DeFi Decoded: Strategic Borrowing in a Bull Market

In a bull market, selling your appreciating assets can be the most expensive decision you make. Learning how to maintain exposure while accessing liquidity isn't just possible – it's strategic.

The Strategic Edge of Borrowing

The most successful wallets we see in Debank, or Nansen, show a fundamental truth: it's not just about what you hold, but how you optimize those holdings. Borrowing against your crypto assets creates opportunities without forcing you to exit positions destined for growth.

Strategic Applications That Matter

Capital Efficiency in Practice

Accessing liquidity while maintaining market exposure isn't just convenient – it's a competitive advantage. From funding major purchases to seizing market opportunities, strategic borrowing lets you keep your position while deploying capital where it's needed most.

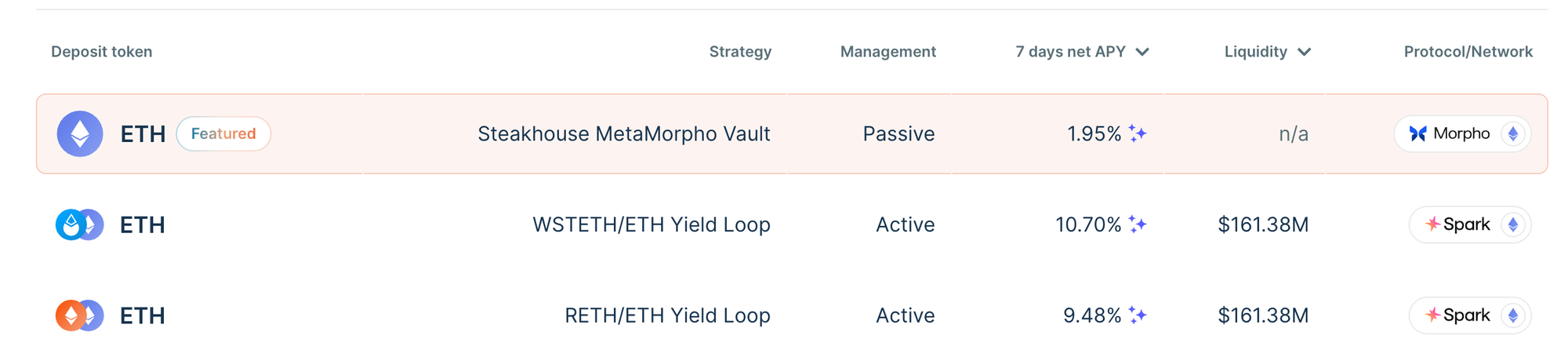

Carry Trade Opportunities

Market inefficiencies create opportunities for those who know where to look. By borrowing at lower rates and deploying capital into higher-yielding opportunities, you can generate returns while maintaining your core positions. This becomes particularly powerful with assets like $sUSDe, where yield stacking creates additional layers of return.

Protocol Token Farming

New protocols often offer significant incentives to early adopters. Through strategic borrowing, you can participate in these opportunities without diluting your existing positions. Projects like AJNA, Morpho, and Ethena demonstrate how token farming can provide substantial yields when approached systematically.

Strategic Position Taking

Markets constantly present new opportunities. Acting on these opportunities without liquidating your existing positions gives you a significant edge. Smart borrowing allows you to maintain exposure to your core holdings while capitalizing on emerging opportunities.

Making Strategic Decisions

Asset Selection Framework

Your choice of collateral and borrowed assets should align with your broader strategy. Consider not just what you have, but what positions give you the most strategic flexibility. Summer.fi provides access to multiple high-quality protocols and assets, letting you optimize based on your specific needs.

Protocol Optimization

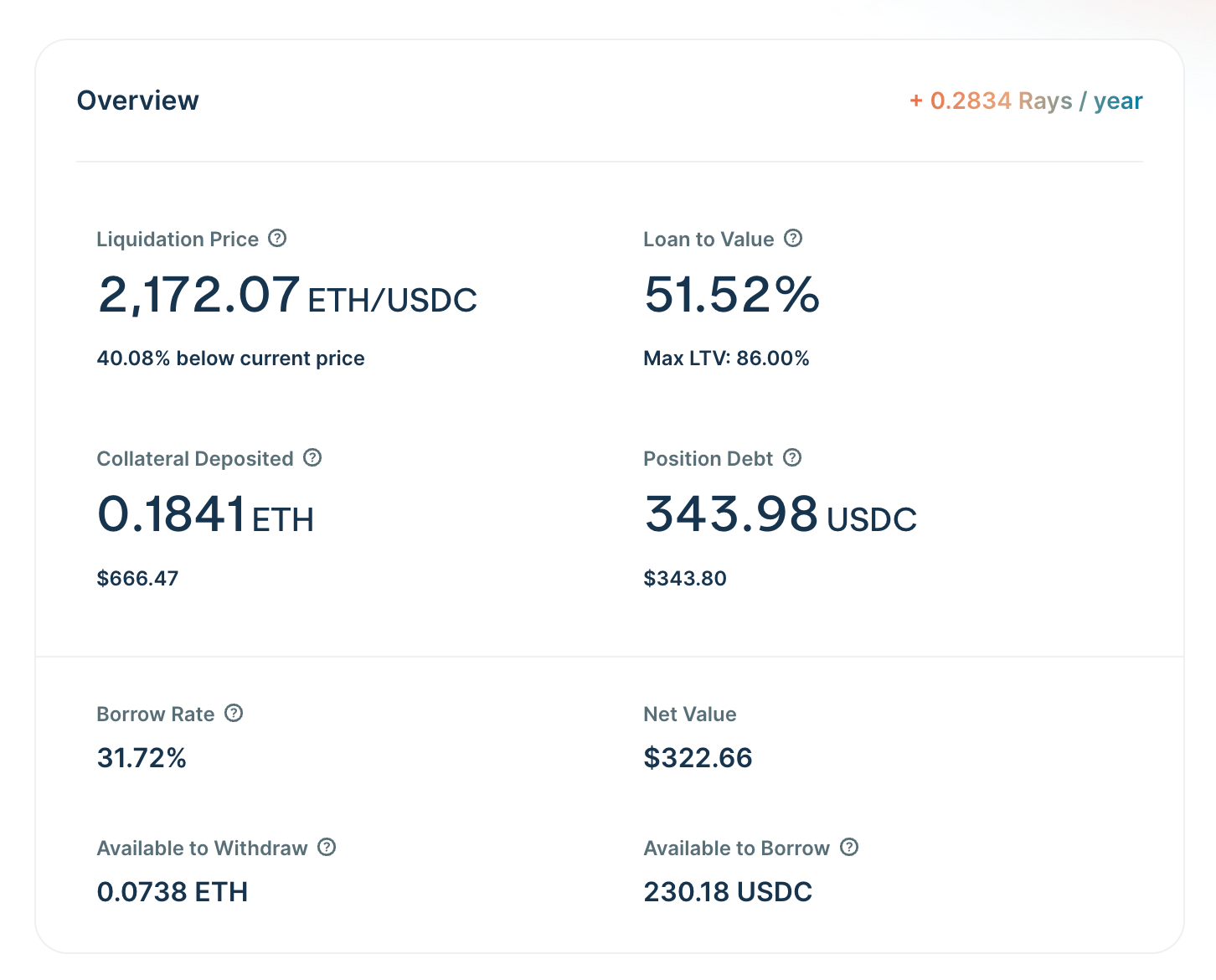

The protocol you select shapes every aspect of your borrowing strategy. While most focus solely on rates, sophisticated traders understand that protocol choice is about the interplay between historical reliability, liquidity depth, and rate stability. A protocol offering slightly higher rates but unstable parameters often proves more costly than one with consistent, reliable performance. Your selection here doesn't just affect your current position - it determines your strategy's long-term viability.

Each protocol has a unique offering, and that's why it's on Summer.fi, but it's up to you to do the research and choose the one that best fits your risk tolerance, and you like the most in general.

The Strategic Advantage

Strategic borrowing isn't just about accessing capital - it's about optimizing your entire market position. By maintaining exposure to appreciating assets while deploying capital elsewhere, you create multiple vectors for growth. When combined with automated risk management and efficient execution, this approach transforms borrowing from a simple tool into a sophisticated strategy for portfolio optimization.

Position Construction

The effectiveness of your borrowing strategy depends on your position construction. Consider the available liquidity for your chosen asset pair and how it affects your ability to enter and exit positions efficiently. Maximum LTV ratios directly impact liquidation prices, while borrowing rates influence holding period strategies. Keep all of these in mind when deploying your funds.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.