How to choose the best Multiply Position

So, you know why you are Multiplying on Summer.fi, but you might be wondering which position is the best for me? This guide will help you determine just that.

What you need to consider

There are 6 key factors that you should consider

- Asset Selection: Which collateral do you have or deem fungible, and which debt tokens do you want to be exposedfungible to?

- Protocol: Which protocols do you trust?

- Liquidity: Is there enough available on offer for you to borrow?

- Borrow Rate, Cost vs LTV / Max Multiple: How much do you want to be able to increase your exposure? What at cost are you willing to pay to borrow?

- Borrow Rate, variability: How comfortable are you with rates changing rapidly?

- Protection, automation availability: Do you want access to Automated Position management tools?

How to choose collateral and debt tokens

Asset Selection: Which Collateral do you have, or which do you deem fungible, and which Debt tokens do you want to be exposed to?

“What asset should I increase exposure to?”

The first thing you need to do is determine which asset you want to increase exposure to. This might be as simple as the asset in your wallet. For example, if you have 50 ETH in your wallet, you might only want to multiply exposure to ETH. If you only want to multiply exposure to a specific asset, simply select only that collateral.

You might have multiple assets that you want to increase exposure to, or you might not care about slight variations in a similar asset (e.g., ETH vs. stETH or cbETH). In this case, simply select all the collateral types to which you might want to increase exposure.

Next, you’ll need to ask yourself an important question. Even though you will be swapping immediately to buy more collateral, your debt will be denominated in the asset that you select.

“What asset would I like my debt to be denominated in?”

For most people, the answer to this question will be some kind of stablecoin. But there are many different stablecoins.

If you have a specific one you want to borrow, then you can simply select it. For example, DAI only.

You can do that in one click if you are comfortable with them.

How to choose a protocol

- Protocol: Which protocols do you trust?

The decision you’ll have to make is about the protocol that you want to use in the backend. The great thing about Summer.fi is that we provide a layer of curation, so any choice is a good choice, but to personalize and optimize your experience, you can further refine your options.

What do I care about most when it comes to protocols?

Regarding to protocols, most users care about two things: Safety and/or Flexibility.

To aid in this, we provide a few tags you can select.

Safety

All projects have audits, and most users are not technical enough to understand them. As such, a few other proxies that most use for safety are time or [Lindyness](https://en.wikipedia.org/wiki/Lindy_effect#:~:text=The Lindy effect (also known, proportional to their current age.) as well as TVL, which can be considered a proxy for the market's implicit trust.

On Summer.fi you can select for these two variables with our Longevity (projects that have been around >3 years) and >1B TVL tags.

Flexibility

Generally, Flexibility means a diversity of assets supported and types of pair types supported. The tag of Isolated Pairs allows you to select for this, as it selects for protocols that contain risks to single pairs only, allowing them to be more expressive.

Liquidity: Is there enough available on offer for you to borrow?

You know what you are going to increase exposure to, and you are confident in the protocol you will use. What’s next?

Can I amplify my exposure in the size that I need?

This question is one of sufficient liquidity. To determine the answer to this question, the selected protocol must have at least the amount of liquidity you need for a specific pair. For example, if you want to amplify exposure for 100,000 USDC size, the min. liquidity you require is 100,000 USDC.

Summer.fi makes this really is with a selector that allows you to choose just that!

How to consider borrow rates

- Borrow Rate Cost vs LTV/Max Available to borrow: How many multiples would you like to increase exposure? What cost are you willing to pay to Multiply?

You now know that it's possible to get precisely what you want. You can increase exposure to the asset you want, and there is sufficient liquidity.

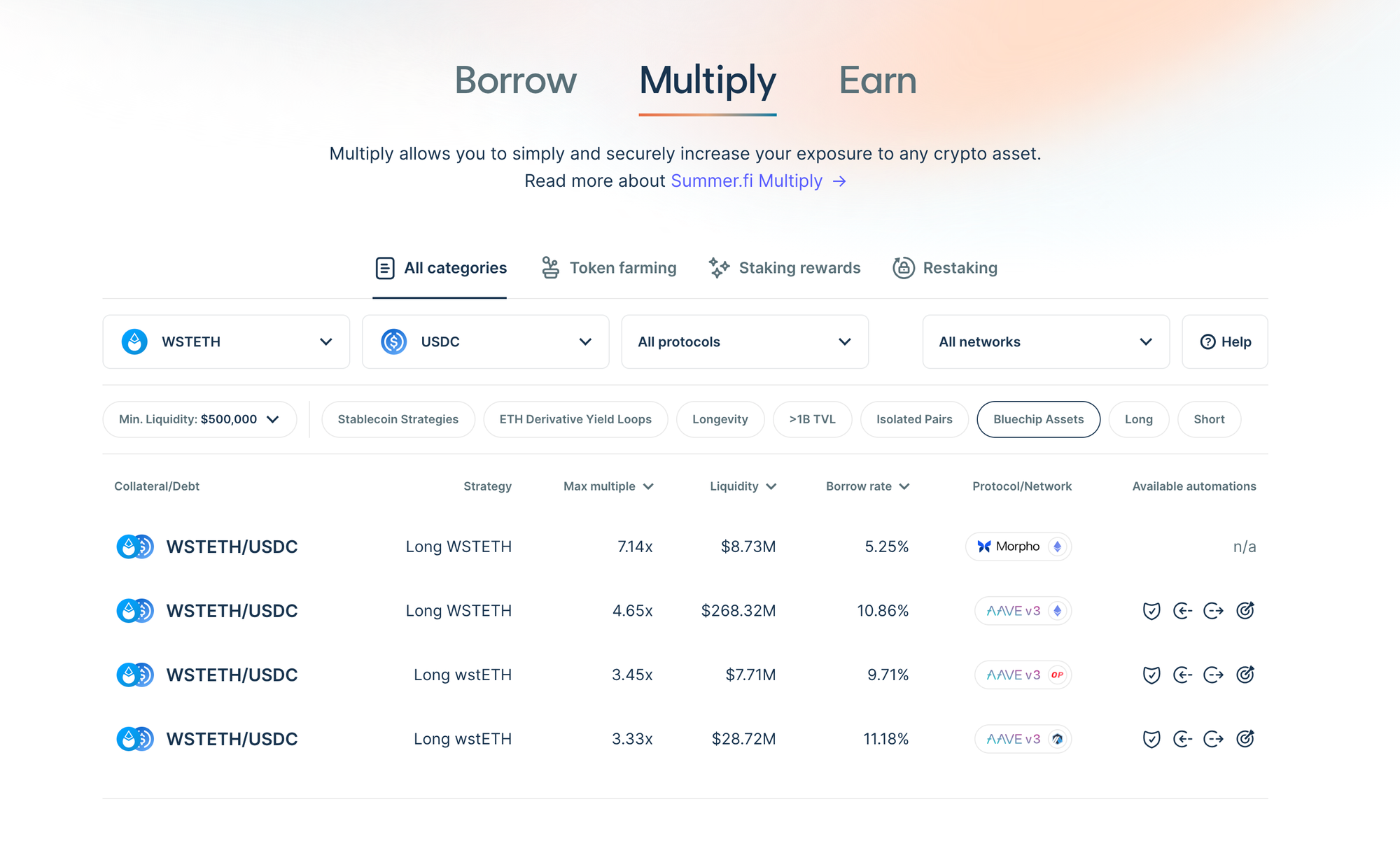

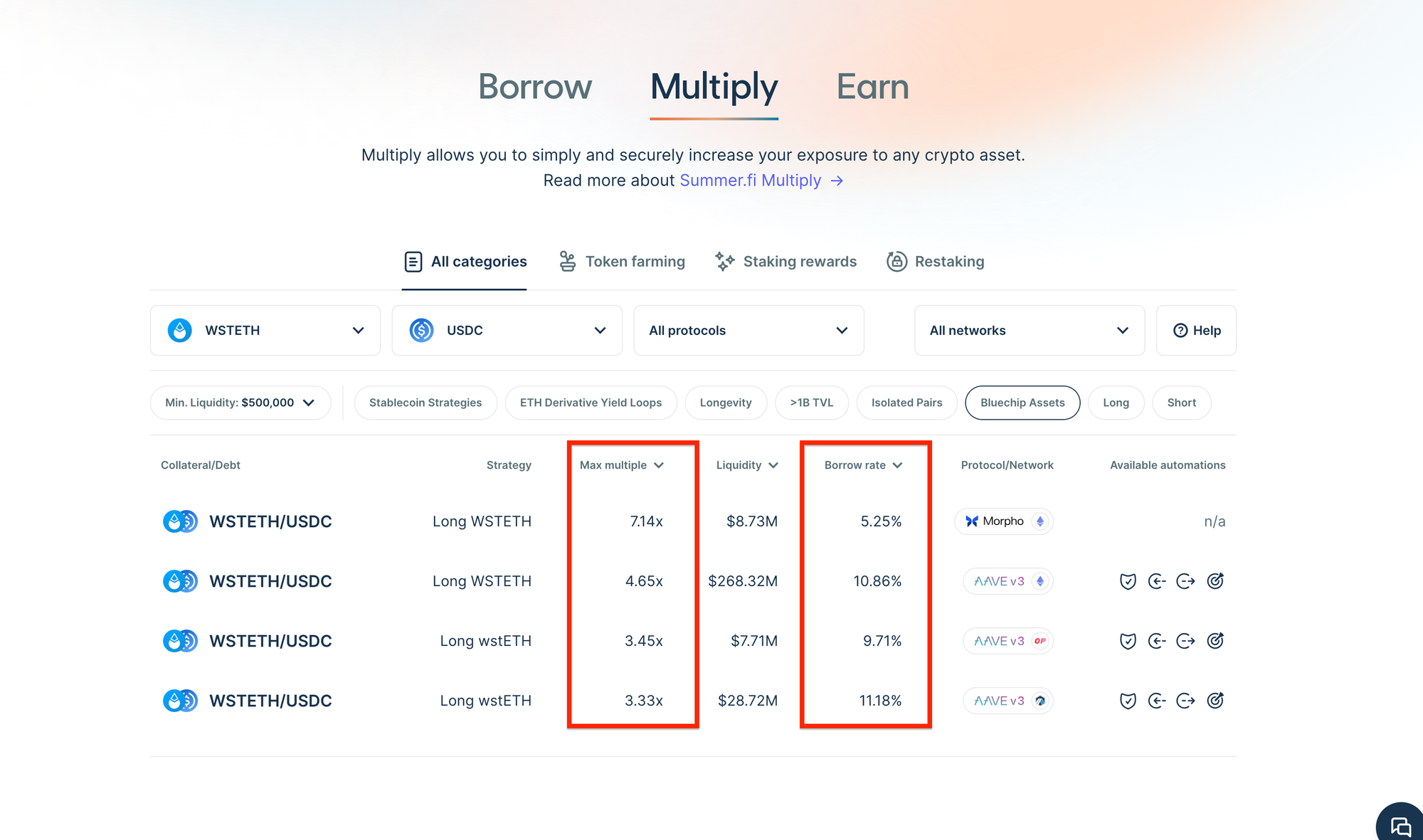

You can have multiple options even for the same pair. Why? For example, in the list below, I am presented with four options for the same pair.

We have already selected our protocol and specified the amount of liquidity we need. The options you see differ on two dimensions: Borrow Rate and Max Multiple.

Start with Max Multiple

Max Multiple is the highest multiple you will be allowed. Practically speaking it is the max you can Multiply at any time (2x,3x, 4x etc..).

Regardless if you plan to utilize the multiple or not, one advantage of choosing the higher Max Multiple option, is that it will always give you a lower liquidation price. But this lower risk profile usually comes at a higher cost!

Determine how much you want to pay with the Borrow Rate.

Different pairs have different borrow rates, that is simply the difference in cost that you will on our outstanding debt.

Generally speaking, the higher the max LTV, the higher the borrow rate. However, a lower Max LTV generally also comes with a higher liquidation price.

How to know if you need position management automation

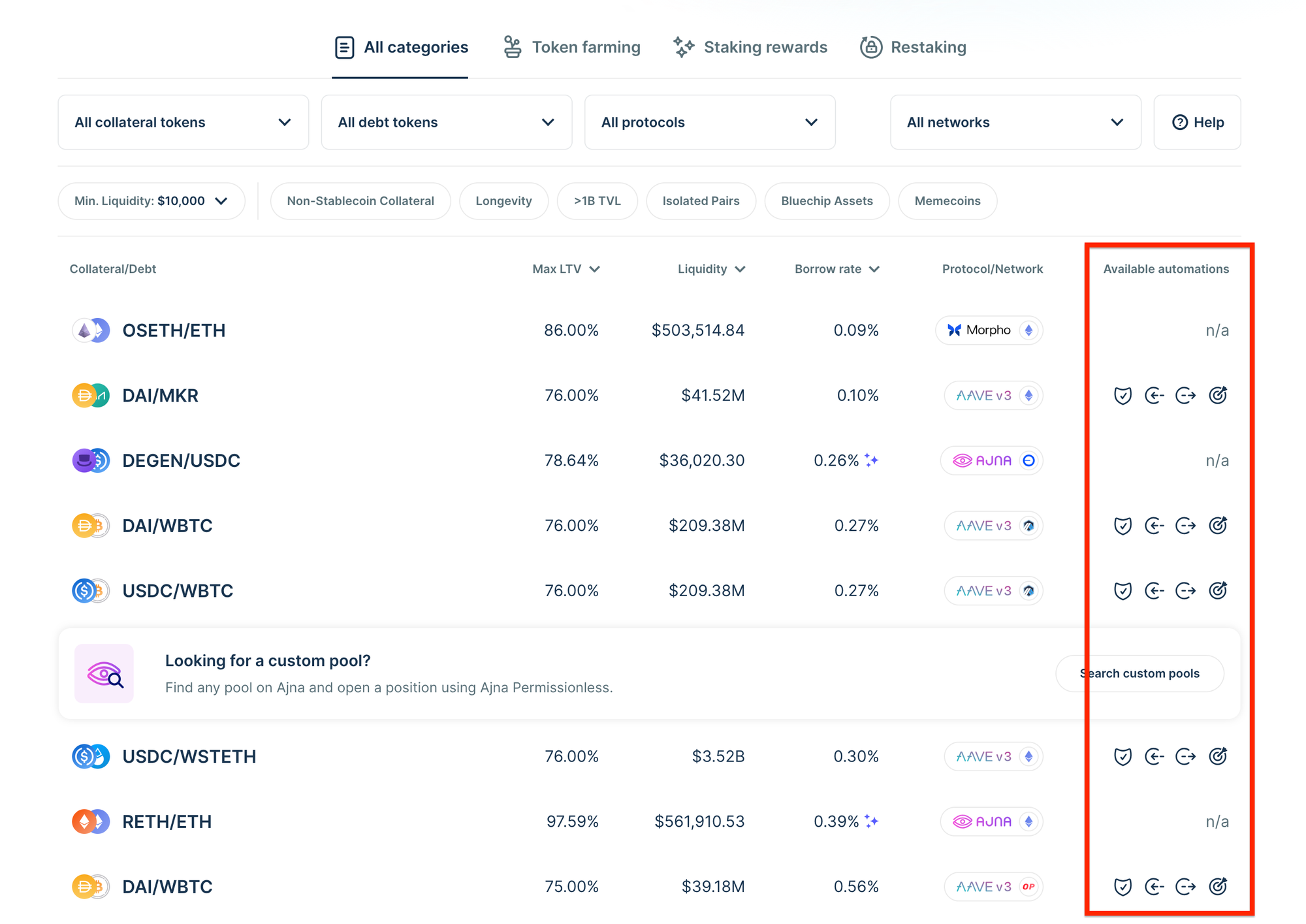

- Protection and Optimization, automation availability: Do you want access to Automated Position management tools?

Do I want to worry about liquidation? Do I want to automate my decisions?

Unequivocally, the answer to the first part of the above question for most is…NO! as such, at Summer.fi we make it really easy to view what automations are supported for any given pair.

And the answer to the second part is usually “Yes! but only if it's easy.” Luckily, Summer.fi automation is designed to be highly user-friendly Summer.fi.

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.