Automation Takes Emotions Out Of Your Position Management

Position management is hard

The origin of DeFi Automated Position Management began with the protecting users from liquidation. Many users felt immense amounts of anxiety and fear about their vault positions within protocols like Maker and AAVE because at the time, there was no mechanism to help prevent their positions from being liquidated in times of a market wide sell off and mass panic.

Today, the worry of liquidation in position management has reduced a lot, thanks to DeFi automation tools like Stop Loss. From your perspective, as a user, you don’t have to get started with DeFi positions and worry about liquidation.

Liquidated collateral on MakerDAO overtime: Blockanalytica

Of course, position management doesn’t stop at protecting against liquidation. As you probably very well know, the management of your position takes many forms:

- Assessing when to reduce risk

- Understanding when to take advantage of certain opportunities

- Knowing when to take profits or realize some gains.

If you have a position on AAVE, Maker, Spark or Morpho, chances are that you spend time today monitoring your positions for one or all of the above reasons. You might even find yourself saying things like:

- “Should I borrow more against my collateral?”

- “Is it the right time to multiply more?”

- “Prices have been rising a lot, is it the right time to take some profits”

Your decisions, without emotions

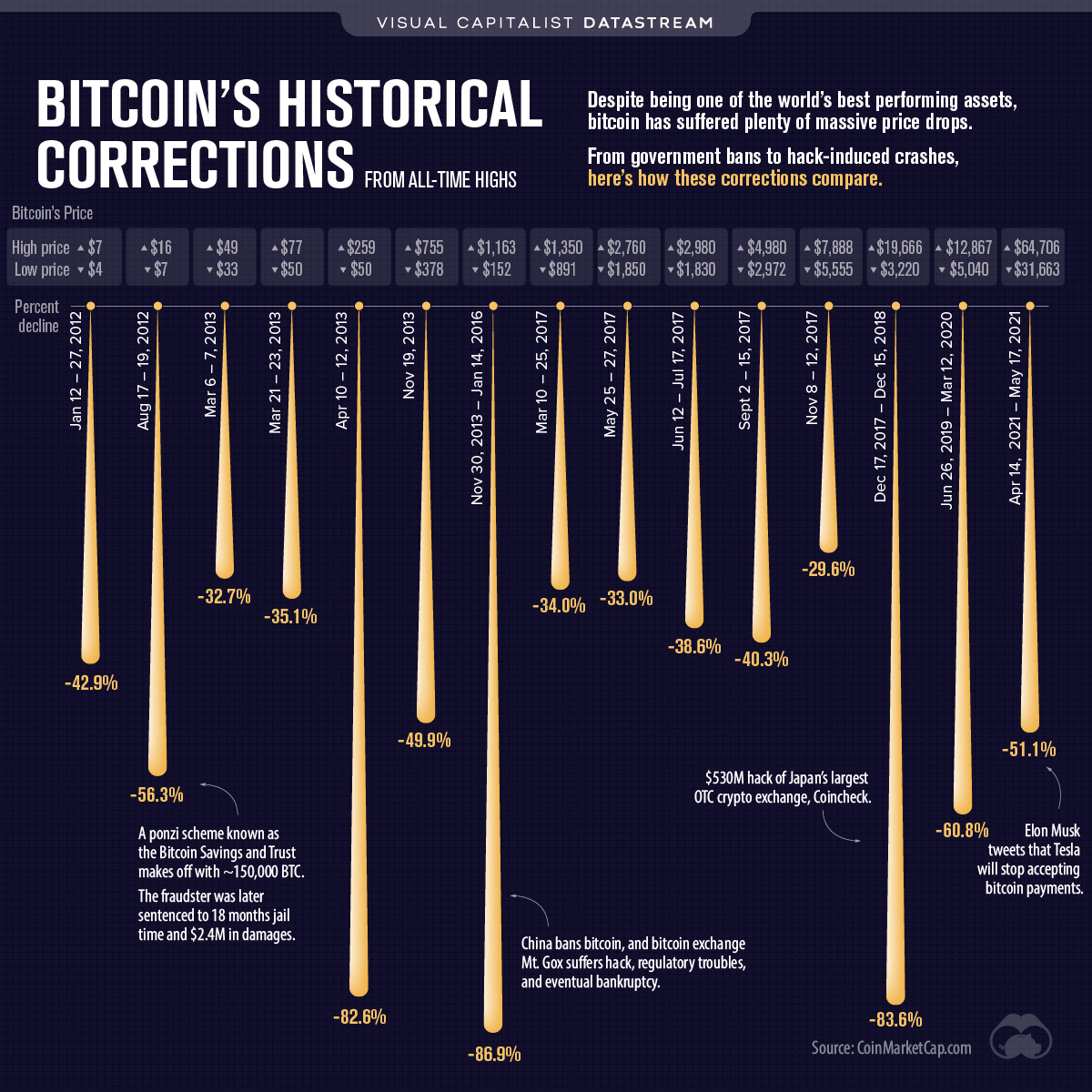

At the end of the day, managing a position is about the quality and coherence of your decisions. What gets in the way most of most peoples judgement and decision making? Emotions. This is especially true in financial markets. How were you feeling on the days of crypto’s most volatile days? Both to the upside and the downside, would you have had the emotional fortitude to do the right thing, or would you let your emotions take control?

Bitcoin historical drawdowns - Visual Capitalist

Automated DeFi Position Management enables users to focus on the quality of their decisions, and forget about the emotions. This is the real power of Automated DeFi position management tools.

How?

Every single automation on summer.fi requires a simple set up. Though, the main aspect of the set up is deciding on how and when you’d like the automation to execute.

Automated DeFi position management on summer.fi forces you to confront very serious questions about your position, that will inevitably arise in the future, only when doing it in the context of setting up DeFi position management you won’t be overwhelmed with emotions of fear or euphoria.

Questions like:

- At what price do I never want to buy more?

- At what price do I never want to sell?

- When do I want to start taking profits?

- How often do I want to start taking profits?

and many more….

The hands off approach, taking emotions out of the equation with Automated DeFi Position Management

No matter that market condition, or the expected direction of volatility, summer.fi has a Automated DeFi Position Management tool for your position. The tools and strategies below allow you to take a second think and consider what’s best for you and your position. They allow you to make sound decisions before hand, and then let the automation execute them in the moment.

Looking to protect yourself against liquidation for your Maker, Spark or AAVE positions? try the following automations:

- Stop Loss: Making a decision about when you want to cut all risk.

- Trailing Stop Loss: Making a decision about when to both cut risk and capture gains.

- Auto Sell: Making a decision when you want to reduce risk, and by how much.

Looking to take advantage of market opportunities with your Maker, Spark or AAVE postions? try the following automations:

- Auto Take Profit: Making a decision about how much profit you want to realize, and when.

- Auto Buy: Making a decision about when you want to buy more, and how much.

Start taking advantage of Automated DeFi Position Management with Summer.fi