Earning in DeFi, CeFi and TradFi

Decentralized Finance (DeFi) and Traditional Finance (TradFi) are two terms creating a buzz in the financial world. TradFi has been the foundation of our financial dealings for many years, while DeFi is a new approach changing how we view finance. This article aims to explain the difference between these financial approaches and how they will shape the future of finance.

TradFi is centralized and operates through a centralized authority such as a bank. On the other hand, DeFi is decentralized and operates in the blockchain. Lastly, CeFi is a mix of both worlds, as it is centralized in its operation but also uses cryptocurrency, which can be decentralized in some cases.

It is essential to understand these terms and how they differ. We can better prepare ourselves to navigate the ever-changing financial landscape by understanding these differences.

Core Differences between DeFi and TradFi

In the case of TradFi, customers must comply with protocols and requirements established by the financial institutions, which often pose barriers such as geography, credit history, and income. In contrast, DeFi disrupts these barriers by providing a permissionless and inclusive platform accessible to anyone with internet access. DeFi also promises a level of control and freedom not associated with TradFi, words as ‘self-custody’ or ‘permisionless’ are native to DeFi. Also, Centralized Exchanges, which fall under the category of CeFi, are more similar to a bank, than to a DeFi protocol.

Earning in DeFi vs TradFi - 'Money Legos'

The fancy words for DeFi are 'money legos' – a new combination describing its workings and interoperability. Like the possibility of using infinite Lego bricks for more creativity in building different structures, DeFi enables developers and users to build new financial services by stacking various protocols and tools. This composability is fueling new products and services, in contrast to the relatively rigid and siloed offerings of TradFi.

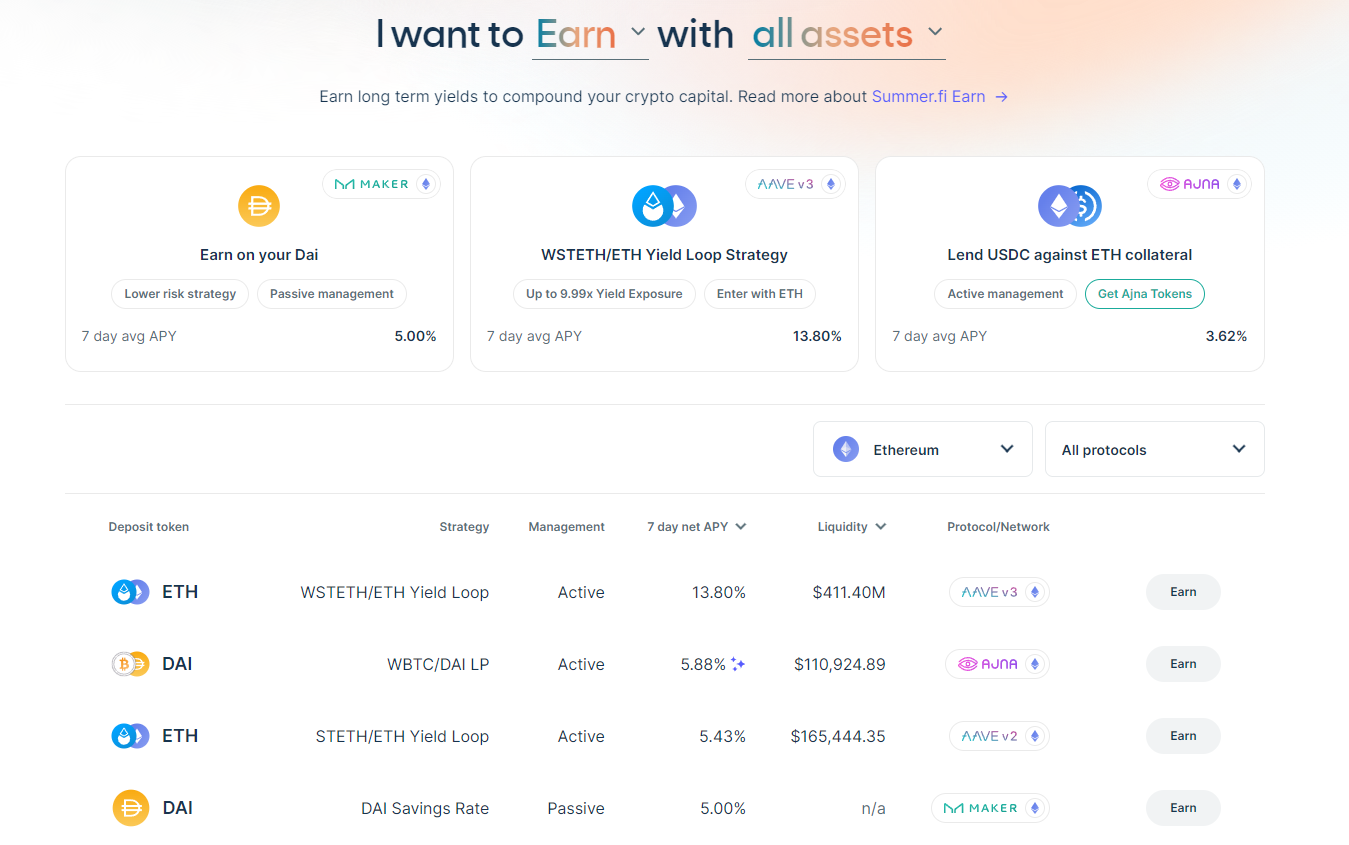

Let’s go with an example of “Money Legos”, using Summer.fi:

Alex has 2000 DAI idle in his wallet, and he wants to start earning some yield on them. The first move is going to https://summer.fi/earn/dsr/, and depositing his DAI into de DSR. Now, his DAI is deposited in MakerDAO, which pays him an annual rate of 5%. In exchange for the deposited DAI, he gets sDAI, and this is where the fun begins. This yield-bearing token will accrue yield by just being in his wallet, but Alex wants more, so using https://summer.fi/ethereum/aave/v3/earn/sdaiusdc#simulate he deposits his sDAI into this strategy, which will deposit his sDAI, borrow USDC, which will be swapped for more SDAI. Alex now is earning a multiplied yield of his sDAI; your imagination is the limit regarding Money Legos in DeFi!

This “Money Legos” type is hard to do in TradFi or CeFi. If you buy a stock, you can’t do much more than wait until it goes up (or down if you’re not lucky!).

Personal Conclusion

While DeFi offers innovation and inclusivity, TradFi and CeFi provide stability and proper regulation for users who need to gain knowledge or are more risk-averse with their investments. Like any product, you need to do proper research before investing; luckily, there are now millions of sources of information to learn everything you need to know about DeFi and how it works!

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.