Everything you need to know about earning yield on Morpho Blue

Morpho Blue is a decentralized, non-custodial lending protocol that allows anyone to create isolated, permissionless lending markets with fully customizable collateral, LLTV (liquidation loan-to-value), and oracle settings.

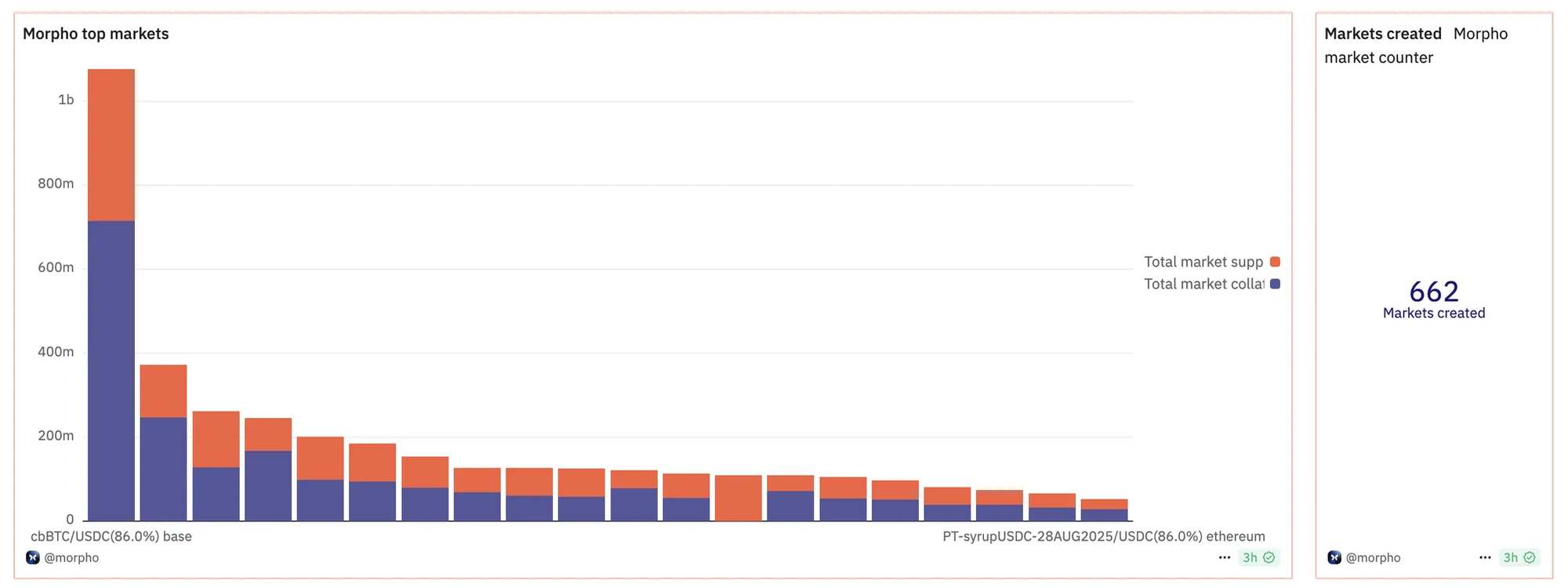

Today, Morpho stands as the second largest lending protocol in all of DeFi. It seems like a no-brainer for the Lazy Summer Protocol to integrate Morpho.

Unlike the original Morpho Optimizer (which built on Aave and Compound), Morpho Blue is a standalone, immutable protocol—engineered for efficiency, flexibility, and minimal governance.

How do users earn yield on Morpho?

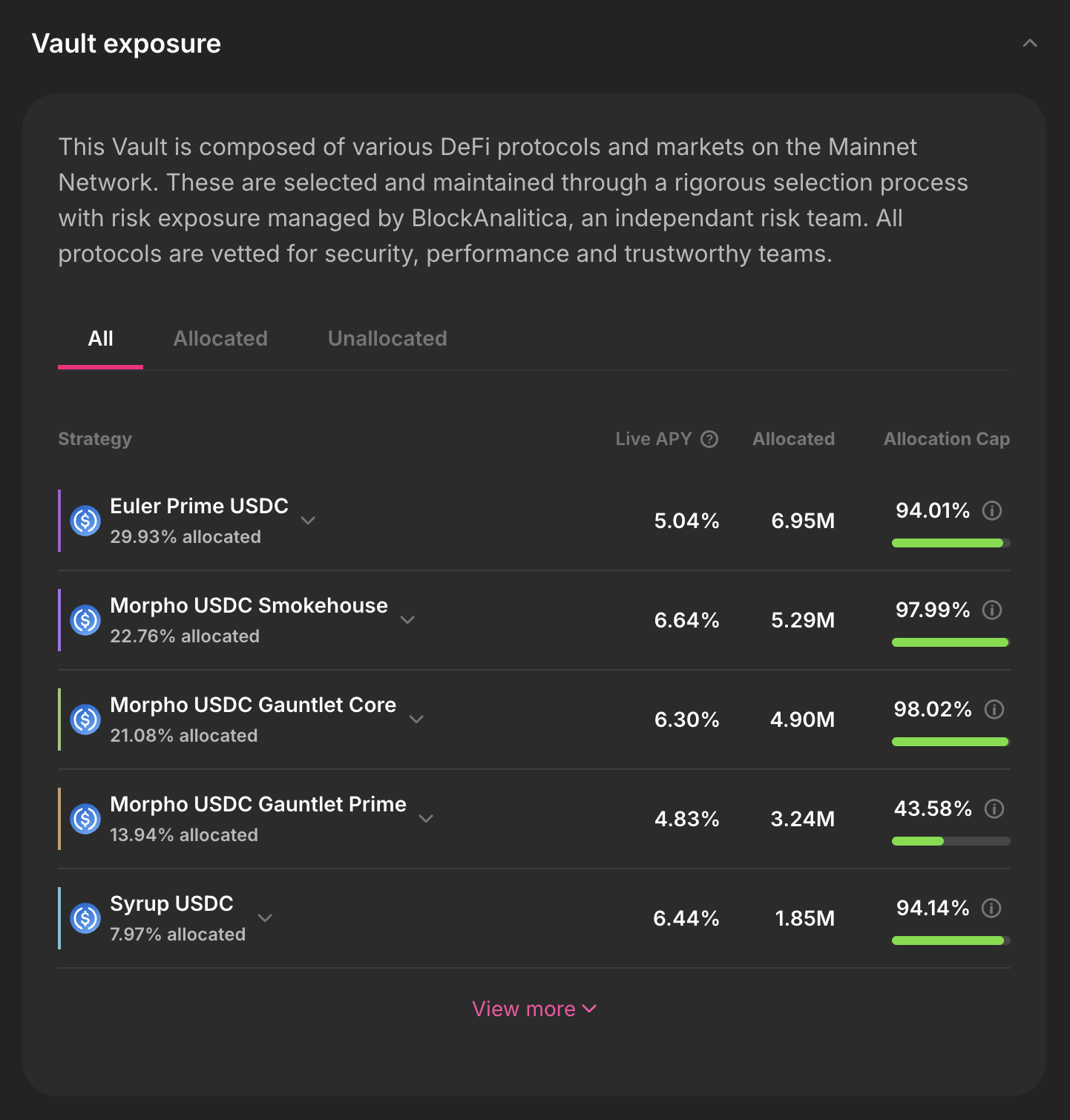

Users earn yield via Morpho Vaults—permissionless, automated lending strategies built directly on top of Morpho Blue. These vaults abstract away the complexity of managing individual lending positions, allowing users to earn passive income without needing to make active decisions.

Where does Morpho’s yield come from?

When you deposit into a Morpho Vault, your capital is allocated across carefully selected lending markets where borrowers pay interest—and you collect the yield.

- Lenders earn passive yield from borrower interest.

- Borrowers use capital for trading strategies, LP positions, and arbitrage.

- Curators manage the vaults: selecting markets, allocating capital, and setting risk parameters. They’re compensated with performance fees for effective management.

- Each market is isolated, meaning yields (and risk) are driven by supply and demand within that specific market.

Why Morpho is critical for the Lazy Summer Protocol

Morpho and Lazy Summer are a perfect match. Morpho has over 650 markets, and Lazy Summer integrates a curated and continuously rebalanced set of 24 of them.

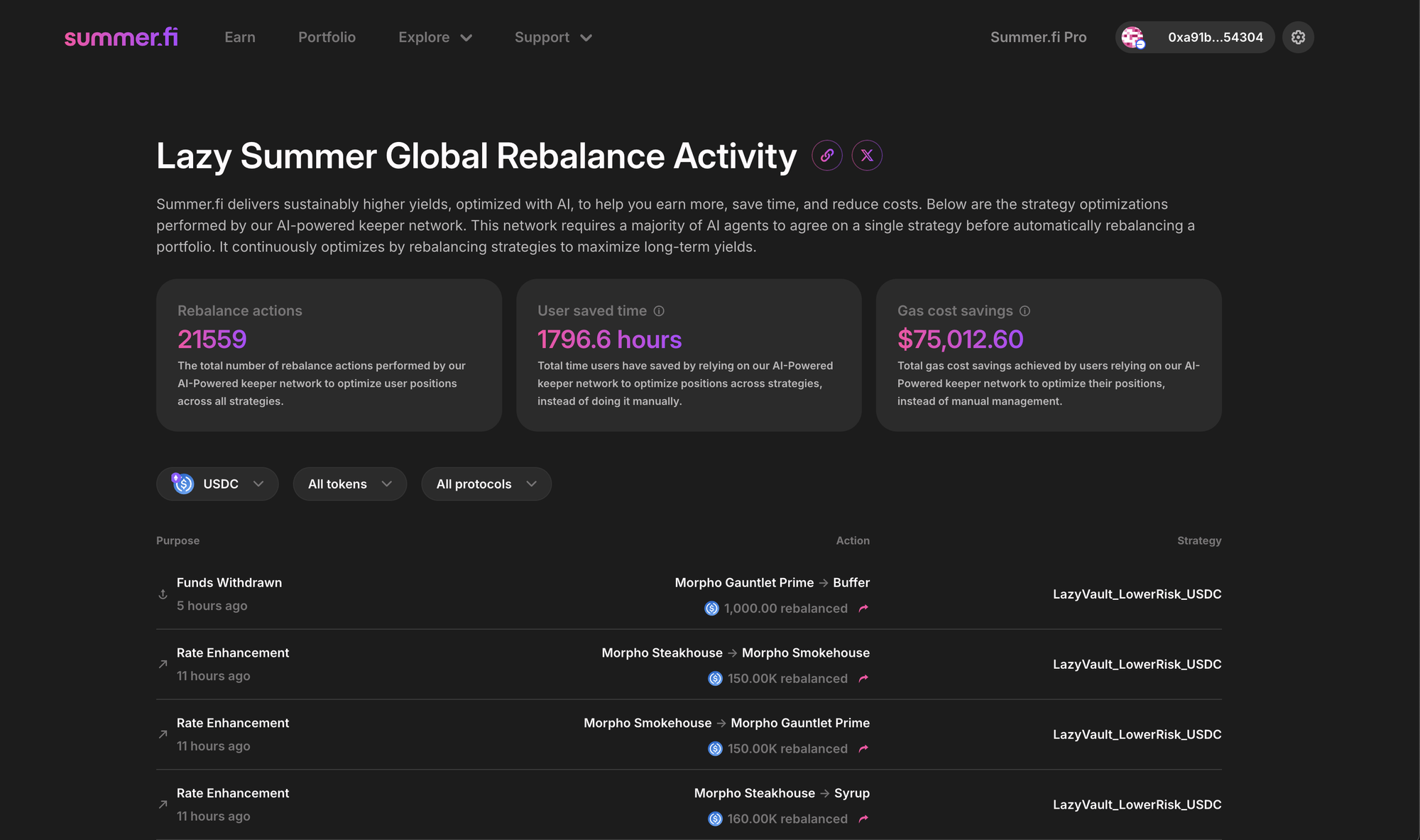

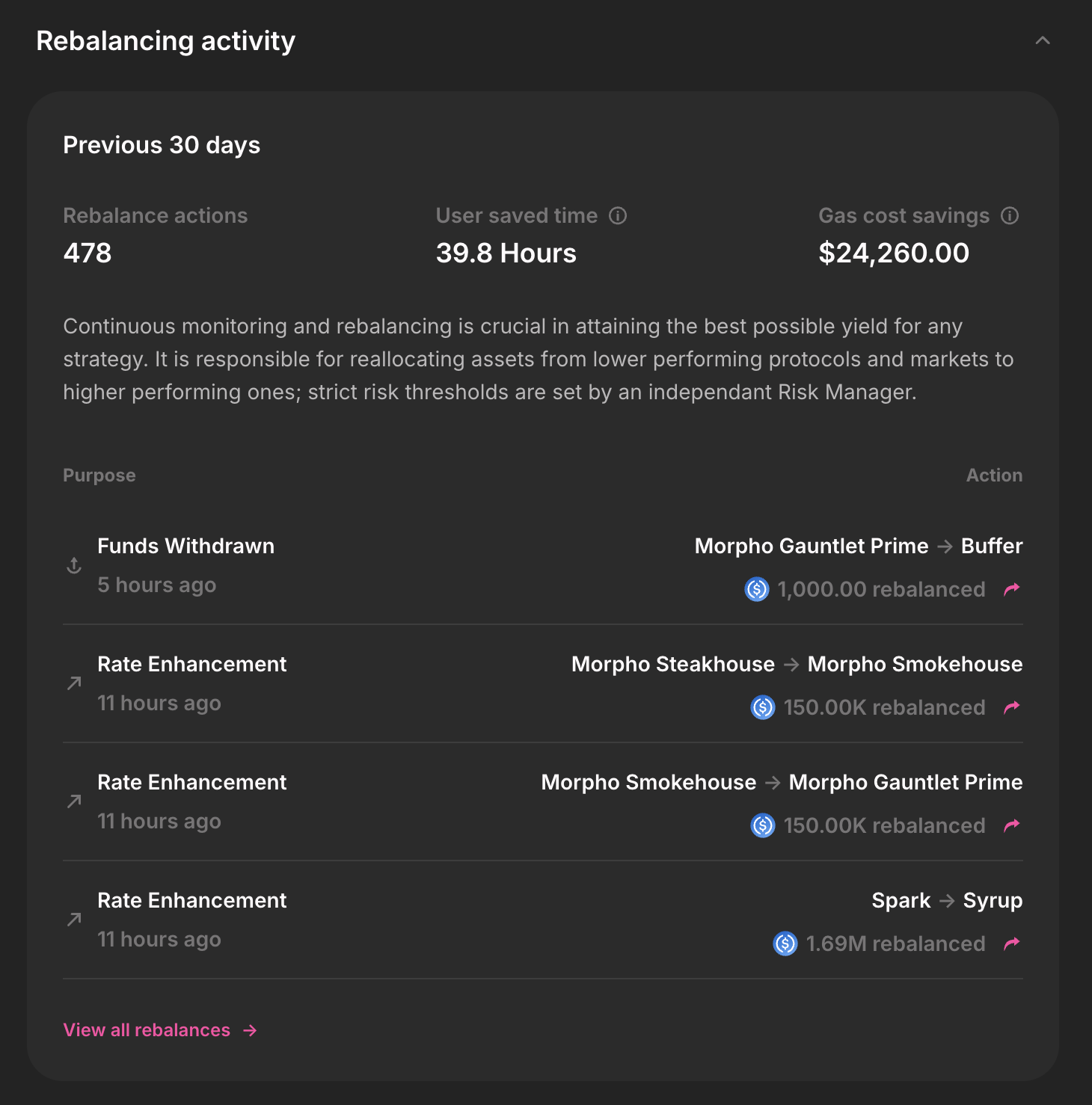

This rebalancing is powered by AI-optimized Keepers, so users get automated exposure to the most performant vaults—without having to track yield, market shifts, or risk manually.

Crucially, Lazy Summer can onboard any Morpho market, subject to governance approval.

Popular Morpho Markets, now live on Lazy Summer

Some of the most active and high-performing markets on Morpho include:

All of these are supported on Lazy Summer. Even better—you don’t have to choose between them. A single deposit gives you automated exposure to all.

The paradox of choice in Morpho Vaults

Morpho’s biggest strength—diverse, high-yield strategies—can also create complexity for users:

- How do you choose the right vault?

- Is it worth switching from one to another?

- How do you compare risks across vaults?

With hundreds of markets, even passive strategies can feel like active portfolio management.

Lazy Summer solves the choice problem

This is where Lazy Summer changes everything. Instead of asking users to pick a vault, Lazy Summer handles that decision automatically—dynamically shifting capital to the best-performing Morpho vaults.

Currently, 10 of the top Lazy Summer vaults are powered by Morpho strategies, representing —that’s 57.4% of total TVL across the Protocol.

Why access Morpho Vaults via Lazy Summer?

Lazy Summer offers a smarter, easier, and more powerful way to tap into Morpho:

- Automated yield optimization: Your deposit is rebalanced across Morpho’s top-performing vaults.

- Risk curated by experts: Block Analitica and vault curators continuously monitor and manage risk.

- No more management: You no longer have to monitor market rates or reallocate capital or worry about holding tokens instead of real yield—Lazy Summer does it for you.

- Compounded benefits with $SUMR: Grab the chance to earn sustainable yield plus $SUMR, Lazy Summer’s governance and rewards token.