DAO Managed vaults: How to future proof your DeFi yield strategy

DeFi yield is one of the few categories in crypto that has undeniable product-market fit. Lending, staking, restaking, structured vaults. DeFi-native users, and increasingly institutional users and fintechs, want yield on their onchain assets, and the market has responded with an explosion of ways to earn it.

At Summer.fi, we've been saying it for months: 2025 was the year of DeFi yield fragmentation, and 2026 is the year of onchain vaults. While those posts laid the foundation of what we believe to be true, this one is about what you can actually do about it.

Right now, the state of DeFi yield is simultaneously the best and the worst it has ever been.

The best of DeFi yield

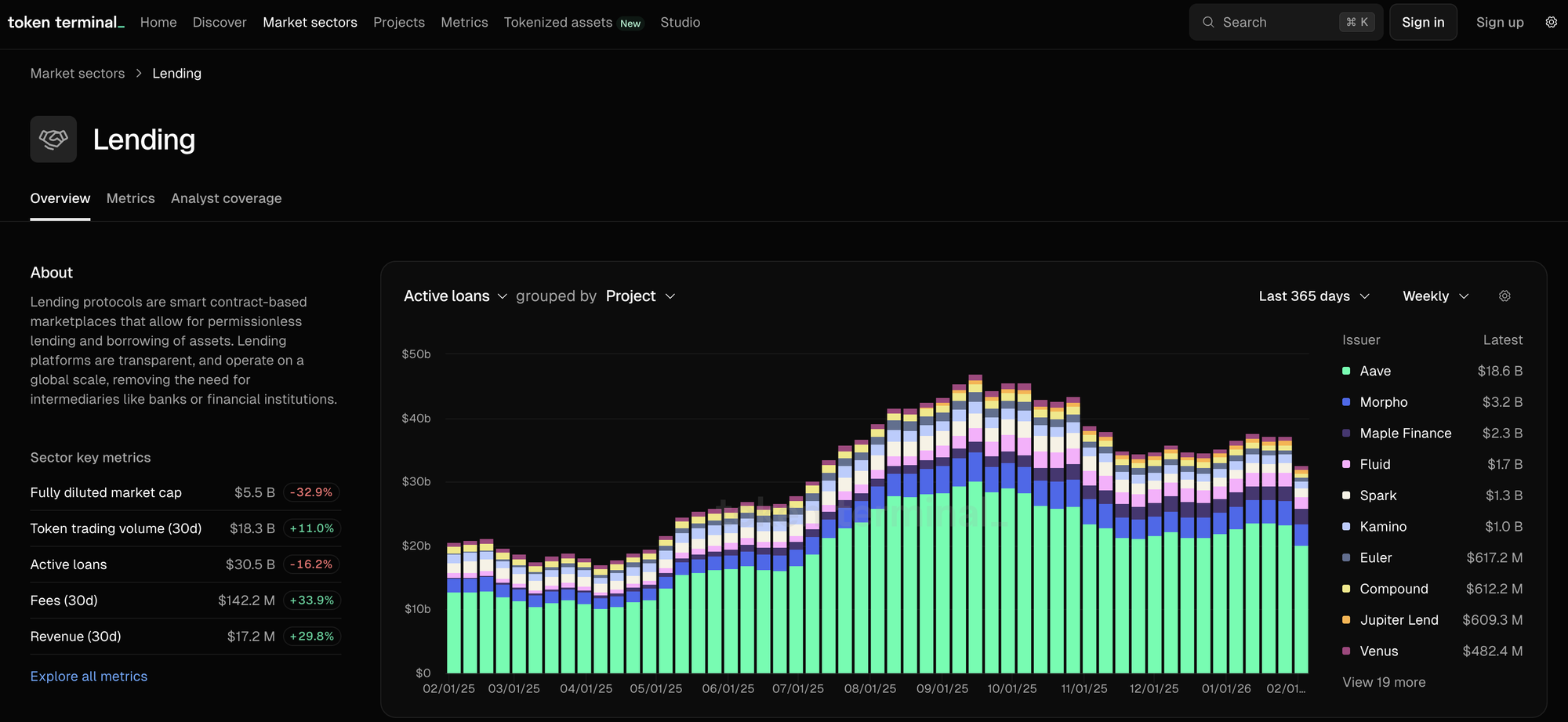

There are more credible yield sources, more protocols, and more strategies than at any point in DeFi's history. Onchain lending alone has grown nearly 10x from its bear market lows. DeFi TVL recently breached its 2021 high of ~$150 billion. The yields are real, and the ecosystem is maturing quickly to satisfy more demanding customers and customer needs.

The worst of DeFi yield

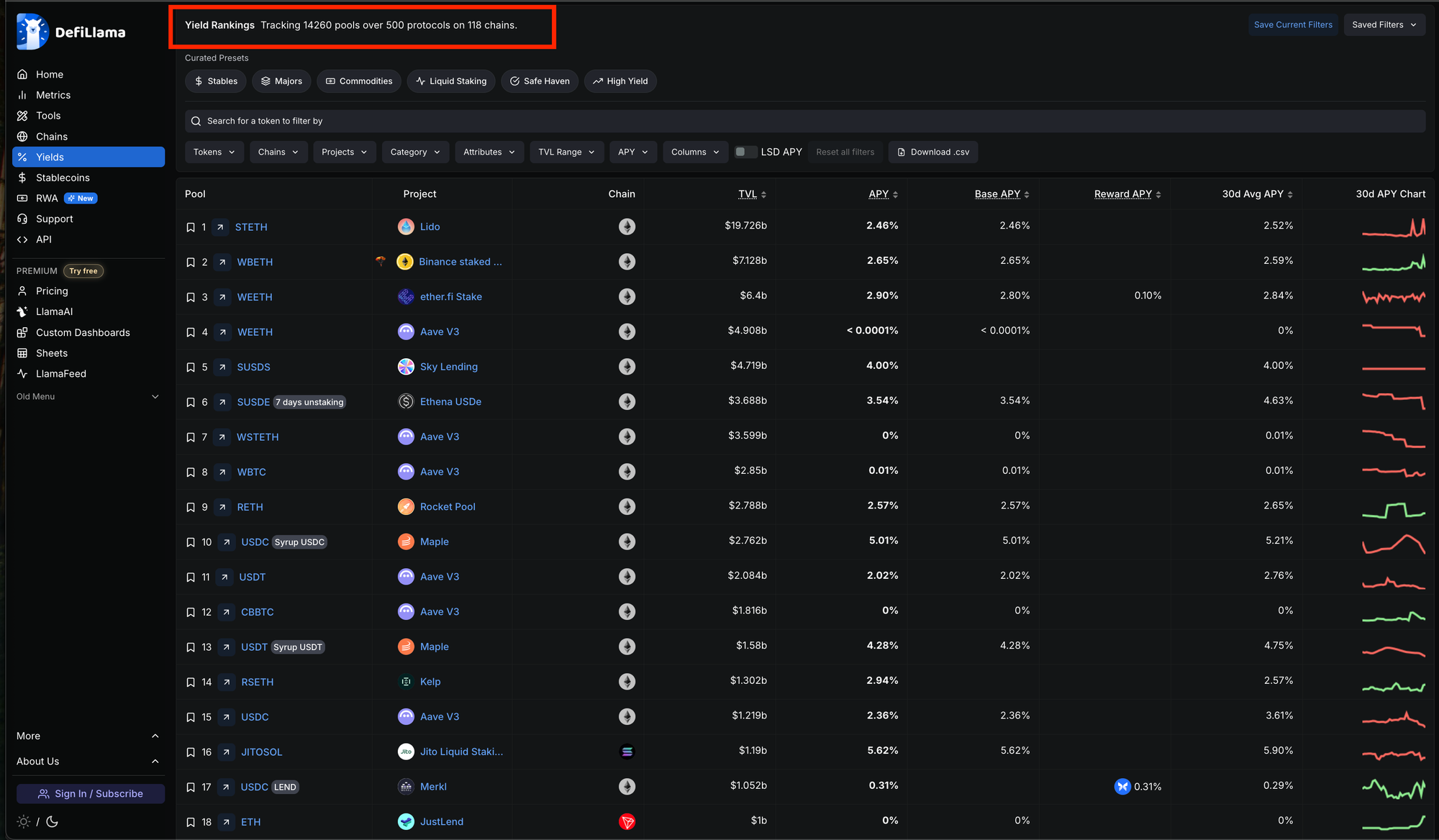

The very diversity that makes DeFi yield so powerful is also what makes it nearly impossible to manage well. There are dozens of protocols, hundreds of individual vaults, and yields that shift daily. Risk profiles require constant monitoring. Galaxy's research on onchain yield frames it perfectly: the DeFi market is diverse, fragmented, dynamic, and only getting more so.

If you're sitting in a single Morpho vault, a single Euler position, or just holding USDC and ETH in your wallet right now, this should matter to you, because you're either missing out on what DeFi has to offer, or spending your time competing against automated systems that rebalance capital the moment opportunities arise.

Where DeFi yield is going (whether you're ready or not)

Beyond the incredible growth, the DeFi yield landscape is changing structurally. Three forces are converging that will make 2026 a turning point, and they all point in the same direction: more yield, more complexity, and a greater premium on getting your allocation strategy right.

Stablecoins and their yield-bearing children

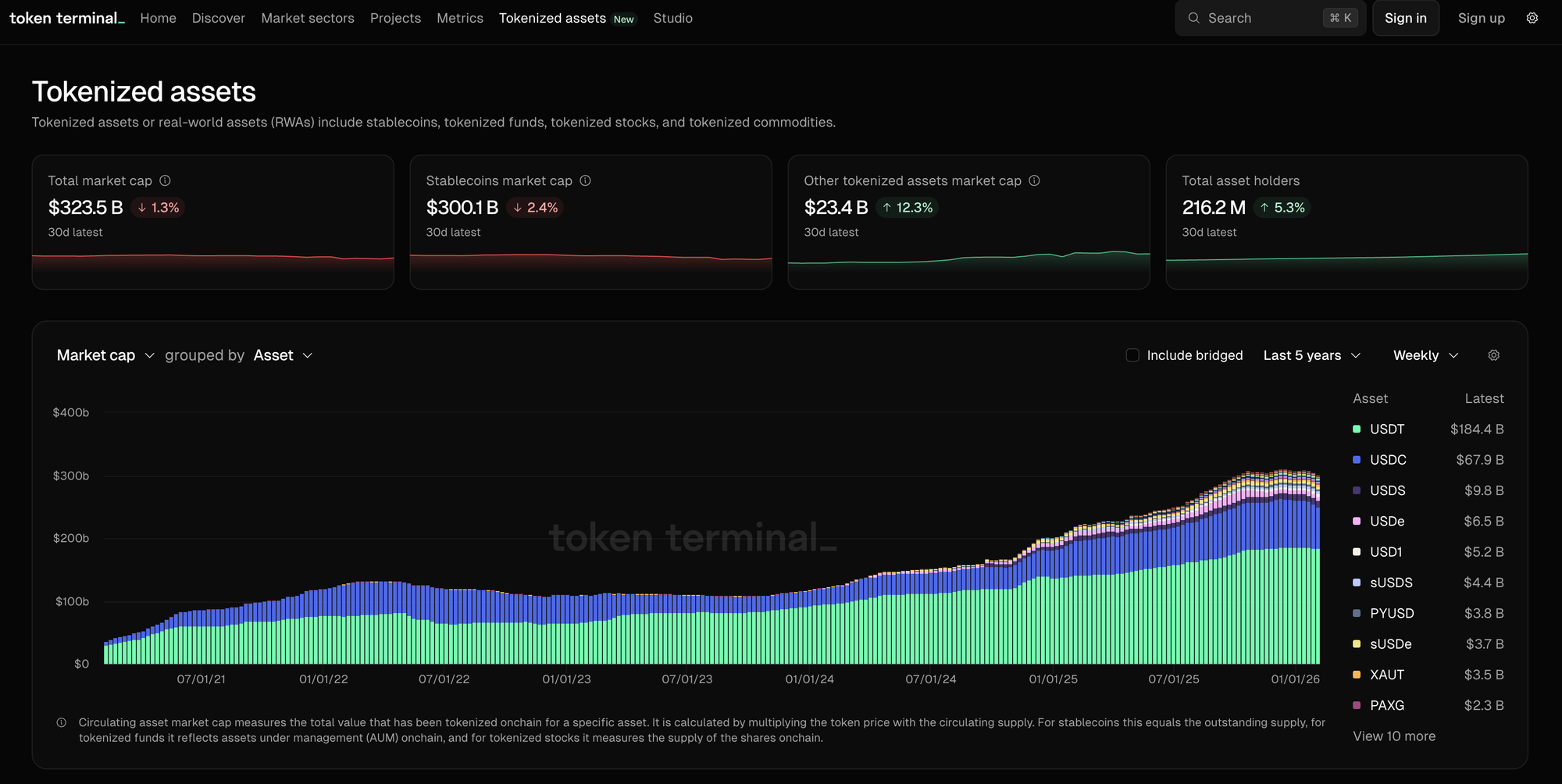

Stablecoins have crossed the $300 billion supply threshold. They've processed $46 trillion in transaction volume over the past year — nearly three times Visa. More than 1% of all US dollars now exist as tokenized stablecoins on the blockchain. The GENIUS Act and forthcoming CLARITY Act provide regulatory clarity in the US. Every single one of these facts points to mass adoption of stablecoins across the globe.

But there's a gap.

Most stablecoin holders are earning zero. USDT pays nothing. USDC yield sharing is minimal. If you're holding stablecoins in your wallet, on an exchange, or even in a basic peer-to-pool lending market, you are almost certainly leaving yield on the table at a similar level of risk.

The rise of yield-bearing stablecoins and stablecoin-denominated vault strategies is the market's answer to this gap. The demand is self-evident in the monumental rise of yield-bearing stablecoin TVL and onchain vault deposits.

{GRAPHIC}

Tokenization is not a pilot anymore

Larry Fink has compared tokenization today to where the internet was in 1996, when Amazon had sold just $16 million worth of books. BlackRock's op-ed in The Economist described it as the most profound transformation in market infrastructure since the 1970s. Their own tokenized money market fund, BUIDL, has crossed $2 billion in TVL.

The tokenized asset market nearly quadrupled through 2025 to almost $20 billion. Superstate's 2026 predictions expect onchain capital formation breakthroughs, tokenized equities entering DeFi, and notably, onchain vaults powering the next phase of RWA growth.

Why does this matter for your yield strategy? Because as more real-world assets come onchain, the range of yield sources available to vault strategies expands dramatically. The vaults that can access both DeFi-native lending and tokenized real-world credit will have a structural advantage. And the users in those vaults will earn yields that simply aren't available to anyone sitting in a single-protocol position — a game-changer for the risk/reward balance across DeFi yield strategies.

Vaults are the product category that wins

If stablecoins are the asset class and tokenization is the infrastructure, vaults are the product that ties it all together. They're the wrapper that lets users access the full breadth of DeFi yield without becoming a full-time yield farmer.

This is how onchain yield goes from $10 billion to $100 billion — not through millions of individual users manually chasing APYs, but through automated, diversified, risk-managed vaults that abstract away the complexity, available to DeFi-native users and integrated within institutions alike.

The problem with where you are today

If you're holding USDC or ETH in your wallet, you're earning nothing. In a market where credible DeFi lending protocols are paying slightly above treasuries on stablecoins, idle assets are a choice.

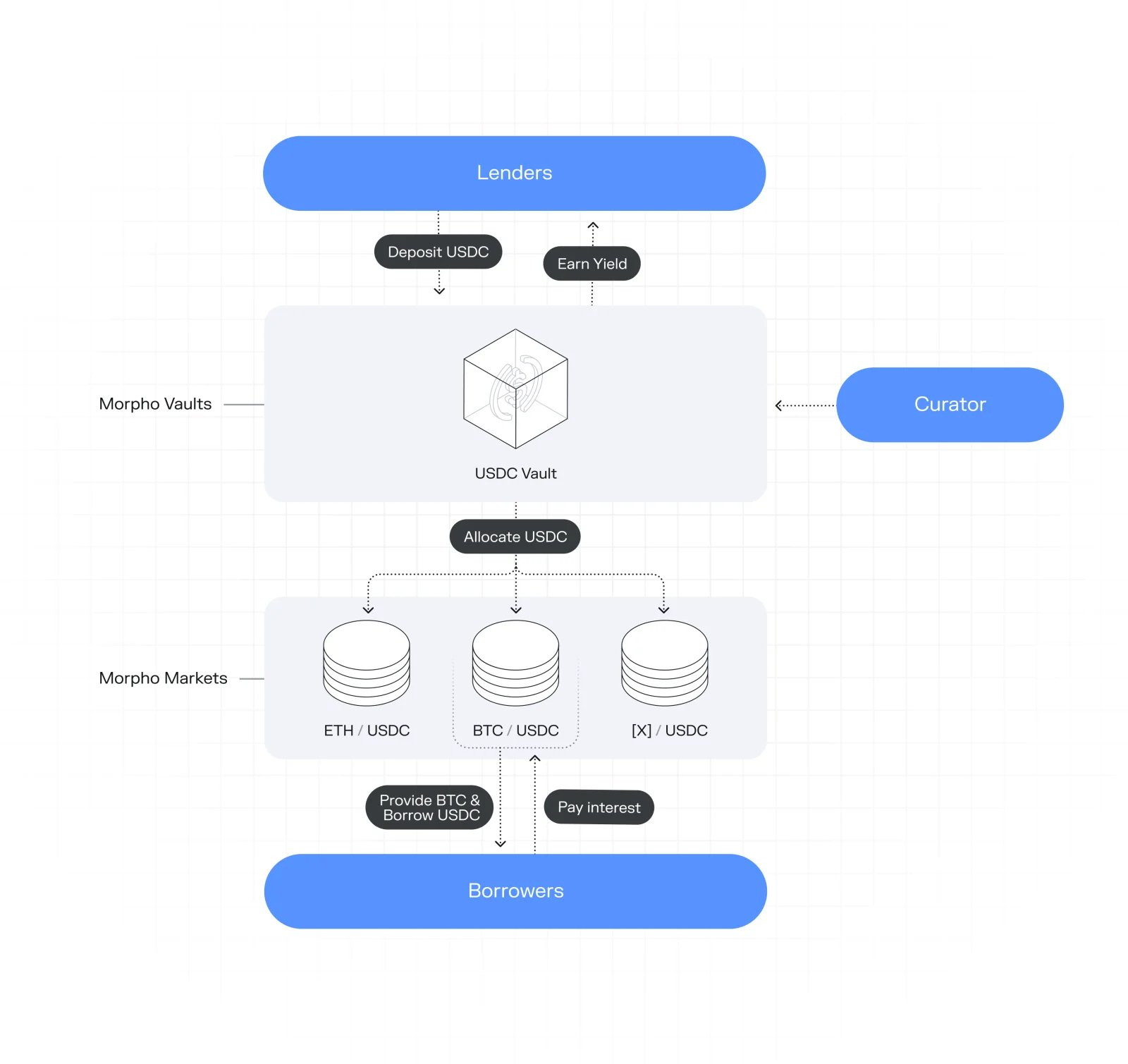

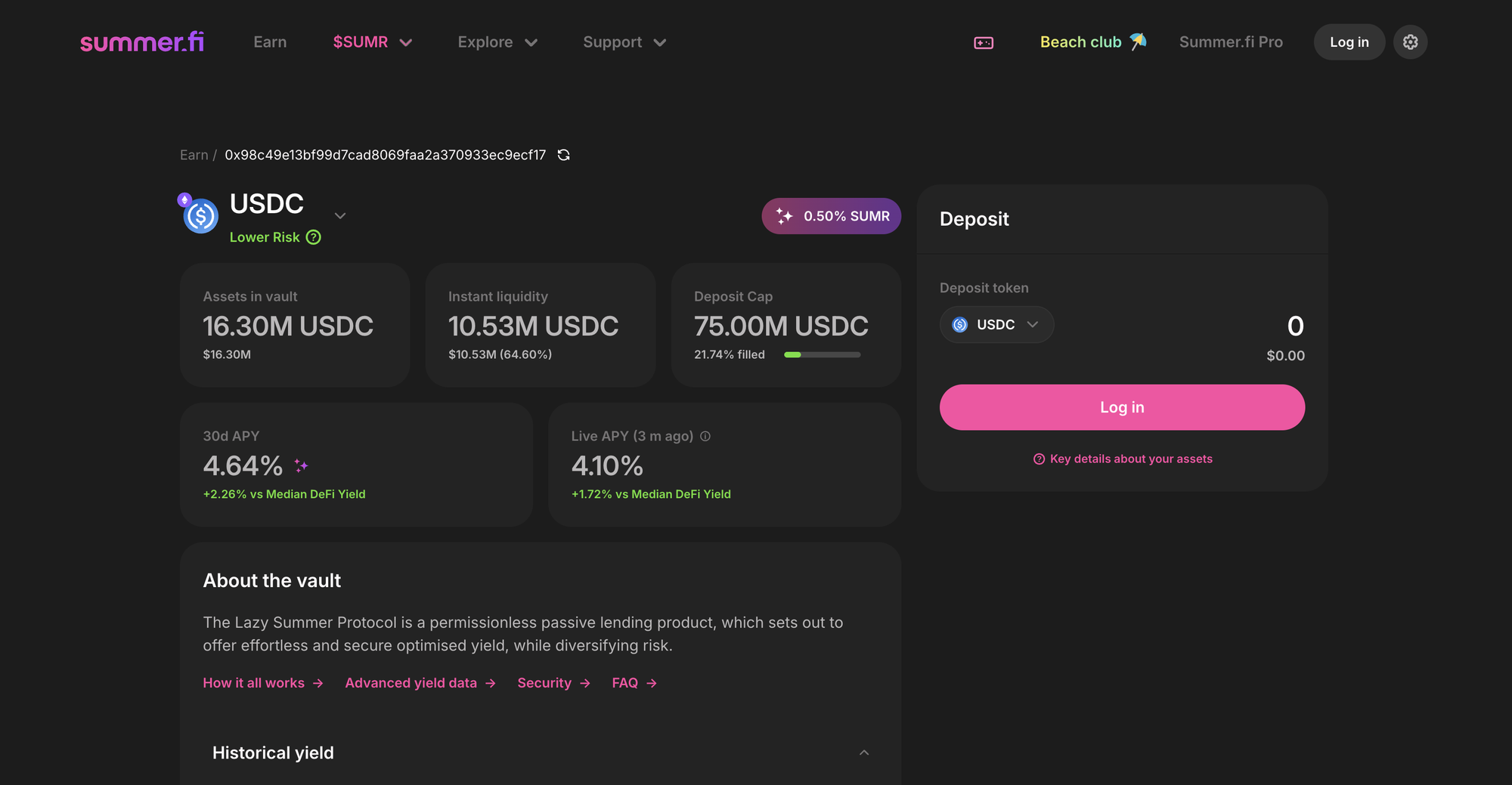

If you're deposited in a single Morpho vault ie, Gauntlet USDC Prime or Steakhouse USDC, you're doing better than most. But you're also accepting a set of constraints that you may not have fully considered:

You're locked into a single curator's thesis. Every Morpho vault reflects the risk appetite and strategy of its curator. Gauntlet has a different approach than Steakhouse, which is different from Yearn, which is different from kpk. Each one has its merits. But you're betting that one curator's approach is optimal across all market conditions, and that's a bold assumption in a market that can, has, and will continue to be volatile.

You're exposed to single-protocol risk. Even if you diversify across curators, if all your yield is flowing through Morpho, you have concentration risk at the protocol level. Smart contract risk, governance risk, oracle risk, these are protocol-specific and they compound when you're 100% allocated to one place.

You're managing this manually. When Fluid launches a new lending market with 12% USDC rates, when Euler's Stablecoin Maxi vault starts outperforming, when Sky Rewards are elevated for a limited period, are you catching those? Are you rebalancing? Are you comparing net yields after gas? For most people, the answer is no.

You're paying for fragmentation with your time. Even if you're sophisticated enough to monitor all of this, the operational cost is enormous. Galaxy's research noted that yield markets have evolved more in structure than in size, the complexity is growing faster than the yields themselves. Monitoring 30 vaults across 5 protocols on 3 chains is a full-time job.

How to future-proof your DeFi yield strategy

The key question isn't "which vault should I be in?" It's bigger than that.

In a market where yield sources are proliferating, market structures are shifting, and new protocols are launching monthly, you need a strategy that automatically adapts — not one that assumes that one protocol, one curator, or one yield source can do everything for you.

Future-proofing your DeFi yield strategy means three things:

Future-proof from fluctuating yields. When the lending rate on Fluid drops from 8% to 3% and Morpho's Smokehouse vault jumps from 4% to 9%, your capital should move automatically.

Future-proof from risk. Diversification isn't just a nice-to-have, it's how you survive the next protocol exploit, the next oracle failure, or the next liquidity crisis. The users who were concentrated in a single strategy when Balancer was exploited in November 2025 learned this the hard way.

Future-proof from missing out. This might be the most underappreciated one. When new yield sources emerge, and they will, at an accelerated rate, you want exposure to them in a reasonable amount of time, after they have been stress-tested.

Introducing DAO Managed Vaults: Lazy Summer's next evolution

Lazy Summer's core promise has always been simple: Do Less. Deposit once, and let the protocol handle the complexity.

That means:

Above-benchmark yield: Diversified exposure that consistently beats static deposits.

Risk curation: Access to new yield sources inside a strict, governed framework.

No yield chasing: Governance and risk experts handle rotation discipline so users don't have to.

But the market has evolved, and so has what users are asking for.

For users who want the best risk-adjusted yields in DeFi , conservative, battle-tested, curated by Block Analitica, Lazy Summer's existing vaults remain the best option. Period. We firmly believe that.

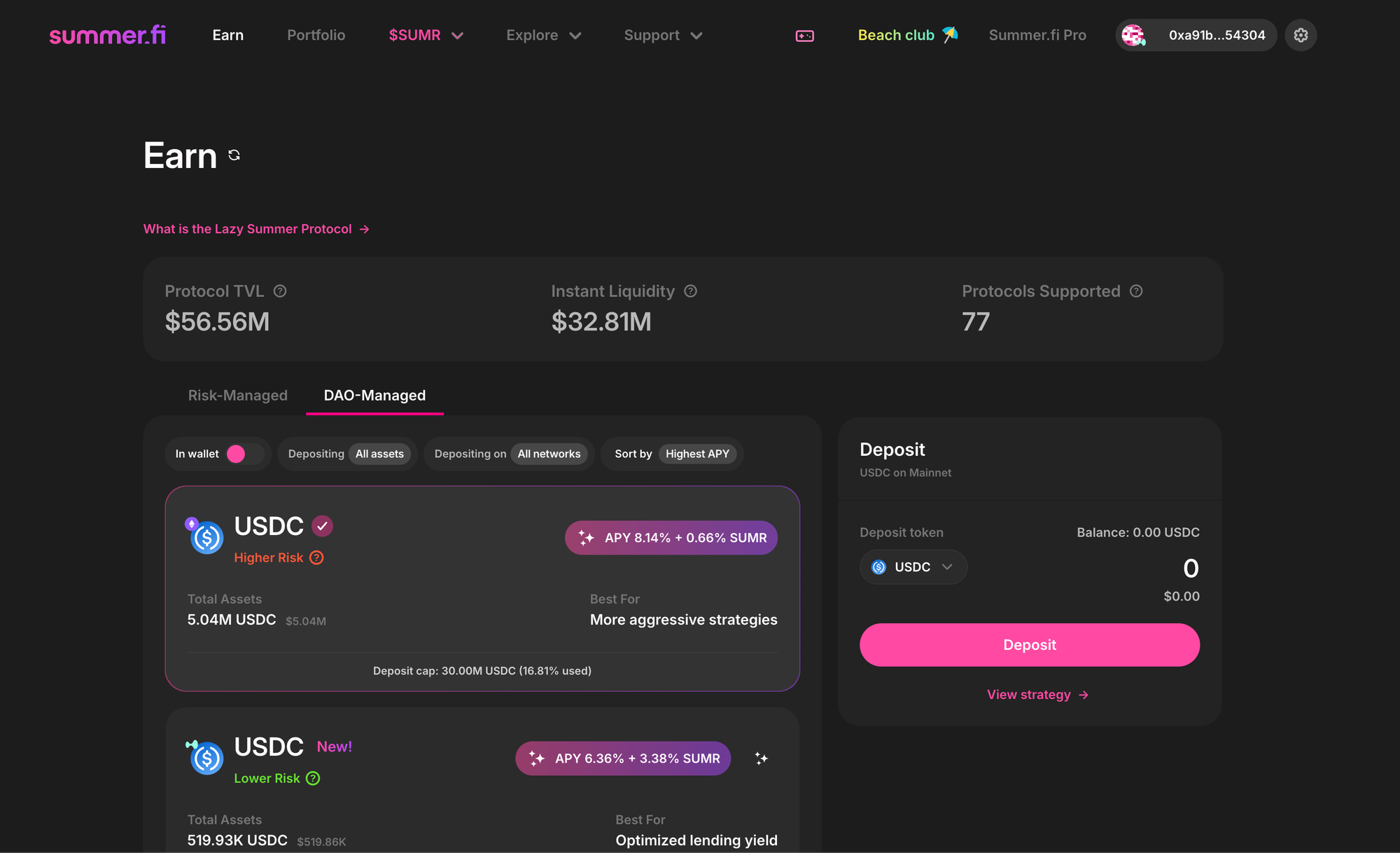

But we've heard from a growing segment of users who want something different. They don't just want risk-adjusted returns. They want DeFi strategies with a higher risk/reward ratio. They want access to more yield sources, more protocols, more aggressive strategies. But they still want the automation, diversification, and the set-and-forget experience that Lazy Summer is known for.

What are DAO Managed Vaults?

DAO Managed Vaults are yield-bearing vaults that give users automated exposure to DeFi's highest yields from the best protocols.

Unlike Lazy Summer Core Vaults, they are optimized for risk/reward — not purely risk-adjusted yield.

These vaults give you everything that makes Lazy Summer great, without restrictive active risk management:

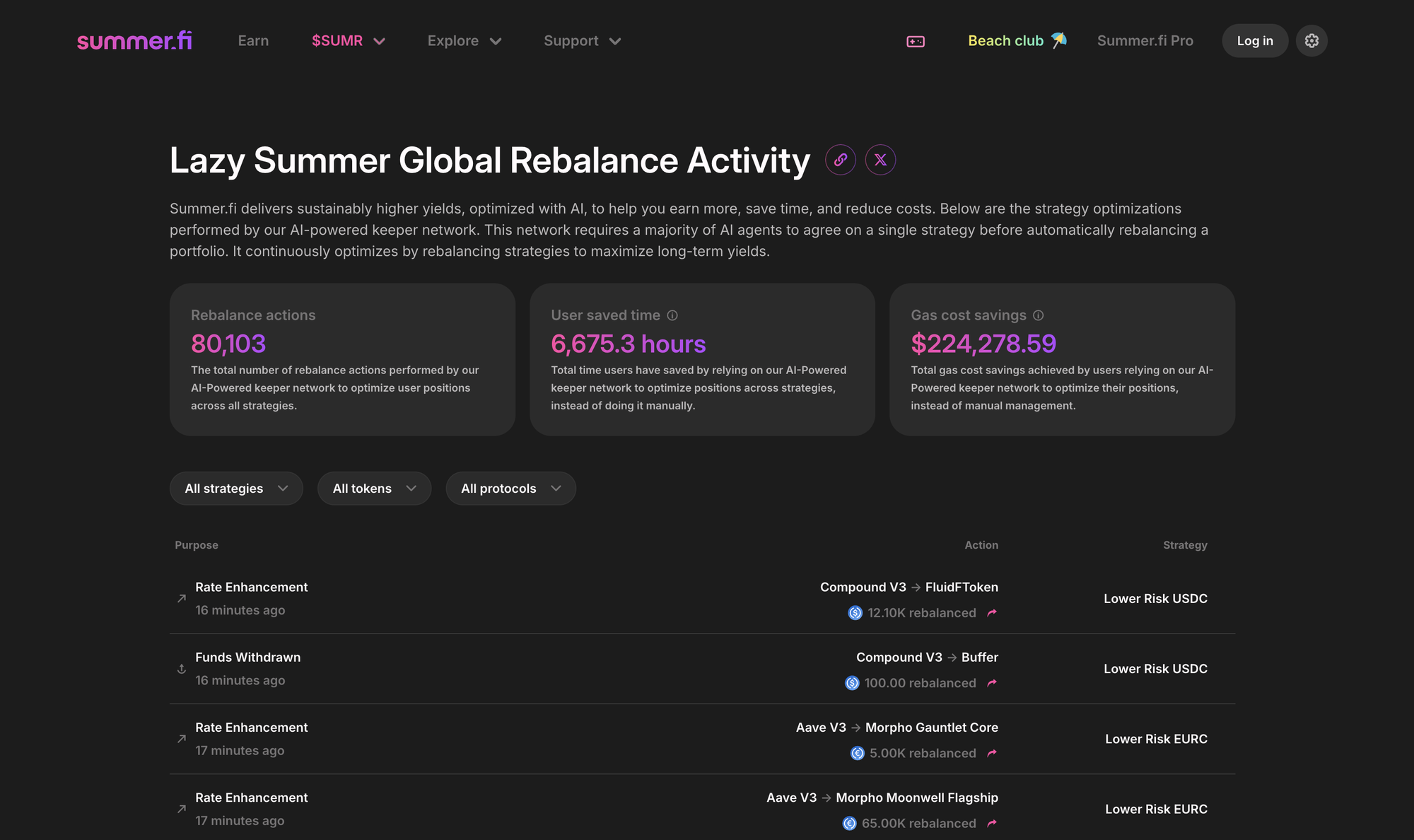

Automated rebalancing: Earn the best yields automatically with a single deposit.

Diversified exposure across multiple protocols: Never rely on a single yield source or protocol.

…but with a more flexible risk framework. Instead of optimizing purely for risk-adjusted returns, DAO Managed Vaults optimize for the highest available yields across DeFi's best protocols, so long as they fall within a defined risk framework.

Here's what that means in practice:

More outperformance. DAO Managed Vaults can deploy capital into the best-performing strategies across DeFi, faster.

Increased access. DAO Managed Vaults have a wider variety of yield sources than Lazy Summer Core Vaults because they search for the best risk/reward opportunities.

Transparent, rules-based risk framework. DAO Managed Vaults use a transparent risk framework that determines which yield sources are allowed into the vault.

Lazy Summer automation saved users over 1,100 hours of management time in a single month. With DAO Managed Vaults, that same automation now covers a dramatically broader range of yield sources. Automated access to DeFi's highest yields.

How do DAO Managed Vaults work?

DAO Managed Vaults work in a simple four-step process, which includes a clear and transparent risk framework developed in partnership with Block Analitica.

Step 1: Yield source proposal

Anyone can come to Lazy Summer and propose a yield source for inclusion in a supported DAO Managed Vault (USDC or ETH on Mainnet, or USDC on Base).

Step 2: Risk filtering

Before the proposal is even considered, the yield source goes through the DAO Managed Vault risk filter. This screens all proposed yield sources across the following dimensions:

| Filter | Explanation |

|---|---|

| Protocol Age | Ensures the smart contracts have been live on mainnet long enough to be battle-tested, eliminating unproven protocols. |

| Audit Status | Requires at least one audit by a top-tier firm (e.g., OpenZeppelin, Trail of Bits) within the last 12 months to ensure security standards are current. |

| TVL / APY Screen | A mathematical check to ensure the yield gain is worth the added risk. If adding the source doesn't meaningfully raise the total fleet APY, it's rejected. |

| Backing Liquidity | Guarantees that the assets backing the yield source aren't stuck in long vesting or lockup periods, allowing for a quick exit during market stress. |

| Verifiable Backing | Backing must be verifiable either onchain (continuous proof) or via monthly attestations by at least two independent auditors. |

| Swap Liquidity | If a swap is needed to enter or exit, there must be enough liquidity to prevent slippage that would erode earned yield. |

| Critical Dependency | A catch-all filter for systemic risks like single-oracle failures or issuer issues flagged by BA Labs or the Guardians. |

Step 3: Risk categorization

After passing the initial screening, the yield source is placed into one of three confidence categories, which determines how much capital can be allocated to it within the vault.

| Risk Attribute | Category A: High Confidence | Category B: Moderate Confidence | Category C: Lower Confidence |

|---|---|---|---|

| Track Record | Long-term maturity with a clean safety history. | Established presence on the target chain. | Baseline proof of life; may be a newer entrant. |

| Strategy Complexity | Direct yield only; no financial engineering. | Allows one complex layer (e.g., leverage or delta-neutral). | Allows multiple complex layers simultaneously. |

| Liquidity & Exit | Highly liquid; standard market exit. | Quick exit; strictly defined maximum withdrawal window. | Variable exit; may include queues or cooldown periods. |

| Network Scope | Strictly single-chain operations. | Strictly single-chain operations. | Allows cross-chain backing and bridge dependencies. |

| Fleet Allocation | Primary: Can serve as the core holding for the entire fleet. | Supplementary: Significant but capped to ensure diversity. | Tactical: Smallest footprint; strictly limited to mitigate impact. |

| Rebalance Speed | Aggressive: Allows large-scale capital movement. | Moderate: Balanced inflow/outflow controls. | Cautious: Small, incremental capital movements only. |

Step 4: SIP vote and onboarding

Once the yield source has passed the risk checks and been placed into a category, it goes to a vote where SUMR holders decide whether to allow it into the protocol.

Once approved, the yield source is deployed into the vault within 5 days.

What can you expect from DAO Managed Vaults?

Users can expect DAO Managed Vaults to be among the top-performing vaults in DeFi for the most liquid assets and chains: USDC and ETH on Mainnet, and USDC on Base.

If you want to always be earning the highest yields from protocols with reasonable risk assumptions (not degen, but not overly conservative either) then DAO Managed Vaults by Lazy Summer will be the go-to strategy. Expect to find them at the top of the yield leaderboards.

DAO Managed Vaults launch next week for USDC on Mainnet, ETH on Mainnet, and USDC on Base.

Here's a preview of the yield sources you'll get automated access to from day one.

USDC: Ethereum Mainnet

From a single deposit, your USDC flows across the best yield opportunities on Ethereum:

| Yield Source | Protocol | Description |

|---|---|---|

| Sky Rewards | Sky | Ecosystem stablecoin yield |

| Syrup USDC | Maple Finance | Institutional lending |

| Fluid USDC | Fluid | Lending market |

| Morpho kpk USDC Yield V2 | Morpho | kpk-curated vault |

| Morpho Yearn OG V2 | Morpho | Yearn-curated vault |

| Morpho Gauntlet USDC Frontier | Morpho | Gauntlet's frontier strategy |

| Morpho Gauntlet USDC Prime | Morpho | Gauntlet's prime strategy |

| Morpho Smokehouse USDC | Morpho | Smokehouse-curated vault |

| Morpho Steakhouse Prime Instant | Morpho | Steakhouse's prime vault |

| Euler Stablecoin Maxi | Euler | Stablecoin-optimized vault |

| Upshift USDC | Upshift | Lending pool |

| Upshift Core USD | Upshift | Core strategy |

| Resolv USR Yield Maxi | Upshift | Resolv yield strategy |

| Origin OUSD | Origin Protocol | Yield-bearing stablecoin |

That's 14 yield sources across 6 protocols, automatically rebalanced, from a single deposit. Compare that to the one vault you're currently sitting in.

ETH: Ethereum Mainnet

For ETH holders, the vault aggregates across the deepest lending markets and yield strategies:

| Yield Source | Protocol | Description |

|---|---|---|

| Fluid Lite ETH | Fluid | ETH lending market |

| Origin OETH | Origin Protocol | Yield-bearing ETH |

| Morpho Singular WETH | Morpho | Singular's ETH vault |

| Morpho kpk ETH Yield V2 | Morpho | kpk-curated ETH strategy |

| Morpho Hyperithm ETH Degen | Morpho | Hyperithm's higher-risk vault |

| Morpho Smokehouse ETH | Morpho | Smokehouse-curated strategy |

| Morpho kpk ETH Prime V2 | Morpho | kpk's prime ETH vault |

| Morpho Clearstar Reactor V2 | Morpho | Clearstar's reactive strategy |

| Morpho Gauntlet WETH Prime | Morpho | Gauntlet's prime ETH vault |

| Morpho Steakhouse Prime Instant | Morpho | Steakhouse's ETH vault |

| Yearn OG WETH V2 | Morpho | Yearn-curated ETH strategy |

| 9Summits Flagship WETH | Lagoon Finance | Flagship ETH vault |

12 yield sources. One deposit. Zero maintenance.

USDC: Base

For those on Base, the same diversified approach:

| Yield Source | Protocol | Description |

|---|---|---|

| Fluid USDC | Fluid | Lending on Base |

| Gauntlet USDC Alpha | Gauntlet | Base alpha strategy |

| Moonwell USDC | Moonwell | Lending market |

| Morpho Clearstar Reactor USDC | Morpho | Clearstar's Base strategy |

| Morpho ExtraFi XLend USDC | Morpho | ExtraFi's lending vault |

| Morpho Moonwell Flagship USDC | Morpho | Moonwell-curated vault |

| Morpho Steakhouse High Yield Instant | Morpho | Steakhouse on Base |

| Morpho Yearn OG | Morpho | Yearn-curated Base vault |

| Gauntlet USDC Prime | Morpho | Gauntlet's prime Base strategy |

| Morpho Gauntlet USDC Prime | Morpho | Additional Gauntlet coverage |

| Steakhouse Prime Instant | Morpho | Steakhouse's prime Base vault |

| Gauntlet USDC Frontier | Morpho | Gauntlet's frontier on Base |

| 40 Acres USDC Vault | 40 Acres | Community vault |

DAO Managed Vaults launch next week. More details on exact timing, deposit mechanics, and expected yields coming soon.