How can Summer.fi help you take advantage of the bull market?

Is the bull market here? by most measures, it is clear that this cycle's bull market has started in earnest.

Of course, there is no specific criteria by which a bull market is officially declared, but there are a few time tested indicators that can help us to make the case.

Stablecoin supply is growing.

Source: Checkonchain.com

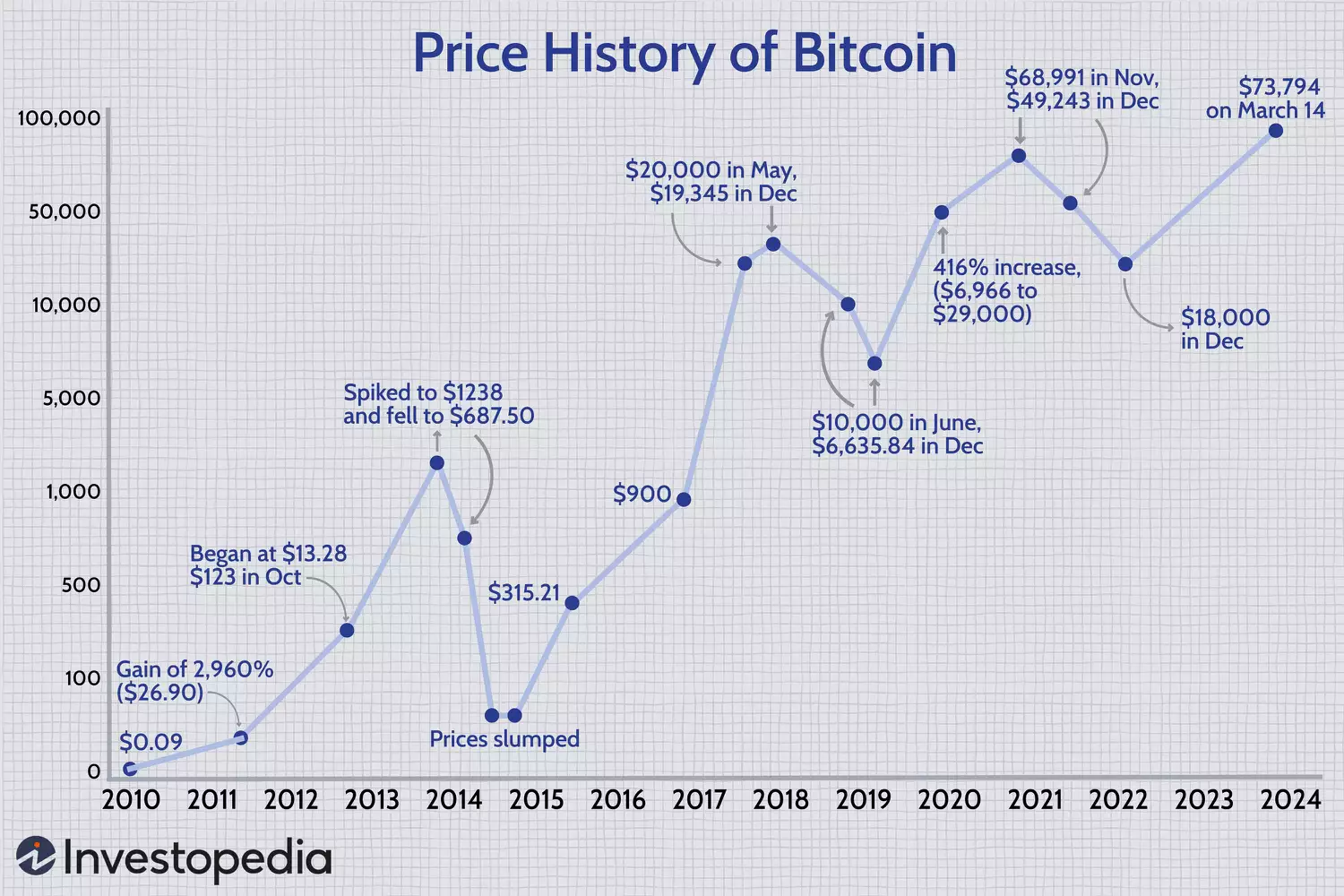

Bitcoin has breached it’s previous cycles all time high.

Source: Investopedia

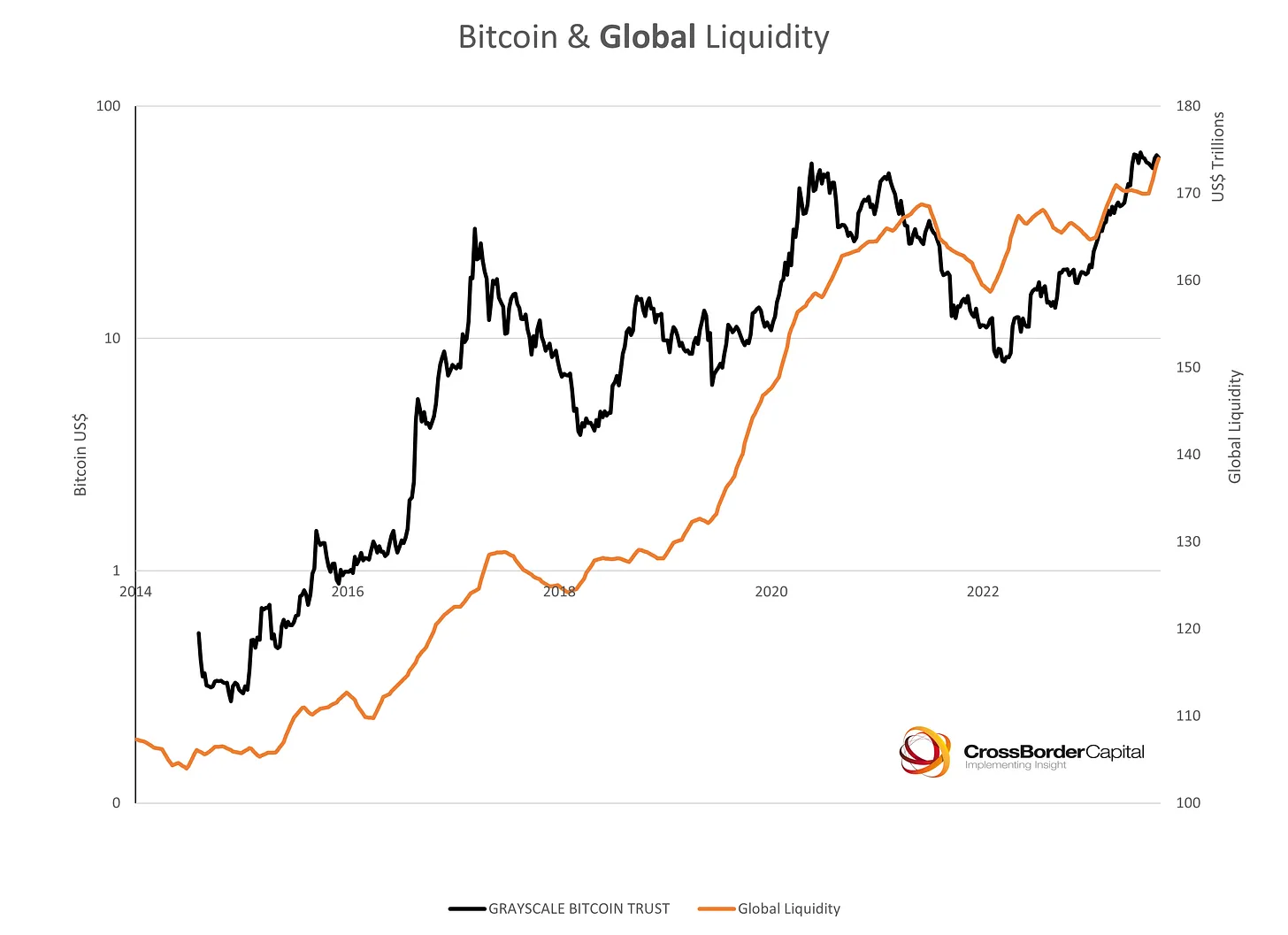

The liquidity cycle is picking up again.

Source: CrossBorder Capital

The bull market mindset

Bull markets require a shift in mindset, as bull markets can make the most logical people do completely irrational things. Bull markets also require a mindset shift because, what it take to succeed in them is almost completely opposite to the bear market.

For most, bull markets tend to creep up without warning. Many market participants find themselves surprised when the bull market becomes overwhelmingly obvious. Most then start to aggressively chase the market. Leading to buying at high, sometimes euphoric price levels.

Regardless of where we are in the bull market cycle, its important to have a self aware mindset, so that you don’t let your emotions get the best of you.

Given our observations of successful and unsuccessful market participants, here are some bull market mindset principles that we have observed to be successful for some market participants.

- Having a plan (and sticking to it).

- Having an idea of where we are in the cycle (and how to act accordingly).

- Keeping your emotions in check (and creating a system for emotional control).

Having a plan (and sticking to it)

Creating a bull market plan, is a personal experience, though its underlying foundation should seek to answer a few key questions.

- What assets do I want to own throughout the bull market? beginning, middle and end

- What are the price or market triggers that I want to enter or exit a specific asset, and why?

- What levels of risk/reward do I want to take with different parts of my portfolio and what is the time horizon relative to those categories?

Having an idea of where we are in the cycle (and how to act accordingly)

Knowing where we are in the market cycle is very difficult and no one knows for sure whether the party is just starting or is about to end.

As such, a simple quantitative rule set is best. It will almost certainly be wrong, but at least it can help you answer the key question you should have at the top of your mind.

- Are we in the beginning, middle, or final stages of this bull market cycle?

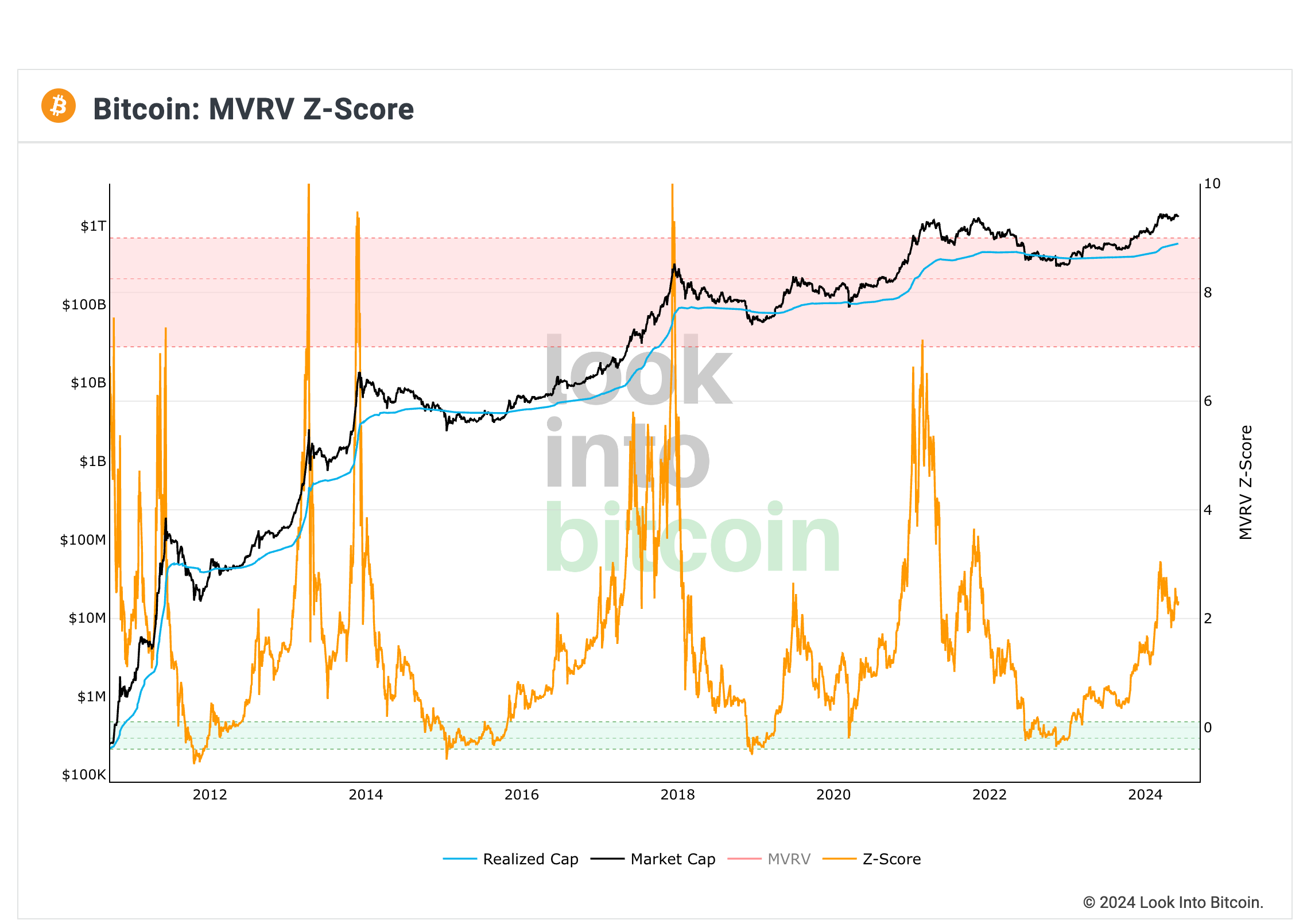

An example of a quantitative rule set for bull markets in crypto is Bitcoin’s MVRV score,

Why is this important? Knowing where we are in the cycle is important because it should inform the structure of your portfolio.

Generally speaking:

Beginning phase of bull market are to Accumulate the assets you want to own.

The middle phase of bull markets is to Speculate on emergent opportunities

Final stages of bull markets are to Distribute high risk assets.

That is a lot easier said than done. determine where we are in the bull market cycle is useful in and of itself.

Keeping your emotions in check, creating a system for emotional control.

Last but perhaps most importantly is keeping your emotions in check. Your plan and your way of understanding where we are in the market cycle will be completely useless, unless you can keep your emotions in check enough to execute.

One of the only ways to combat your emotions is to understand them, such that you can automate them in your plan.

Understanding your emotions

The late Daniel Kahneman and Amos Tversky brought to light the insight of Prospect Theory, among other biases, which break down as follows:

Loss Aversion: People feel the pain of losing money more than the joy of gaining the same amount. For example, a crypto investor feels worse losing $100 in Bitcoin than they feel good about gaining $100.

Value Function: People are cautious with gains but take risks to avoid losses. A crypto investor might sell Bitcoin after a small gain but take a big risk on an altcoin to try to recover losses.

Reference Dependence: People judge gains and losses based on their initial investment. If a crypto investor buys Ethereum at $50 and it rises to $100, then drops to $75, they feel a loss from $100, not a gain from $50.

Representativeness Heuristic: People judge the probability of an event based on how much it resembles a known stereotype. A crypto investor might believe a new coin will succeed just because it looks like a past successful coin, ignoring broader market data.

Endowment Effect: People value things more simply because they own them. A crypto investor might hold onto a losing coin because selling it means accepting a loss, making it hard to make rational decisions.

Simply having this awareness and designing your plan these key psychological principles around might help to quell your urge to act as a result of your emotions.

Okay, now what? How Summer.fi can help you master this bull cycle

While Summer.fi can’t create your bull market plan for you, we have all the tools you need to execute on it.

Summer.fi Products and Strategies for each stage of the bull market

Multiply and amplify your exposure early in the bull into the middle stages.

Multiply on Summer.fi is one of the best products early in a bull market because you can increase exposure to the assets you think are primed to pump later in the bull.

Borrow and capture DeFi opportunities or Boost yield with yield loops in the middle to late stages

Borrowing against your crypto assets and deploying them into DeFi, whether thats buying meme coin, or farming a new project like Ethena is great in the middle to late stages when the crypto assets you own have gone up in value.

Yield loops are also great in the middle to late stages of a bull market when markets can chop around and get boring. You can just stack more yield.

Continue to boost your yield with yield loops or Earn passively into the late stages of the bull

Later in the bull its all about reducing risk and capturing your profits. Summer.fi allows you to sit and earn on your ETH with Staked ETH yield loops, as well as offering lower risk passive strategies for ETH, WBTC, and all major Stablecoins with Metamorpho Vaults. Allowing you to go completely risk off late in the bull, while still earning passive yield.

Master your emotions with Summer.fi Automation in every stage of the bull. Early, middle and late.

Beat Loss Aversion with steth/eth Yield Loops and Stop Loss: Even though losses might feel more painful, Stop Loss allows you to cut all losses automatically. While yield loops keep you earning no matter if the underlying is going down in price.

Beat Value Function with Auto Buy and Trailing Stop Loss: Double down on your winners and protect downside as prices rise. We call this the momentum strategy.

Beat reference dependence with Trailing Stop Loss: As prices rise with a tight trailing stop, you will automatically capture gains that are close to local tops.

Beat the Endowment Effect with Auto Take Profit: There will probably be another terrible bear market, Auto Take Profit allows you to realize profits gradually and automatically. Even though that might mean selling the asset you love into strength.

Ready to take advantage of the bull market? Find the right DeFi product for you, wherever you think we are in the bull market.

Article written by Jordan Jackson

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.