DeFi Decoded: Manual vs Automated Position Management

You know that moment you want to grab a beer during work hours and jokingly (or not) tell your boss, “Hey, it’s 5 o’clock somewhere, right?”

That means it's also 5 a.m. somewhere else, and if that's your case, you're probably sleeping, and opportunities might pass you by. This is why Automated Position Management is essential, and we'll analyze it in this article.

The Reality of Manual Position Management

Picture this: you're trying to enjoy dinner with friends, but your mind keeps wandering to your DeFi positions. The markets are volatile, and you can't help but check your phone every few minutes. Sound familiar? This is the reality of manual position management – it's demanding, stressful, and often disrupts your daily life.

The challenge goes beyond just time management. When you manage positions manually, you're essentially trying to be everywhere at once. The crypto market never sleeps, which means you're constantly on alert for potential risks or opportunities. This constant vigilance it's practically impossible to maintain long-term.

Why Emotions Are Your Biggest Challenge

Now think back to the last major market movement. Did you find yourself frozen with indecision when prices started dropping? Or perhaps you jumped in with more than you planned when everything was going up?

These emotional reactions are completely average – we're human, after all. Fear, greed, and uncertainty can cloud our judgment at crucial moments. The problem is that these emotions often lead us to make decisions that are against our better judgment and carefully planned strategies.

Automated Position Management: Your 24/7 Assistant

The beauty of automation lies in its consistency. While sleeping, working, or spending time with family, your positions are monitored and managed according to your predetermined strategy. No more missed opportunities, no more emotional decisions, and most importantly – no more constant anxiety about your positions.

How Summer.fi Makes Your Life Easier

Summer.fi's automation tools transform complex position management into a straightforward, stress-free process. Here it's why:

Protection Made Simple

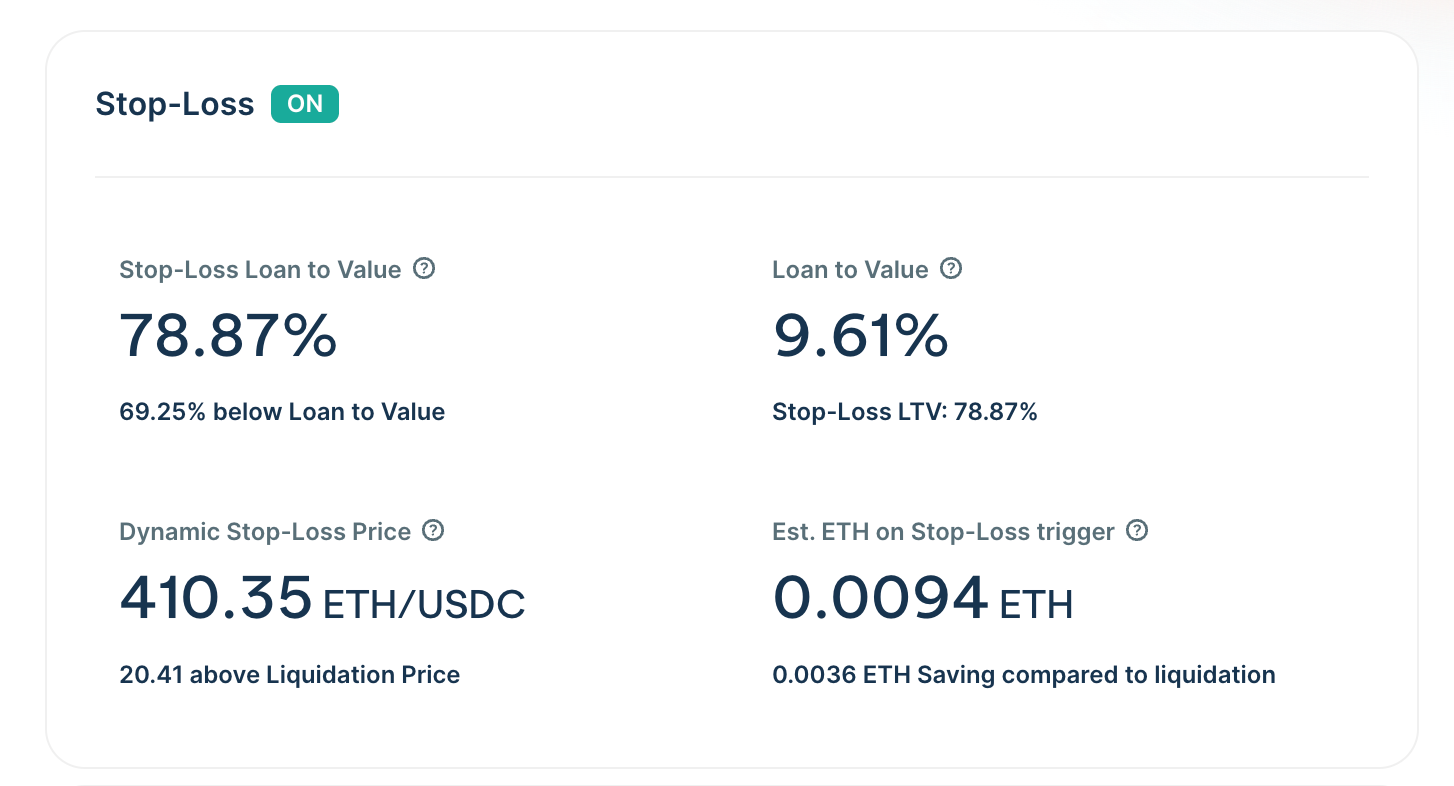

Gone are the days of constant liquidation fears. Summer.fi's Stop Loss feature acts as your safety net, automatically protecting your position when markets get turbulent. For those who want more dynamic protection, the Trailing Stop Loss adapts to market movements, helping you lock in gains while maintaining downside protection.

Catching Opportunities Without the Stress

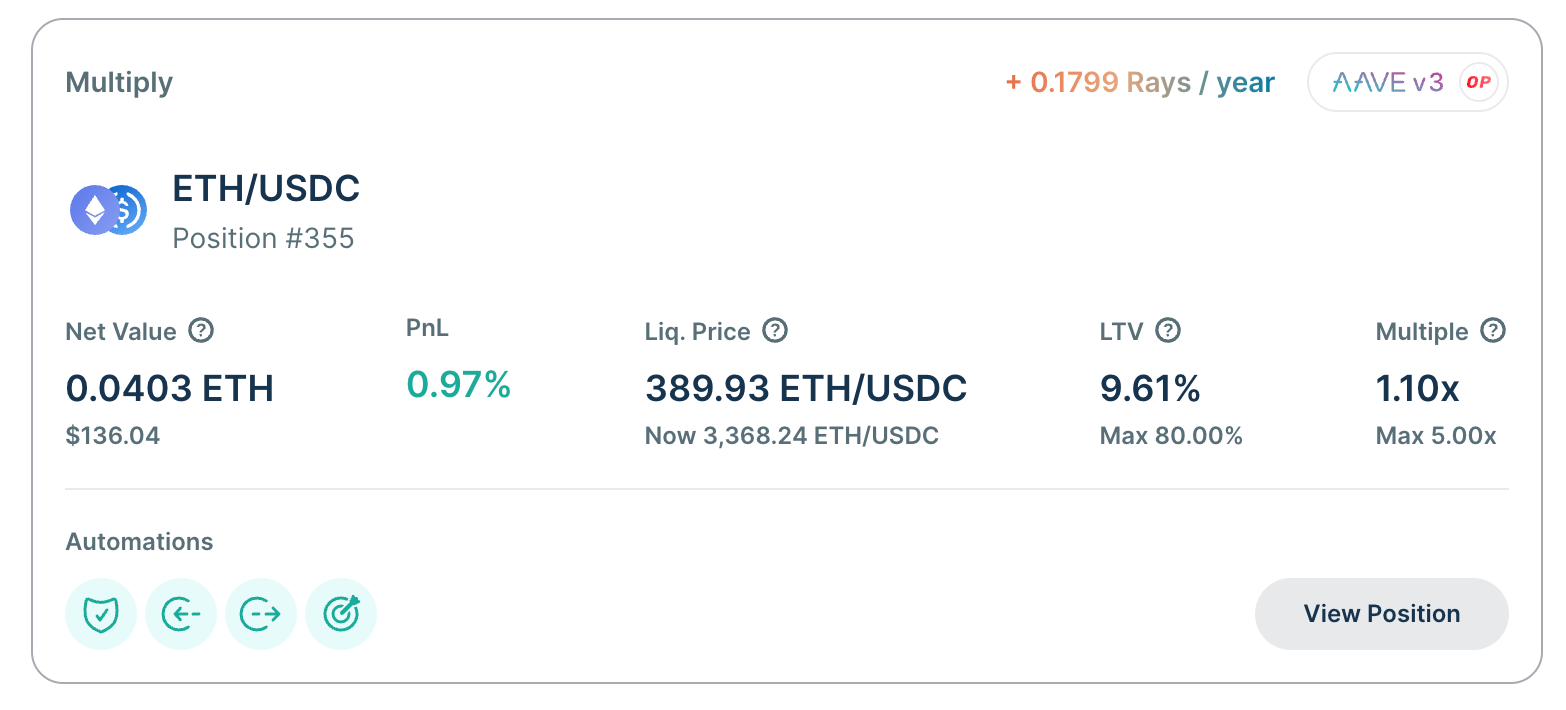

Instead of trying to time the market perfectly, let automation do the heavy lifting. Set up Auto-Buy to catch those perfect entry points you'd otherwise miss. Want to take profits systematically? Auto Take-Profit ensures you lock in gains according to your strategy, not your emotions.

Getting Started Is Easier Than You Think

Whether you're new to DeFi or have existing positions, starting with Automated Position Management is straightforward. For newcomers, simply head to Summer.fi, set up your position, and choose your automation parameters. Already have positions elsewhere? No problem—you can migrate them to Summer.fi and gradually add automation that makes sense for your strategy.

Real Talk: Why Automation Makes Sense

Let's look at some real situations where automation proves its worth. While manual traders might panic and make emotional decisions during market crashes, automated strategies execute calmly according to plan. When it comes to taking profits, instead of second-guessing yourself, your predetermined strategy takes care of it systematically.

The most significant advantage? Peace of mind.

The Bottom Line

DeFi is exciting, but it shouldn't consume your life. It's about protecting your positions even while you sleep, and catching opportunities without being glued to your screen.

Have questions? Summer.fi's Discord community is always there to help you get started on your automation journey.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.