Ever wondered how Summer’s AI agents monitor the market 24/7

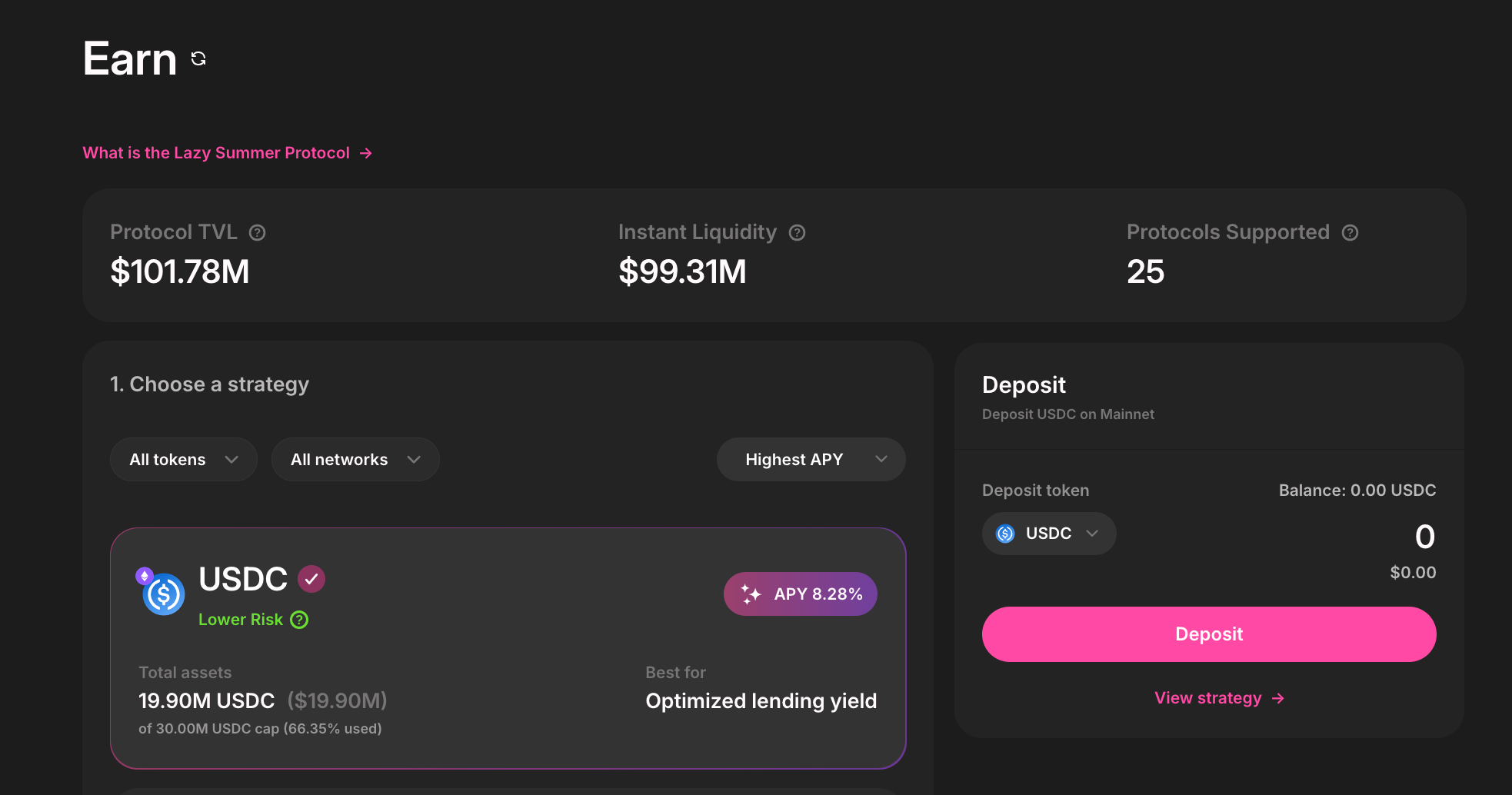

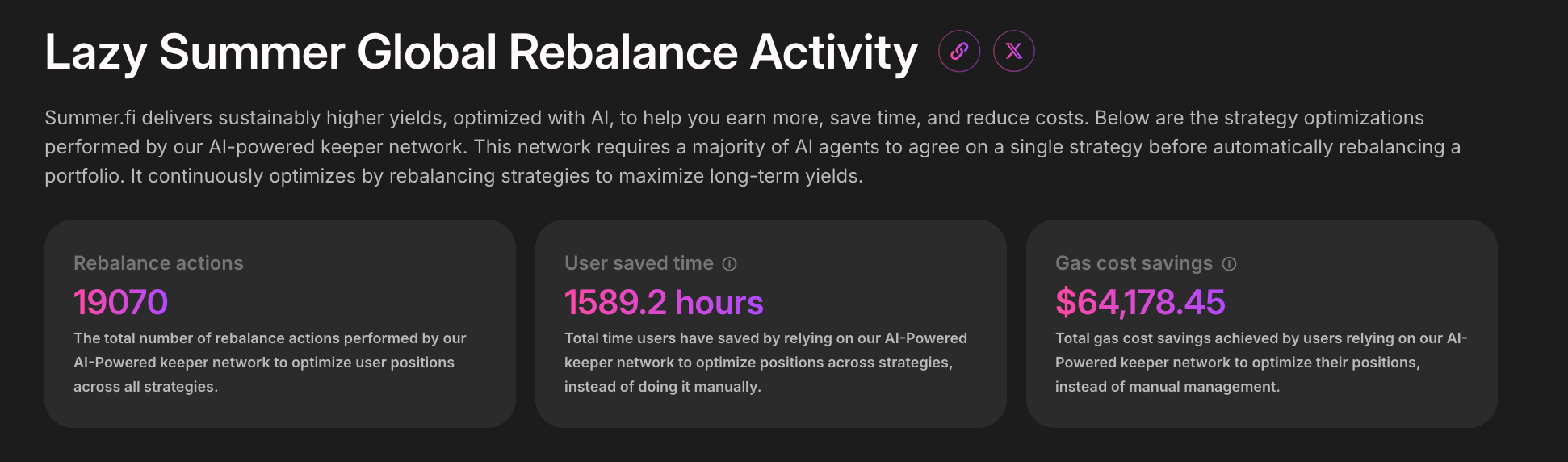

Being able to respond swiftly to market fluctuations is what separates stale capital from solid yield. For this reason, the Lazy Summer Protocol is based on a network of smart artificial intelligence bots known as Keepers that continuously monitor, evaluate, and respond to market signals.

But how exactly do these AI agents work? What kind of decisions are they making? And how do they handle volatility?

AI-Powered Agents: The Brain of the Operation

The Rebalancer is an essential aspect of the protocol that constantly distributes liquidity amongst ARKs (automated yield schemes). AI-informed Keeper Agents, who are subject to stringent guidelines established by the FleetCommander and controlled by the community, manage this rebalancing process.

These agents aren’t just running simple scripts they’re powered by off-chain AI models that:

- Continuously scan real-time yield opportunities across multiple DeFi protocols.

- Simulate scenarios to assess potential returns and risks.

- Recommend rebalances to shift funds from lower-performing ARKs to higher-performing ones.

Unlike traditional DeFi strategies that rely on static assumptions, Keepers operate in a dynamic loop, constantly evaluating whether capital is optimally deployed based on market conditions.

How Rebalancing Decisions Happen

Rebalancing is not arbitrary. The system follows a structured decision-making process:

- Monitoring Phase: Keepers monitor APY trends, liquidity depth, slippage, and volatility signals across supported protocols.

- Trigger Phase: If returns drop below a certain threshold or another ARK significantly outperforms, rebalancing is considered.

- Constraint Check: All proposed actions are checked against protocol-defined constraints—like maximum capital shift per rebalance or rebalance frequency limits.

- Execution: Once cleared, Keepers initiate transactions via secure multisigs to reallocate assets.

These steps ensure yield optimization without compromising safety or governance rules.

Volatility-Aware Adjustments

DeFi yield is not just about chasing APY, it’s about managing risk. Summer’s AI system is trained to react intelligently to volatility, not just blindly chase returns.

For example, during periods of heightened volatility:

- The agents may slow down rebalancing or reduce capital movement to avoid unnecessary churn.

- Yield projections are adjusted using volatility dampeners, ensuring more realistic expectations.

- Capital may be shifted to more stable ARKs temporarily, protecting user funds while maintaining yield.

This allows Summer.fi users to benefit from active management without the whiplash of constant switching or manual intervention.

A Vision Toward Permissionless Intelligence

While the current Rebalancer operates through a whitelisted network of AI Keepers, the goal is full decentralization. Over time, any actor will be able to run a Keeper node and contribute to capital allocation decisions—as long as they comply with protocol rules and pass zero-knowledge checks on performance and constraint adherence.

This means Summer is not just automating DeFi—it’s building a permissionless, intelligent, self-optimizing financial ecosystem.

TL;DR

Summer.fi’s AI agents don’t sleep. They monitor the market 24/7, scan for yield, check constraints, and rebalance capital to optimize your returns all while adapting to volatility like a seasoned trader. It’s like having an elite portfolio manager working for you, on-chain, nonstop.

With the Lazy Summer Protocol, passive yield farming becomes smart, automated, and adaptive.

Stay tuned for more Linktree: https://linktr.ee/Summerfi