DeFi Weekly #5 Recap - We are sooo back!

Welcome to this week’s DeFi Weekly Recap—your go-to for all things crypto and DeFi. From market movers and on-chain metrics to the latest trends in DeFi, we’re breaking down what’s happening so you can stay ahead.

Bluechip Prices

Bitcoin reached a new all-time high, while ETH/BTC started to pick up momentum. We saw some notable moves, with $LOCKIN and $CoW rising, potentially driven by proposed deregulations from Trump. On the flip side, Trump-related coins were on the losing end this week as holders took profits.

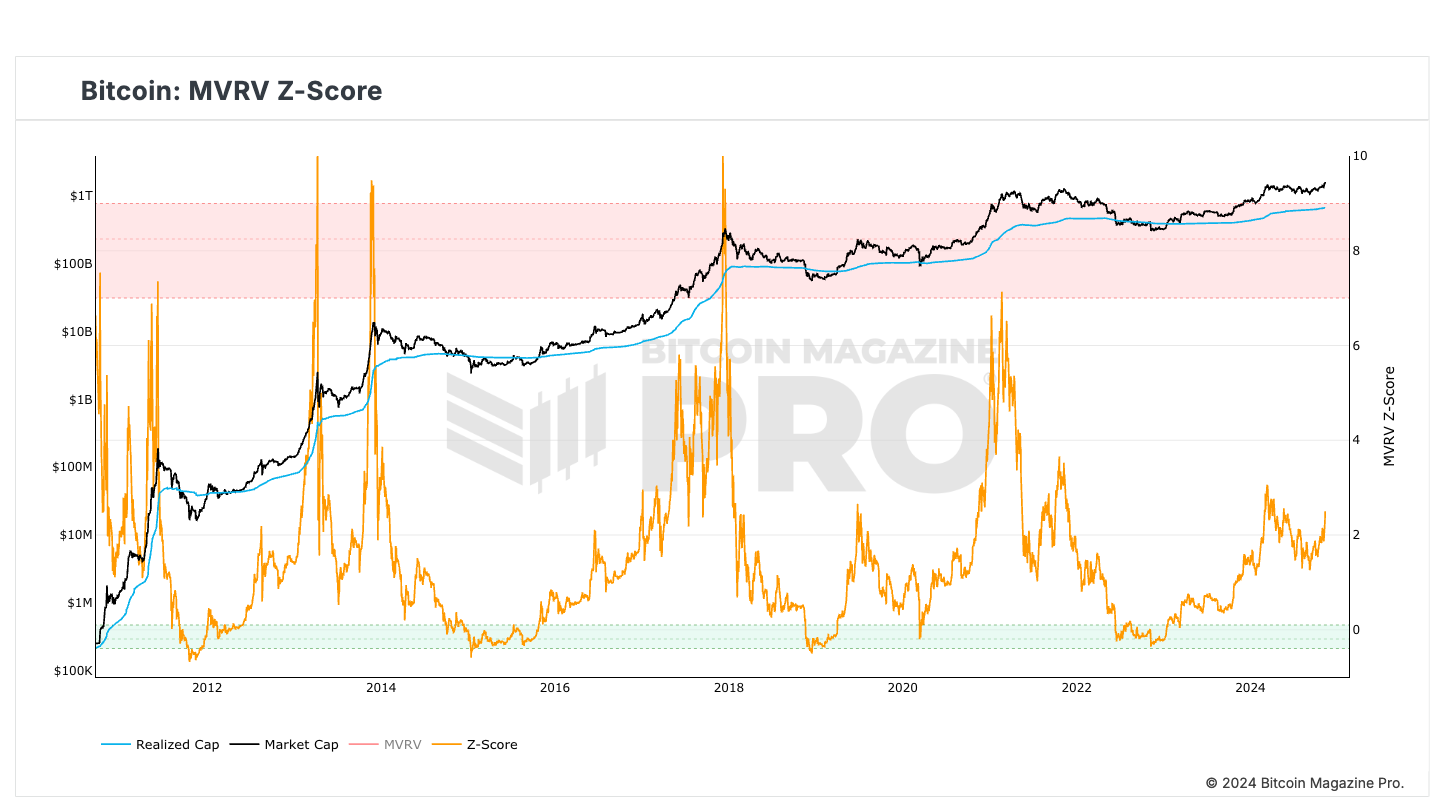

On-Chain Metrics

The MVRV Z-Score is hovering just under 2, which could hint at an accumulation zone—maybe a good time to keep an eye on it? Also, ETF flows showed similar bullish inflows to the BTC ETF’s initial launch, with ETH ETF also seeing some inflows. Funding rates are a bit higher than last week but aren’t showing any alarming spikes yet.

Market Narratives

Crypto election fever is in the air! 🚀 Polymarket is emerging as a product-market fit (PMF) for crypto, and if you’re looking for an insightful take, Brian Armstrong has some thoughts on the impact of the US elections on crypto.

State of DeFi

DeFi Yields & Borrow Rates

DeFi yields are holding strong, with Ethena continuing to lead as the top choice for stablecoin yields. It’s offering competitive rates that make it a go-to for those seeking safe returns. Borrow rates across the board remain steady, with costs around 5-6% on Mainnet—good news for anyone looking to leverage without breaking the bank. And on the bluechip side, new farms and strategies are popping up, giving more opportunities to earn and stack yield through Summer.fi

New New DeFi Things

Rune (the founder of Maker) recently released a community poll that sparked a lot of conversation. The poll invites users to decide whether Maker should keep the current SKY brand or revert to the MKR branding. This choice could signal broader shifts in Maker’s identity and approach as it continues to adapt in the evolving DeFi space. Meanwhile, new projects and farming opportunities are emerging across DeFi, creating fresh ways for users to engage, farm, and earn. Keep an eye on these launches—they’re where the next big moves in DeFi might come from.

Long/Short (NFA)

Our picks for this week: Long on the US, as we’re seeing a lot of pro-crypto sentiment growing there with recent elections and regulatory shifts. On the other hand, it’s a playful “short” on Gary Gensler, who continues to stir the pot on crypto regulation. This balance reflects both optimism for broader adoption in the US and ongoing challenges on the regulatory front.

A Gift and an Ask

This week, we’ve got a treat for you—an interview with the legendary Stan Druckenmiller, who shares his insights on market trends and strategies for success. This is a must-watch for anyone serious about understanding market cycles and macro trends. And if you’re looking for more DeFi-specific insights, check out the Bullmarket Strategies episode on Summer.fi’s YouTube channel, where we dive into actionable strategies for navigating the DeFi space and maximizing yield opportunities.

Watch the full episode here:

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.