How Lazy Summer amplifies Euler finance, so you never miss Euler’s best markets.

What is Euler?

Euler is an on-chain lending protocol. In V2, it’s been rebuilt as a modular, “vault-based” system where anyone can spin up isolated lending markets for almost any ERC-20 prioritizing security, capital efficiency, and developer flexibility.

Why Euler markets are so powerful

Euler markets are powerful because they’re isolated, permissionless, and modular: each market is its own vault set (clean risk boundaries, no cross-asset spillover), anyone can launch new vaults, and builders can swap components in and out, like oracles or interest-rate models to make markets unique to specific use cases.

The known yield challenge in DeFi

Euler, due to its architecture, is isolated, permissionless, and modular. New vaults come to market all the time. That’s great for innovation, but terrible for users who don’t want to spend ample time chasing, vetting, and switching strategies.

The team at Euler has even recognized this with the recent release of EulerEarn, a single vault position that gives exposure to multiple Euler vaults.

But what happens when the Euler vaults fall behind another protocol briefly? … a Morpho, or a Maple.

How do you keep up? You shouldn’t have to.

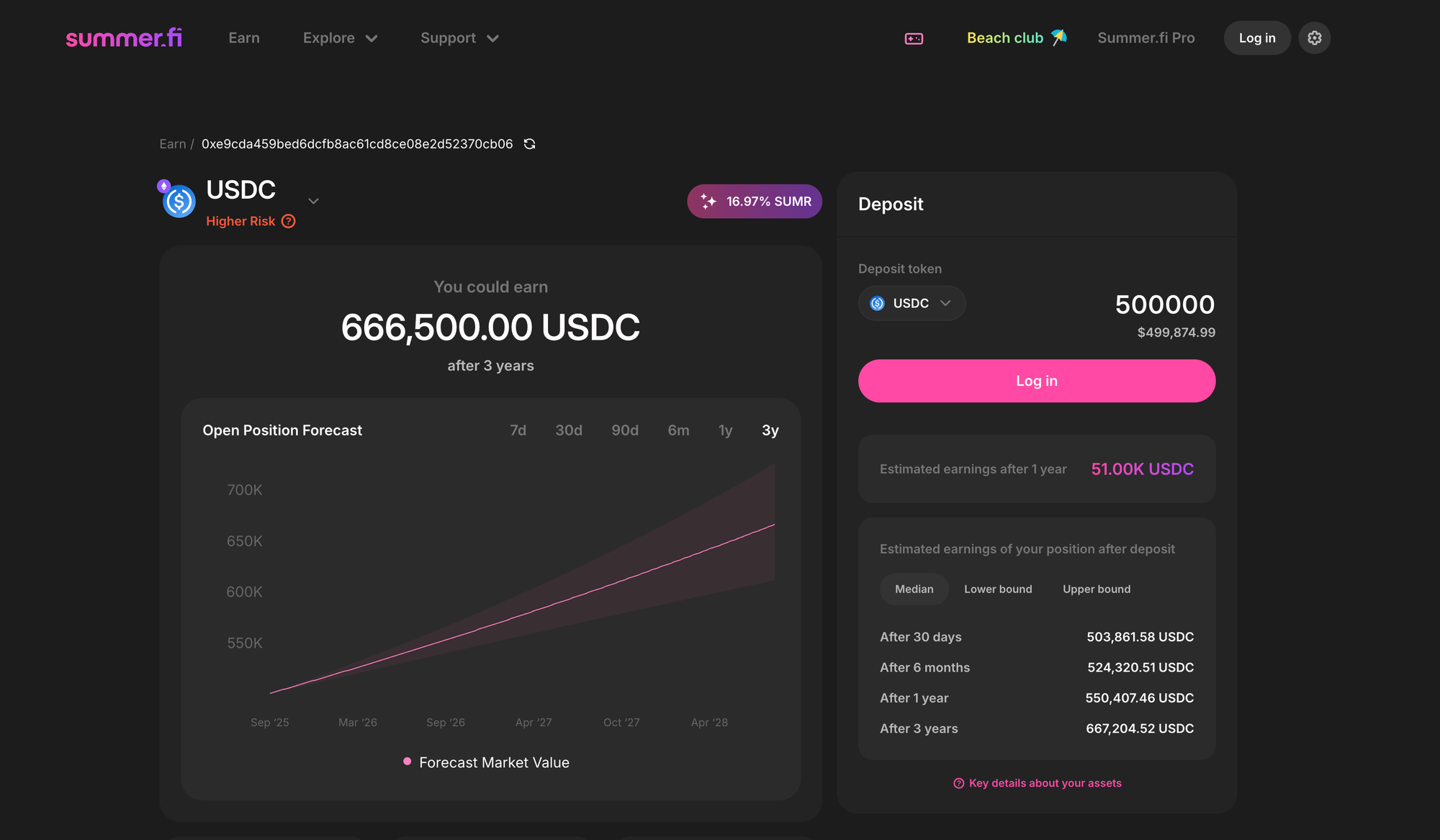

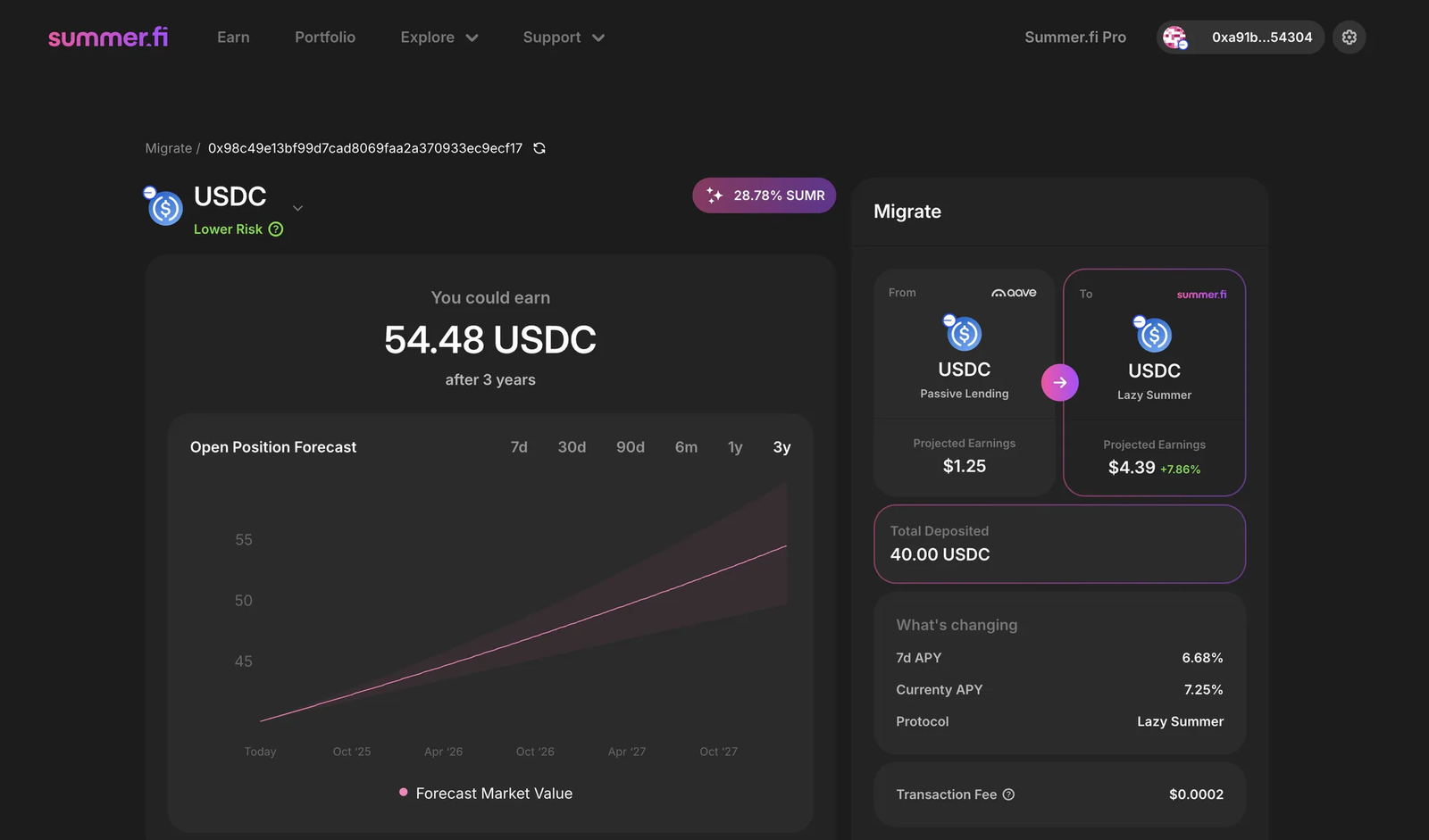

You shouldn’t live in dashboards or miss better opportunities because you’re parked in yesterday’s Euler market. If you want exposure to Euler’s best risk-adjusted opportunities and the rest of the DeFi yield market when they’re best, then Lazy Summer is for you.

Lazy Summer Protocol × Euler: all the best Euler yields, all the best DeFi yields, with just one deposit

How Lazy Summer makes Euler shine:

- Autopilot rebalancing. The protocol rotates between Euler Vaults as relative yield, liquidity, and risk evolve, so you ride leaders, not laggards.

- Independent guardrails. Collateral tiers, caps, liquidity/venue checks, and concentration limits keep exposure diversified by Block Analitica.

- Cross-protocol context. When Euler leads on risk-adjusted return, the protocol leans in. If another protocol briefly outperforms, the protocol adapts, then returns when Euler reclaims the edge.

- Less chasing, more compounding. Fewer manual tx’s. More time in the right vaults.

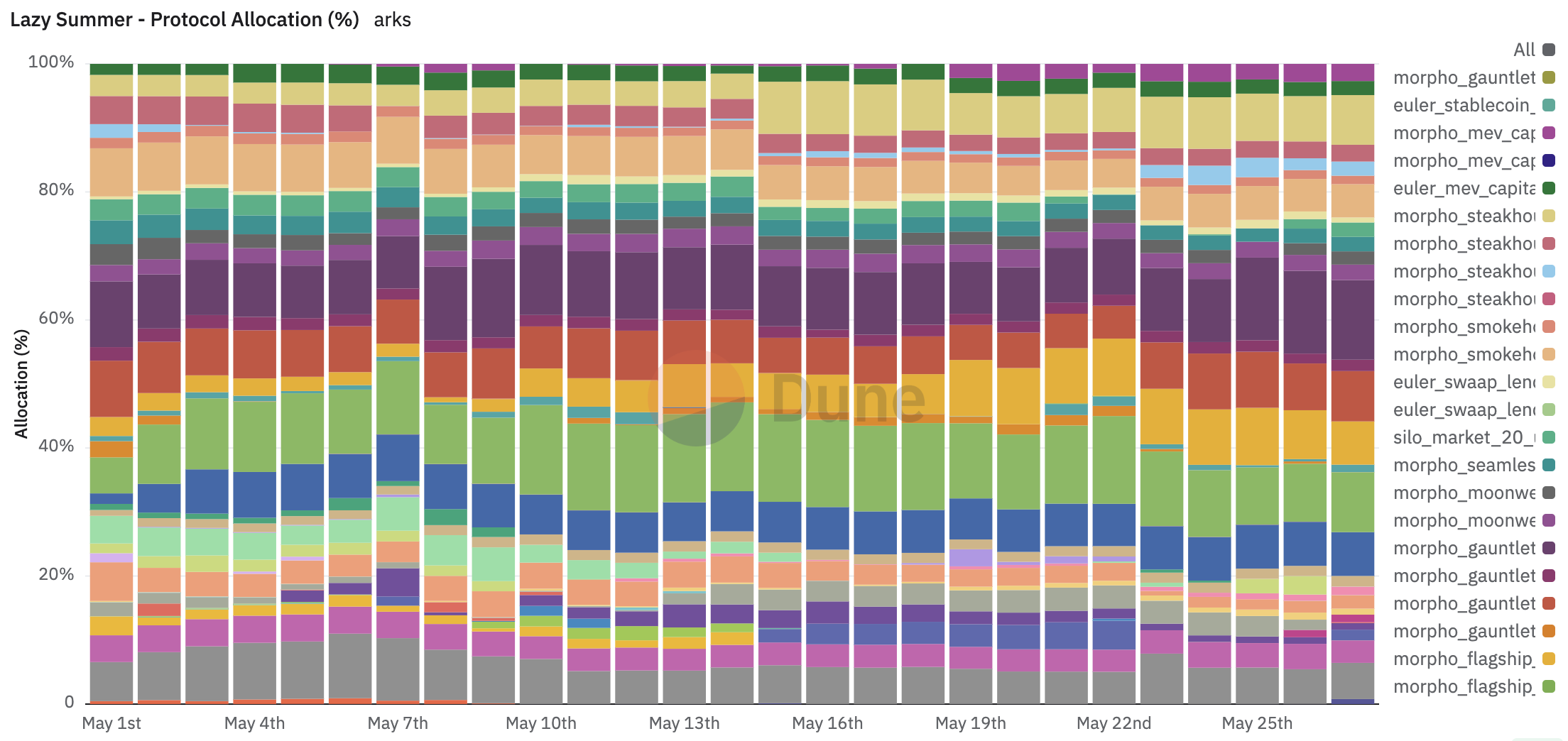

In fact, just 4 months ago, Euler accounted for a large percentage of yield source generation for the Lazy Summer protocol. Specifically, by the end of May, Euler accounted for 16% of Lazy Summer’s TVL yield generation across 15 different Euler Vaults.

This is truly a match made in heaven and shows the power of DeFi composability, as no one depositor could ever achieve this on their own.

All of this while also giving users access to other yield strategies in the same league as Euler like Origin, Morpho, Silo, Fluid, Maple, AAVE, Sky and Spark.

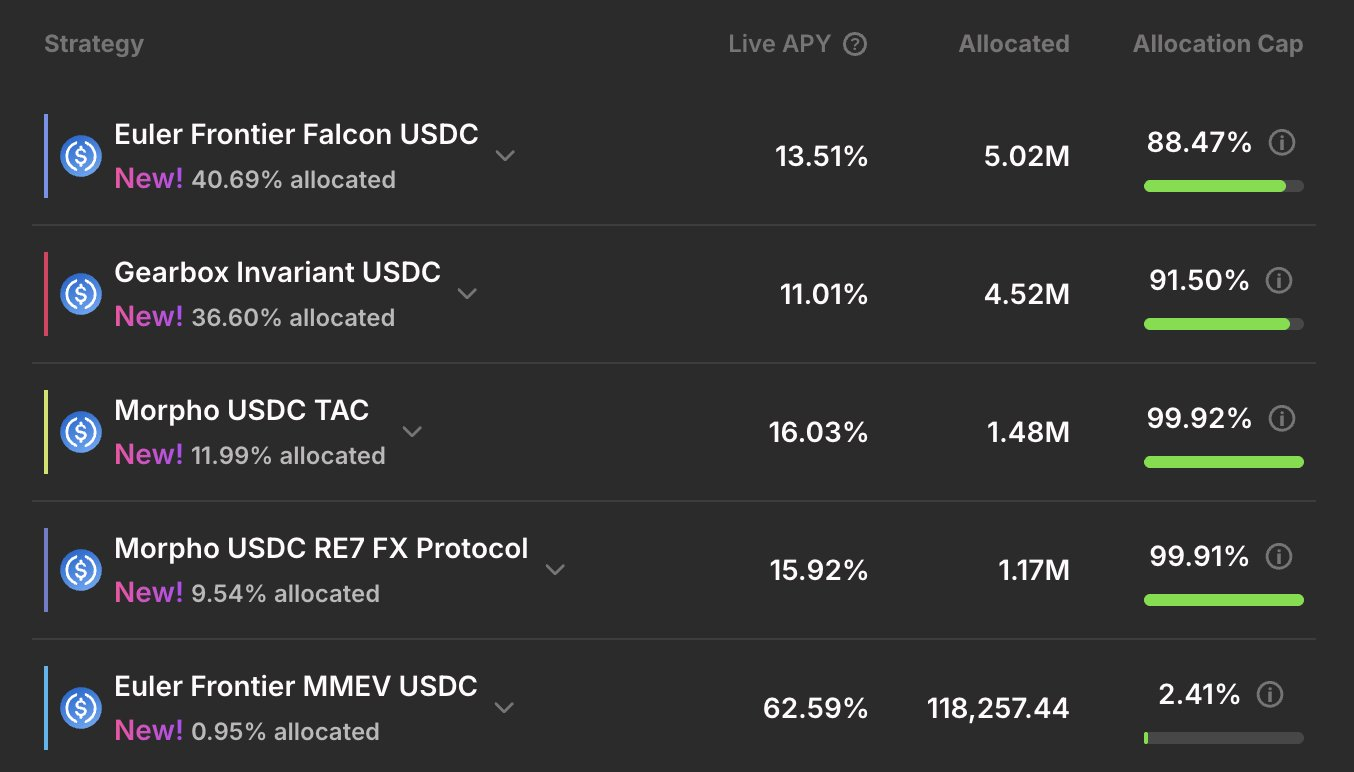

Meet the new Euler yield sources

Recently, Lazy Summer added 15 new Morpho Vaults for USDC and ETH, bringing the total number of Morpho Vaults to 55 different Morpho yield sources on the Lazy Summer Protocol. All of which can be accessed automatically with a single deposit. No manual management whatsoever.

New Morpho USDC Yield Sources

New Euler USDC yield sources

Euler Arbitrum USDC

USDC lending on Euler’s Arbitrum deployment with isolated market design.

Euler Frontier MMEV USDC

Experimental USDC market designed by MEV Capital.

Euler Frontier Falcon USDC

High-risk/high-reward USDC market curated as “Falcon.”

Euler Frontier Hyperwave USDC

Volatile USDC market “Hyperwave,” under Frontier curation.

Euler Frontier YieldFi USDC

Research-oriented “YieldFi” market for USDC.

New Euler ETH yield Sources

Euler Alterscope LRT WETH

WETH vault with liquid restaking exposure and Alterscope risk management.

Euler Frontier Upshift WETH

“Upshift” isolated WETH market; higher risk/reward.

Euler Frontier Puffer WETH

Combines Euler’s isolated lending with Puffer’s liquid restaking.

Get the best of Euler now on Lazy Summer Protocol

Deposit → Start earning Euler’s best, automatically.

TL;DR

Lazy Summer Protocol has onboarded a bunch of new Euler markets:

- WETH: Alterscope LRT, Frontier Upshift, Frontier Puffer

- USDC: Frontier MMEV, Falcon, Hyperwave, YieldFi + Arbitrum USDC

- Deposit once, and your capital is routed across Euler’s best risk-adjusted opportunities—automatically, without babysitting dashboards.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.