From Spreadsheet Hell to Yield Heaven: Automating Institutional DeFi Strategy

DeFi breaks at scale not because of one bad protocol, but because of a hundred tiny frictions: fragmented venues, upgrade churn, bridge hops, inconsistent APIs and, inevitably, spreadsheets. The fix isn’t “another dashboard.” It’s policy-driven automation plus single-integration access to diversified yield under institutional controls.

How institutions currently track yield sources across chains

Manual polling + brittle connectors. Ops teams scrape protocol UIs/APIs, copy rates into sheets, reconcile positions by address, then repeat after every upgrade or market change. Each venue ships its own SDK and cadence; integrations take months and never stop needing maintenance.

Rebalancing is multi-leg and time-sensitive. Capturing spread often means withdraw → bridge → redeploy—costly in gas, fees, and human time.

Concentration risk creeps in. When engineering bandwidth becomes the bottleneck, capital concentrates in a few “survivor” venues the team can actually maintain.

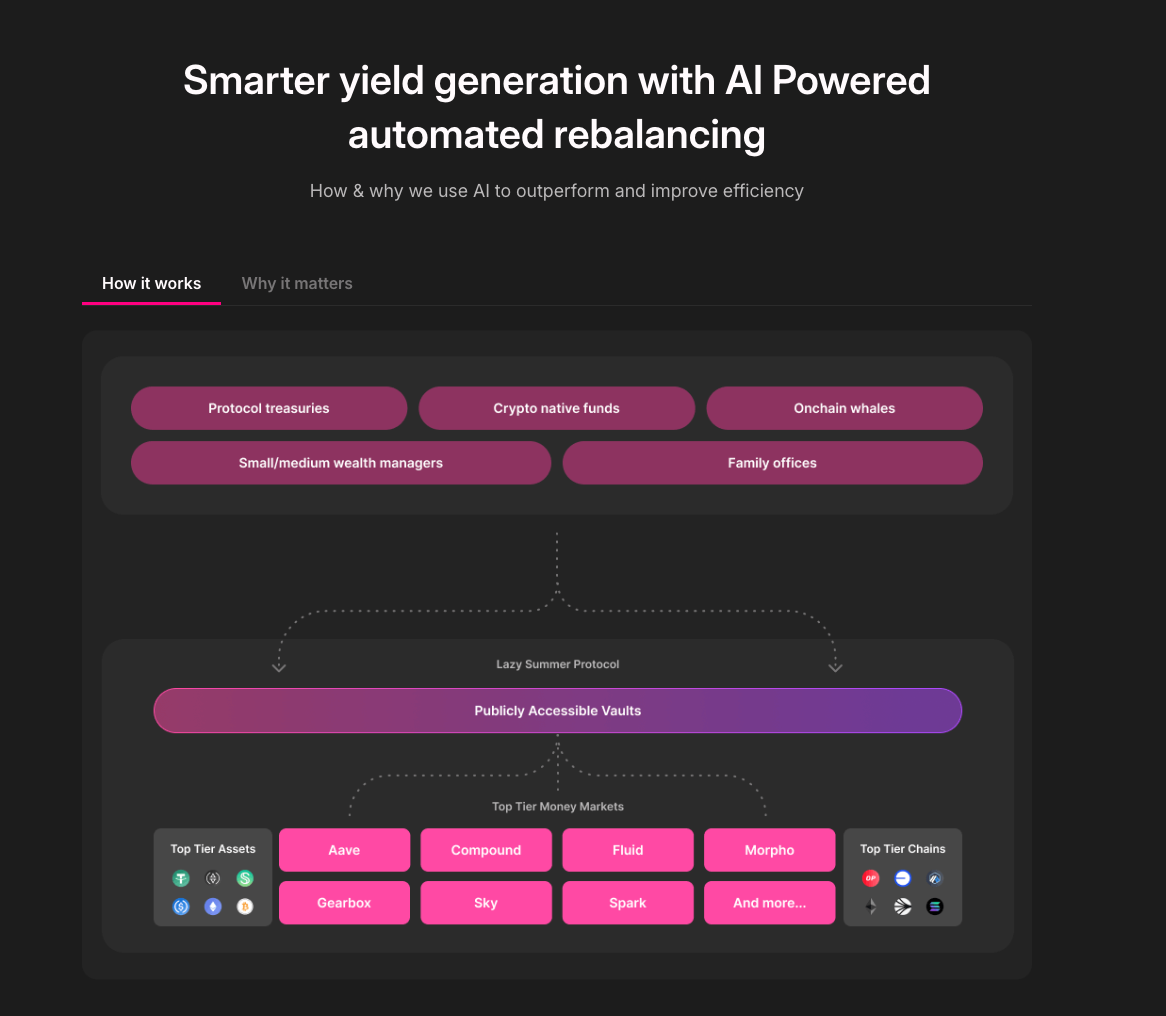

Introducing Lazy Summer’s cross-chain smart routing and yield maximization

Lazy Summer’s design treats supported networks like one liquidity surface. Deposit once on the chain, and you hold assets; AI keeper agents handle cross-chain rebalancing and bridging when net spreads justify it. You just hold Fleet shares on the hub chain; the system moves capital under policy constraints.

At a glance:

- Deposit once, and capital moves across chains automatically.

- Risk controls: governance allow-lists, per-chain caps, and independent risk curation.

- Transparent flows: monthly reports track capital rotation.

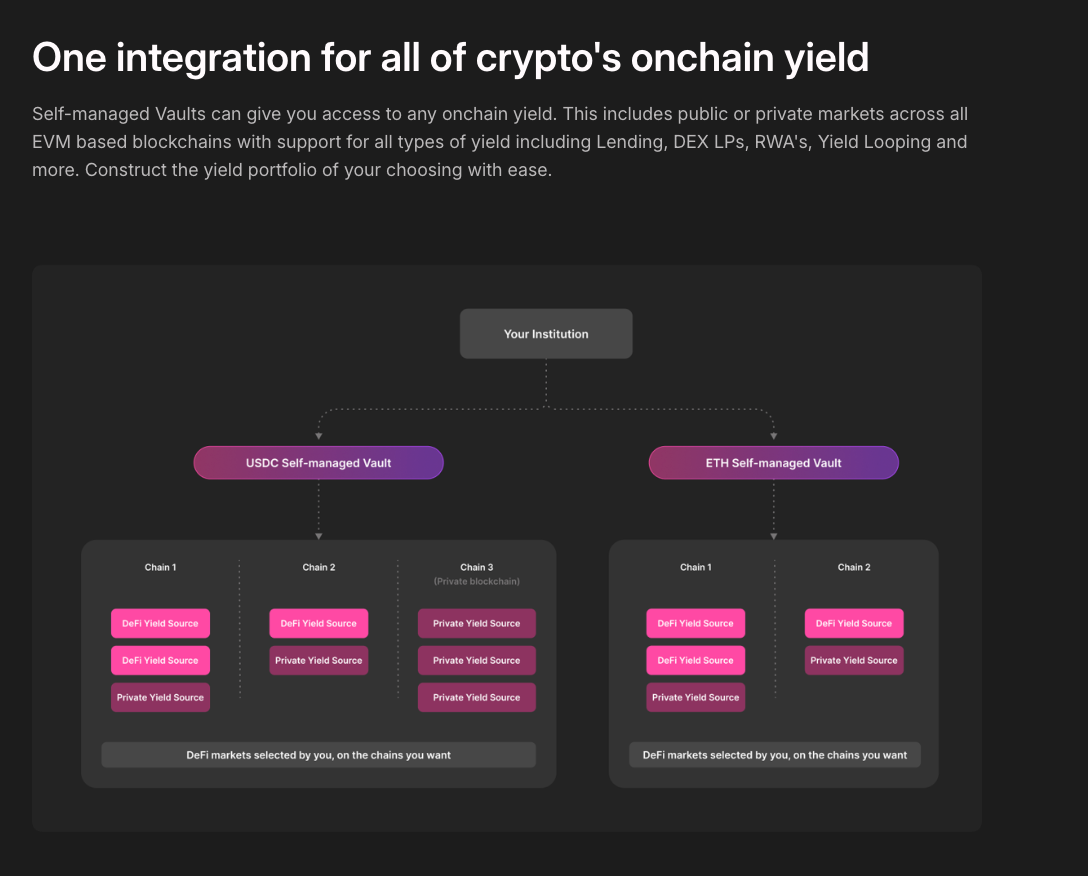

Summer.fi Institutional: one integration, policy-first control

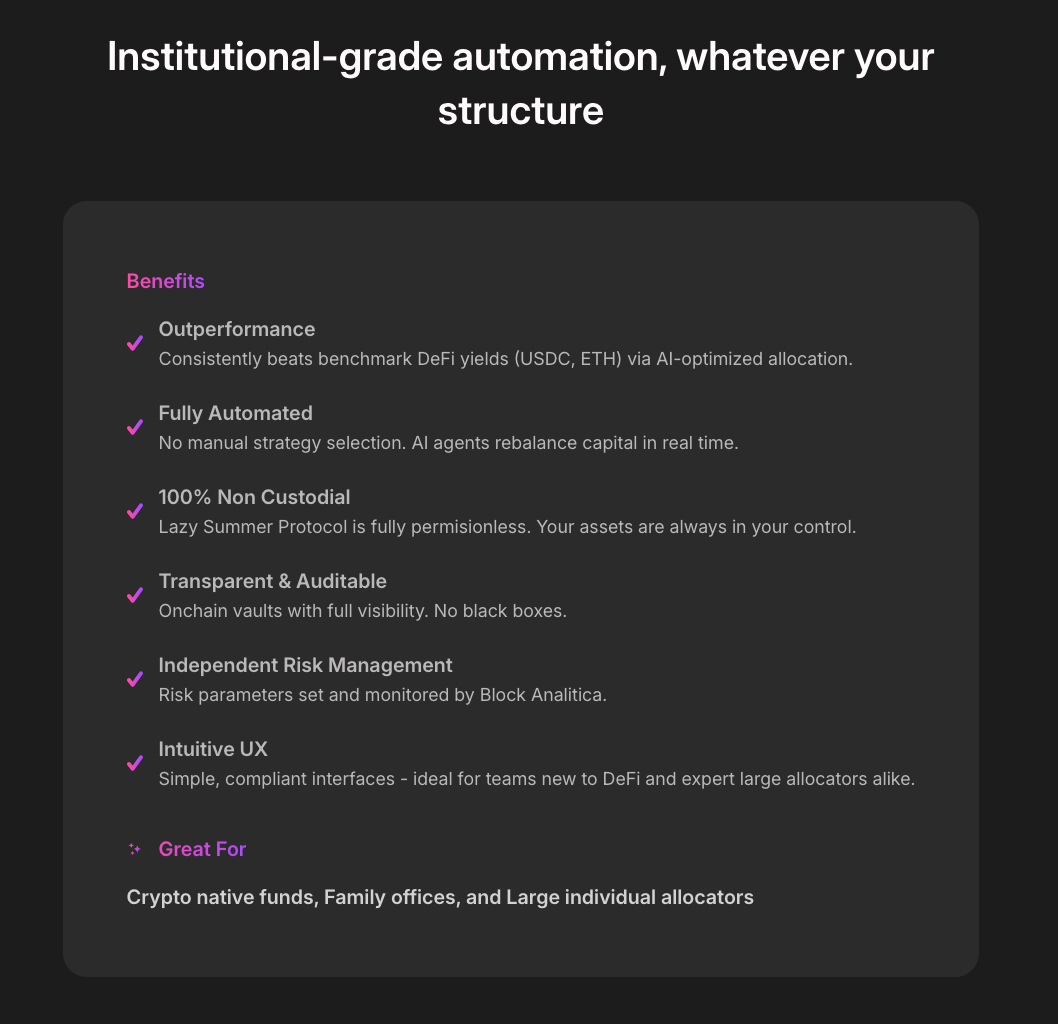

Instead of building a dozen connectors, connect once to a vault layer you can shape to your mandate. Institutional vaults expose both public (DeFi) and private/whitelisted markets; you define assets, venue caps, reallocation logic, and reporting—ring-fenced, non-custodial, and auditable.

Highlights:

- Closed/self-managed vaults: deposits limited to approved entities; no co-mingling; daily NAV files.

- Risk governance options: in-house or delegated to Block Analitica.

Operational efficiency: one SDK abstracts away protocol churn.

Quantifying time/cost saved using Summer.fi’s vault infrastructure

The sites are explicit about saving time and reducing costs via AI-powered rebalancing and single-integration access.

Status quo (illustrative mid-size desk):

- 6 hrs/week monitoring rates/liquidity across chains.

- 4–8 hrs/month executing rebalances.

- Months of integration per venue, plus ongoing maintenance.

With Lazy Summer Protocol + Institutional Vaults:

- Monitoring & execution are automated by keepers.

- Cross-chain bridging abstracted.

- One integration instead of many.

Implementation playbook (quick)

- Map your policy to a vault spec (assets, caps, venues, reporting cadence).

- Integrate once (SDK + custody/back office).

- Let automation work—review flows via dashboards and reports.

Interested in integrating?

Getting access to on-chain yield no longer needs to be complicated. If you’re interested to discover how Summer.fi Institutional would work for you and your clients, get in touch with a member of the team.

🌐 Website: https://summer.fi/institutions

📅 Book a call: https://calendly.com/summer-fi/summer-institutional

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.