DeFi Weekly #4 Blog - In search of catalysts

In this week’s edition of DeFi Weekly, we spotlight key developments you might have missed but need to know about. Here’s your quick guide to the latest in DeFi and how to take advantage on Summer.fi

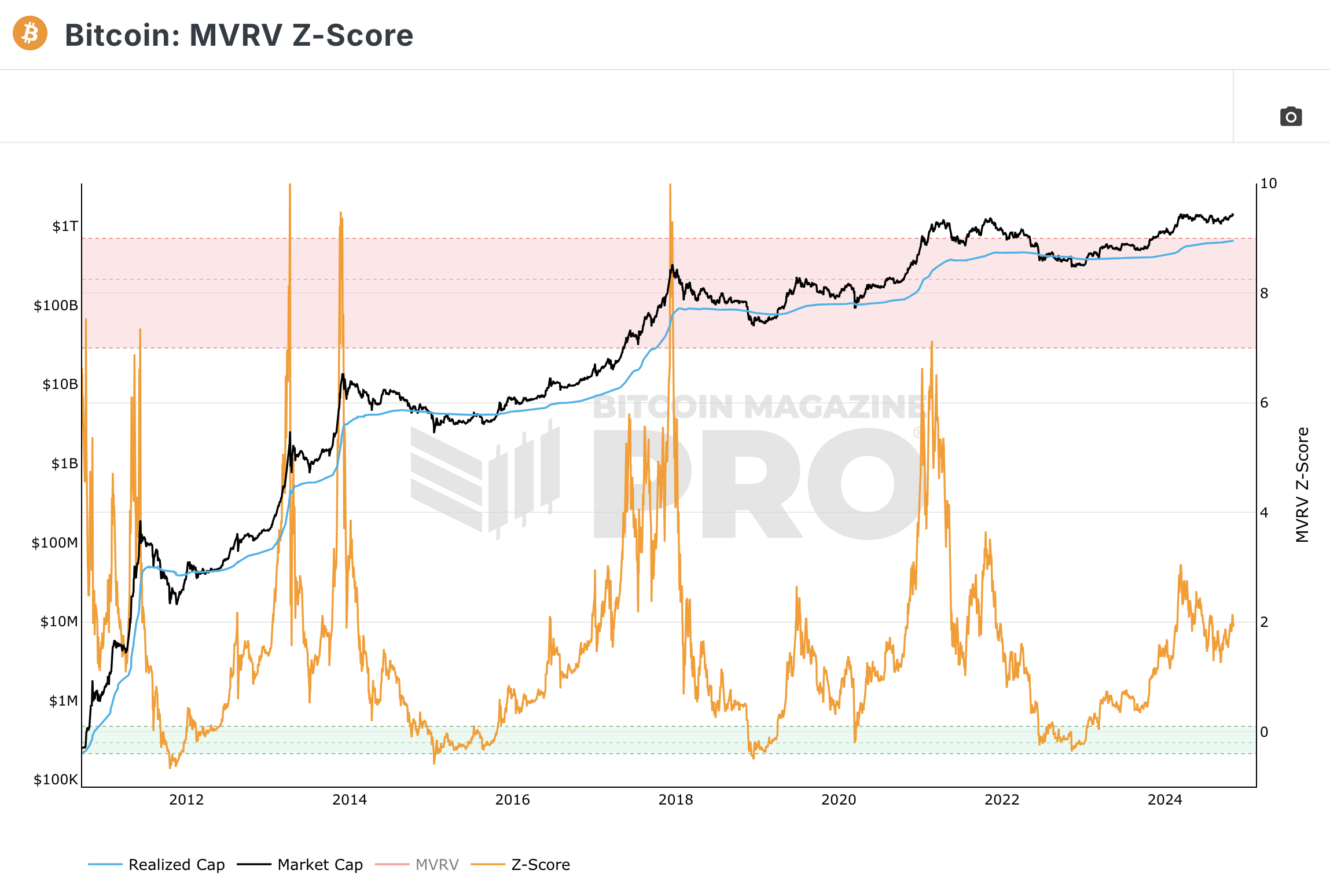

It’s still early inning’s

Based on the MVRV onchain indicator, Bitcoin is still around a score of 2. Generally speaking, the market has been way overheated at scores above 5, and anything under 2 is usually a good place to be buying. Based on this, if you believe we are in a bull market, we are still really early.

How to take action on Summer.fi

If we are early in a bull market and BTC and other assets are well priced, then the following Summer.fi products might be right for you:

Open a Borrow position and get liquidity against your BTC so you don’t have to sell before the price really goes up.

Open a Multiply position and increase your exposure to BTC, with best in class automation tools like Stop Loss, Trailing Stop loss, Auto Buy, Auto Sell and Auto Take Profit before the prices goes bananas.

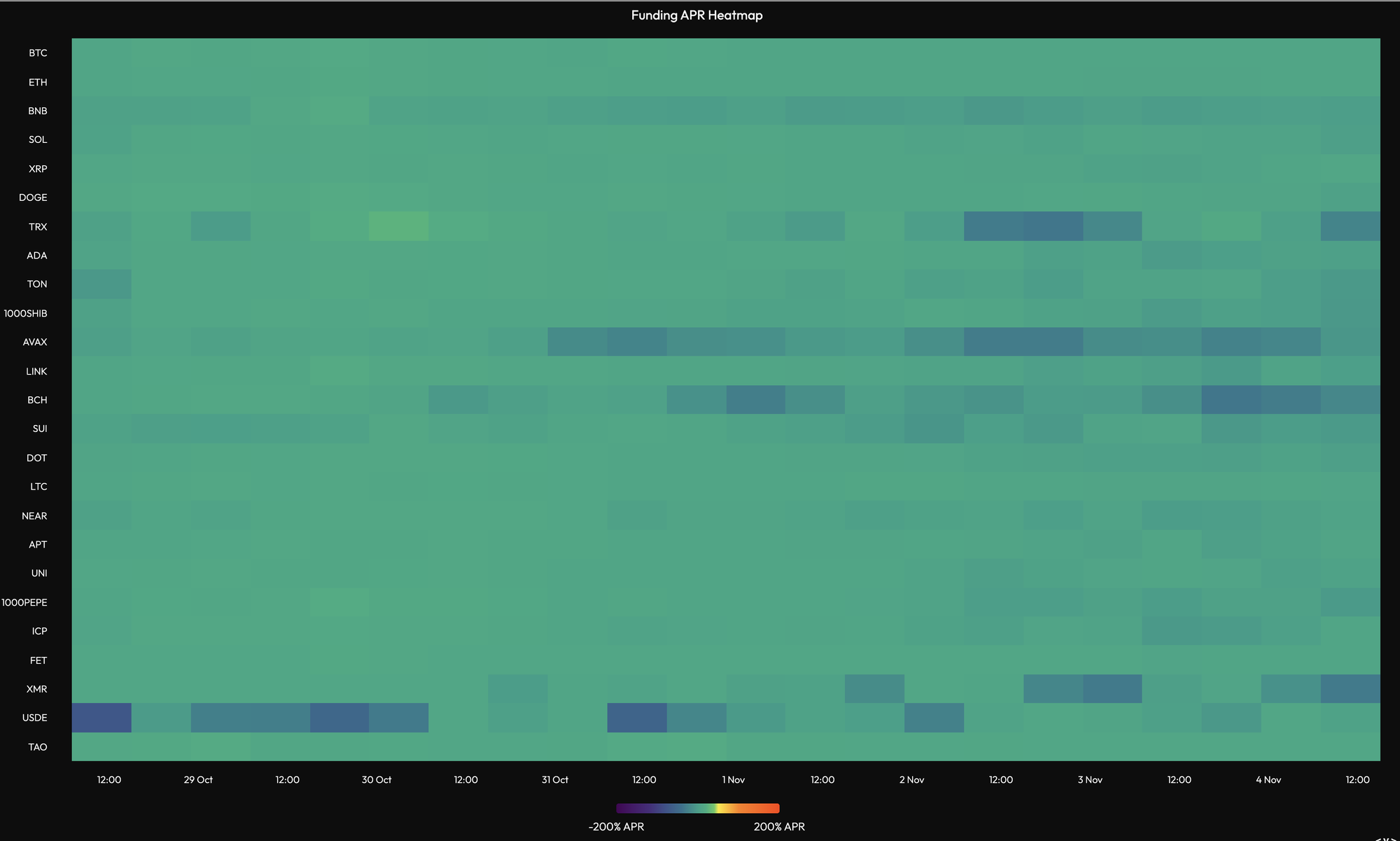

We aren’t over heated, yet.

Based on Velo funding data, the market is not yet getting too overzealous with its appetite to borrow.

How to take action on Summer.fi

If you believe that prices will appreciate and want to be ahead of the crowd based on the funding data, it might makes sense to:

Open a Multiply position and increase your exposure to ETH or BTC, with best in class automation tools like Stop Loss, Trailing Stop loss, Auto Buy, Auto Sell and Auto Take Profit before the prices goes bananas.

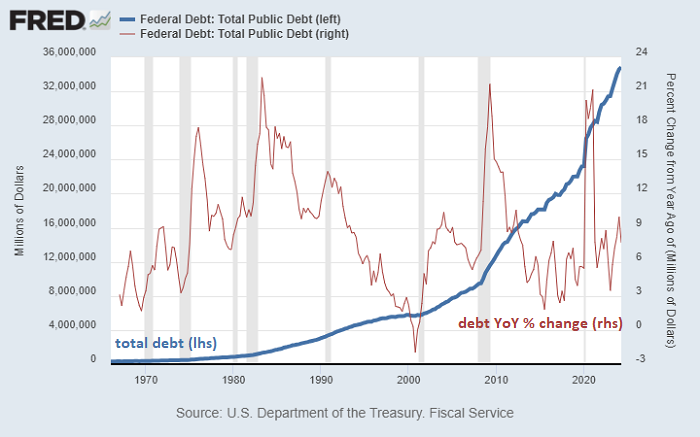

Lyn Alden, 4 Macro Catalysts

Lyn Alden recently posted a great analysis on four macro catalysts for 2025. Spoiler, some are quite bullish.

Here’s the TLDR:

Catalyst #1 U.S. Election and Fiscal Spending

What it Means: The election will probably not change much about government spending. No matter who wins, the government will likely keep spending a lot of money, which means debt will keep growing.

Market Impact: This is neutral to slightly bullish. High government spending can keep the economy afloat, which markets usually like, but it also means more debt.

Catalyst #2 Debt Ceiling

What it Means: In January 2025, the government will need to raise the debt ceiling (the limit on how much it can borrow). If Congress takes too long to decide, it could cause temporary disruptions, but the Treasury might inject extra money into the market in the meantime.

Market Impact: This is mixed but leans bullish in the short term. Injecting money can lift asset prices temporarily, but delays or standoffs create uncertainty, which can cause market volatility.

Catalyst #3 Expiring Tax Cuts

What it Means: In 2025, some tax cuts might expire, especially for high earners. If taxes go up, people will have less money to spend, which could slightly reduce economic growth.

Market Impact: This is neutral to slightly bearish. Higher taxes on individuals could mean less spending, which isn’t great for growth, but the effect is expected to be minor.

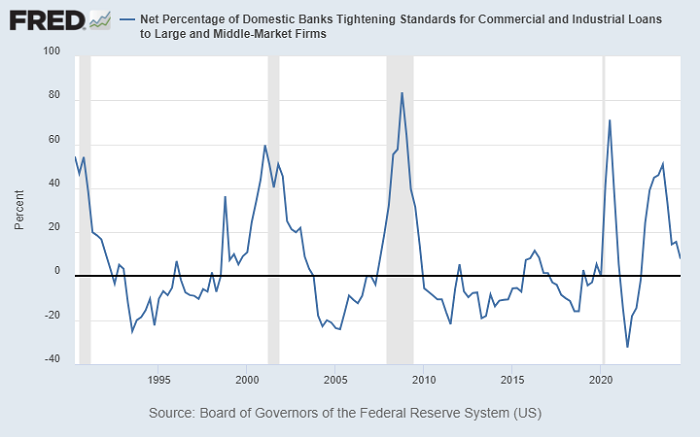

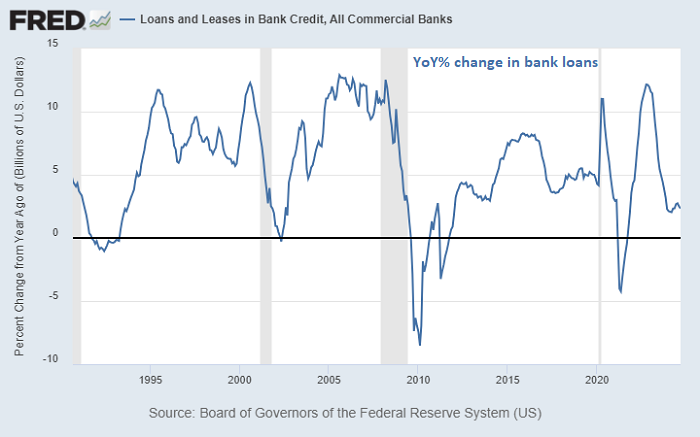

Catalyst #4 Bank Lending and Credit

What it Means: Recently, banks have been cautious about lending money. By 2025, this could change, and banks might start lending more, helping businesses and consumers get easier access to money.

Market Impact: This is bullish. More lending supports economic growth and business activity, which is usually good for the market.

How to take action on Summer.fi

Lyn Aldens report overall leans bullish for 2025 when it comes to Bitcoin and other crypto assets. If you agree with her analysis, the best way to express that view on Summer.fi is:

- Multiply Position for a high risk/reward payoff.

- ETH derivative yield loop position for price appreciation exposure, with juicey yield on top.

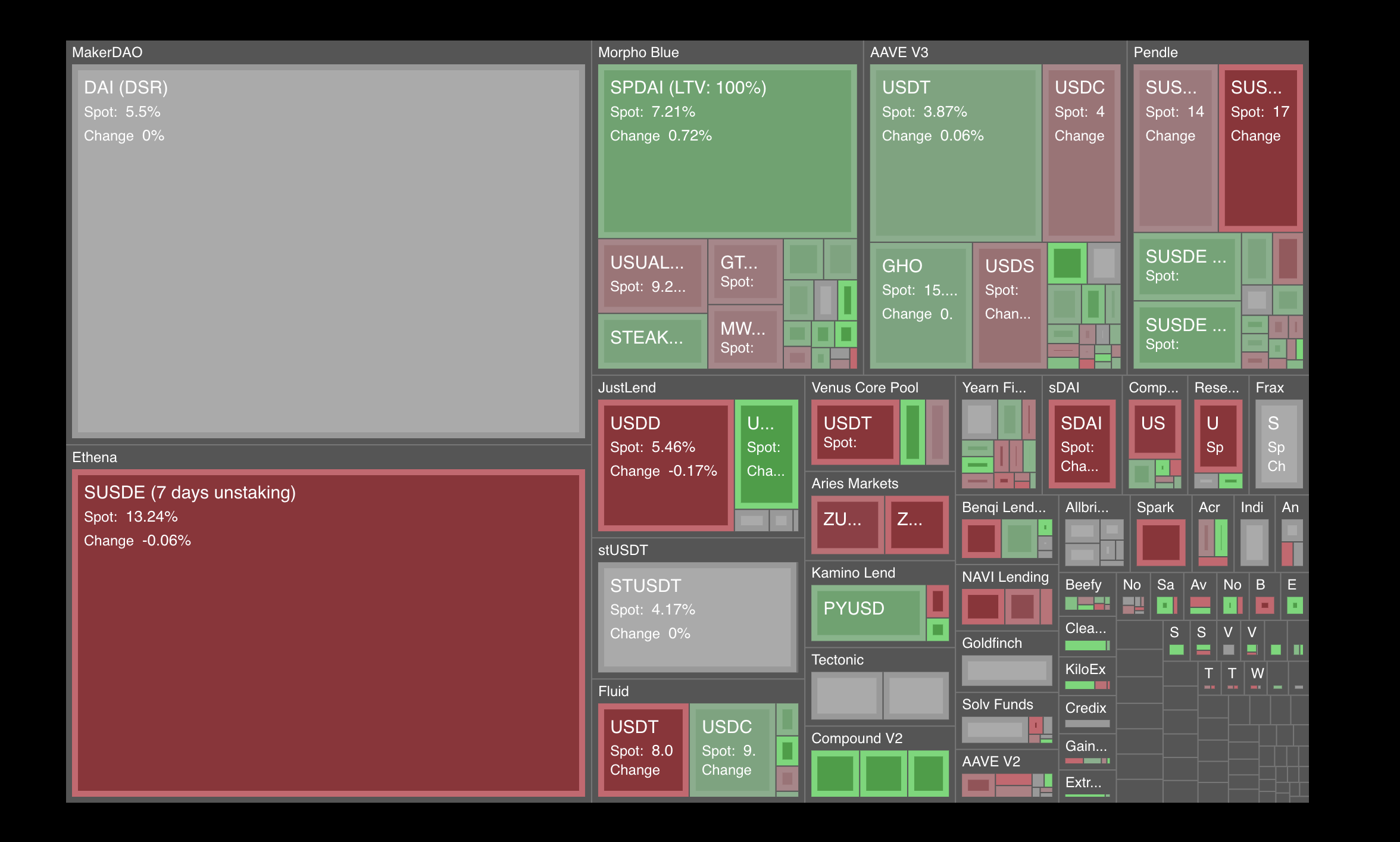

Best DeFi Yield Opportunities

The best risk adjusted yields in DeFi remain to be:

- Ethena SUSDE at 13%

- Maker / Sky sUSDs at 6.25%

- Maker / Sky Dai Savings Rate at 5.5%

How to take action on Summer.Fi

Summer.Fi gives EVERYONE access to these strategies, even our US, UK and EU brothers and sisters.

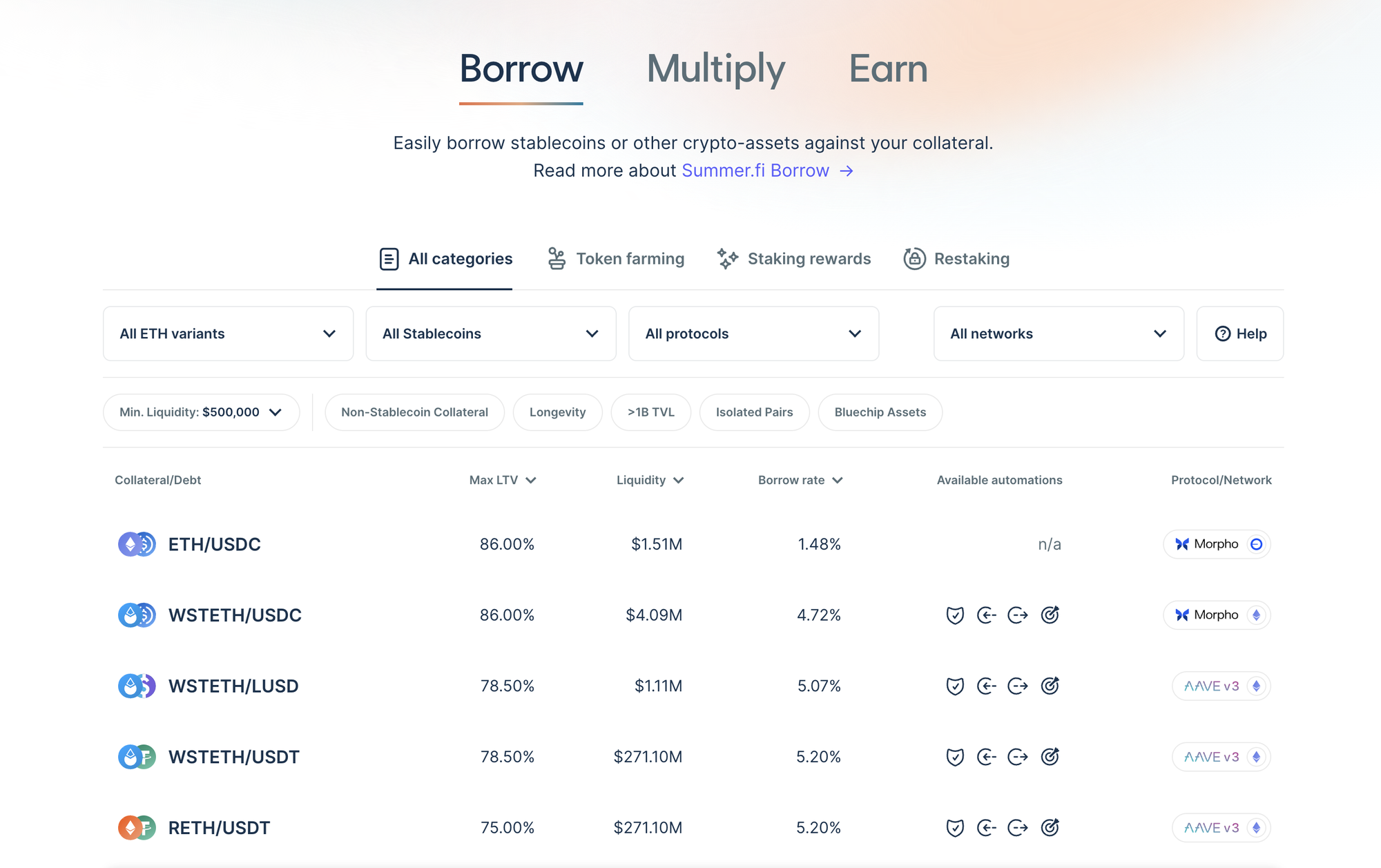

Borrow Rates

Borrow rates accross DeFi remain about ~5 to 6 percent for major assets like ETH.

How to take action on Summer.fi

On Summer.fi, anyone can Borrow against their cryptoassets. We believe that it is the best place to do so because you can use a stop loss and compare against the best DeFi protocols.

Summer.fi Position Spotlight

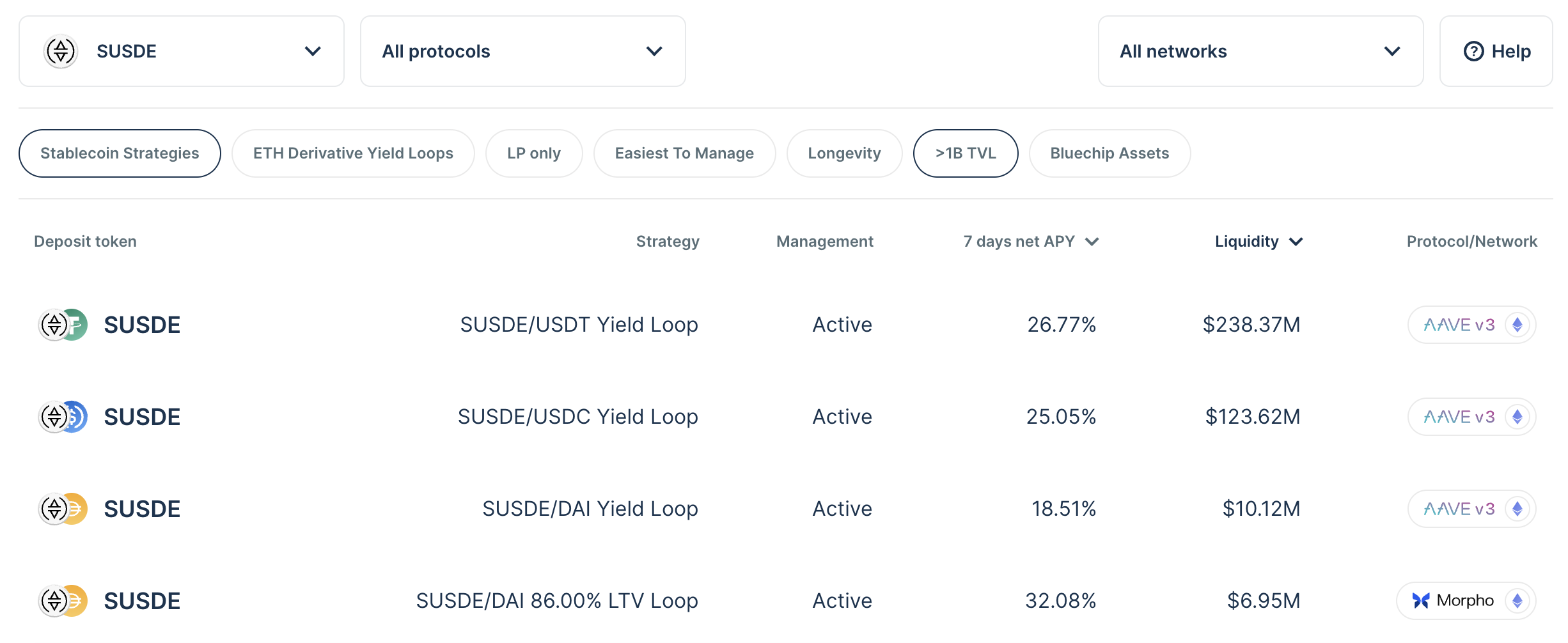

This week, the Summer.fi position we’d like to spotlight is Ethena SUSDE Yield Loop positions.

Currently, users can earn anywhere from 18-47 percent on their SUSDE, boosting the native yield by up to 3x. All while remaining eligible for Ethena’s point program.

Learn more about Summer.fi with CEO Chris Bradbury

This past week, our CEO Chris also appeared on the Edge Podcast with DeFi Dad. They cover a lot, but you can expect to learn:

- How to use Summer.Fi in bear, bull and crab markets

- What our protocol is going to do and how to prepare for its launch

- And a SURPRISE that you will only hear about if you listen to the episode.

Stay tuned for our next episode this week! Hope you enjoyed it 💥

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.