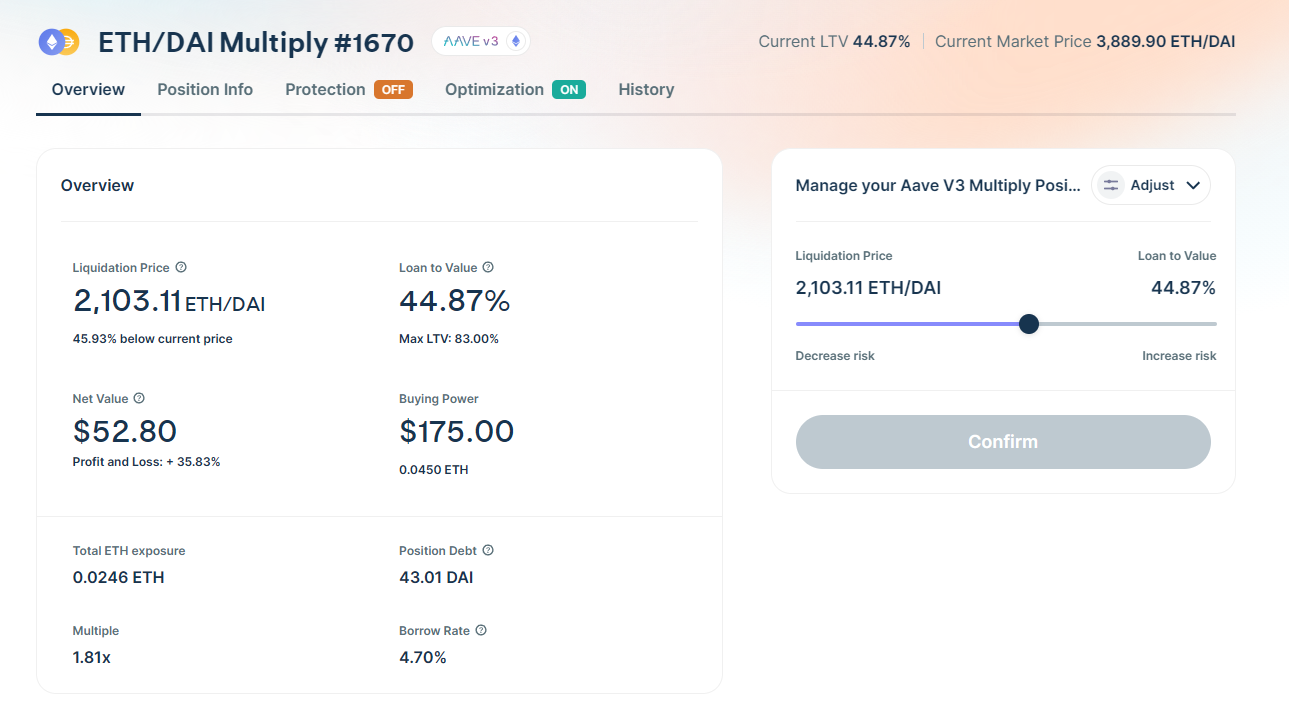

Multiply on Aave.

One of the most used Summer.fi features on Aave, is “Multiply”. This powerful tool allows you to execute multiple actions within a single transaction. With just one click, you can deposit capital, borrow against it, purchase additional capital using the borrowed funds, and redeposit those new assets back into your Aave position. Multiply enables you to ramp up your exposure to 2x, 3x or 4x leverage in one smooth operation. Contrarily, it also lets you unwind positions easily- you can repay loans directly from collateral and close out positions without requiring any funds in your wallet.

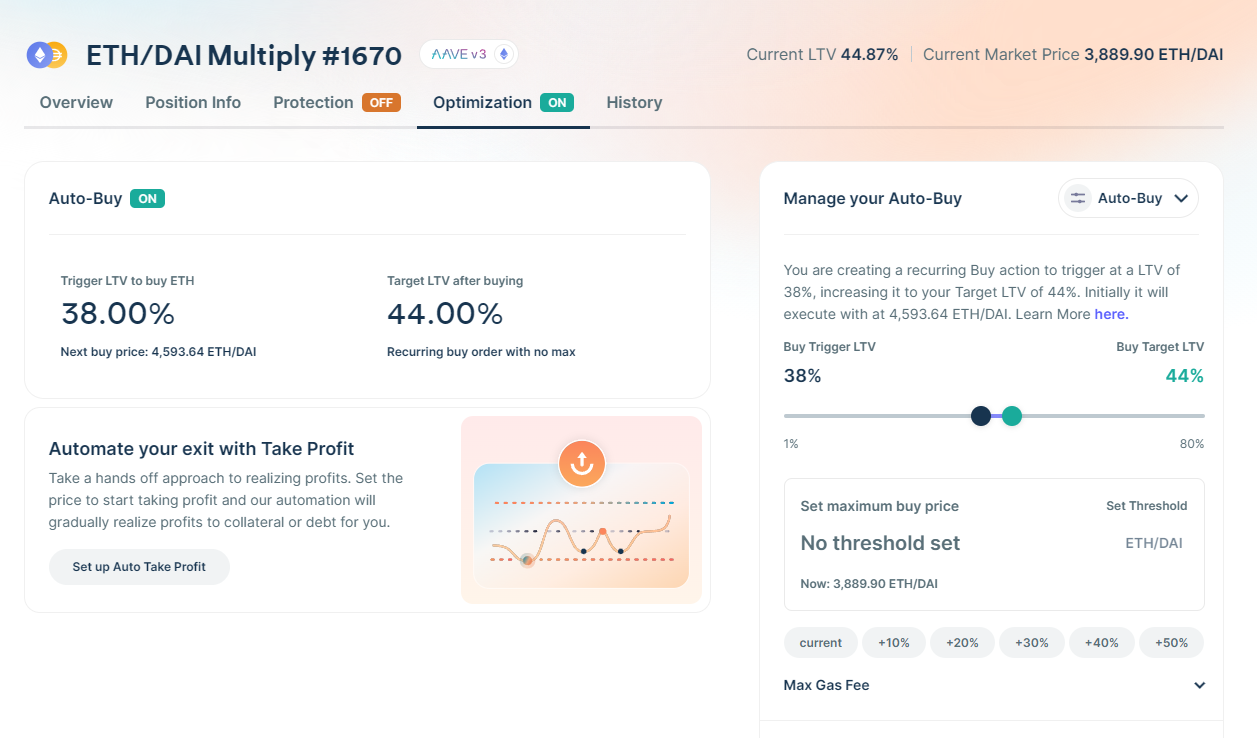

Automate your exit strategy.

Summer.fi has this awesome suite of automations for Aave that lets you craft your own strategy. You can use one or mix and match a few to get just what you need. Want to protect your position? You’ve got options like Stop-Loss and Trailing Stop-Loss. Planning your exit? Go for Take-Profit or Auto Take-Profit. For example, you could pair Stop-Loss with Take-Profit to keep a close eye on your risk. If things start to go south, Stop-Loss has your back, but if everything’s going your way, Take-Profit will lock in those gains.

Optimize your collateral management with Auto-Buy and Auto-Sell.

Gone are the days of kicking yourself for missing a good buying opportunity or wishing you’d sold earlier. With Summer.fi’s Auto-Buy and Auto-Sell, you no longer have to worry about that. No need to scramble for extra capital, just use the debt and collateral from your position to make the most of the market. And the best part? You don’t have to be glued to your computer, Summer.fi handles it all for you!

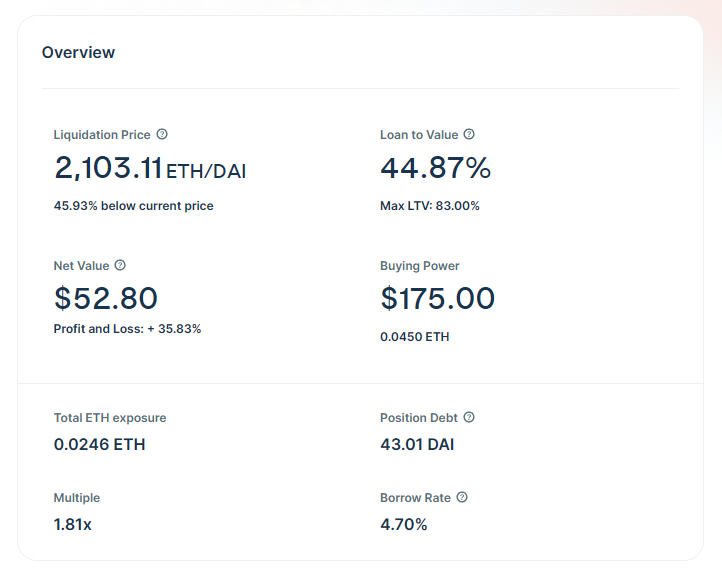

Clear information about your position.

Understanding your position’s details is key for good risk management, and Summer.fi ensures you’ve got all the info you need right there. Knowing your liquidation price is a big deal because it tells you the market price at which your assets might get sold to cover the loan. This helps you keep an eye on risk.

Keeping your Loan to Value (LTV) ratio in check is crucial too. It shows how much you've borrowed compared to the value of your collateral, so staying within safe margins can prevent your assets from getting liquidated.

Your Net Value is super important because it gives you a clear snapshot of what your investment is worth right now, with all the info neatly pulled together in one place.

In short, having all this information at your fingertips is indispensable for making smart decisions, managing risks, and maximizing the potential of your position.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.