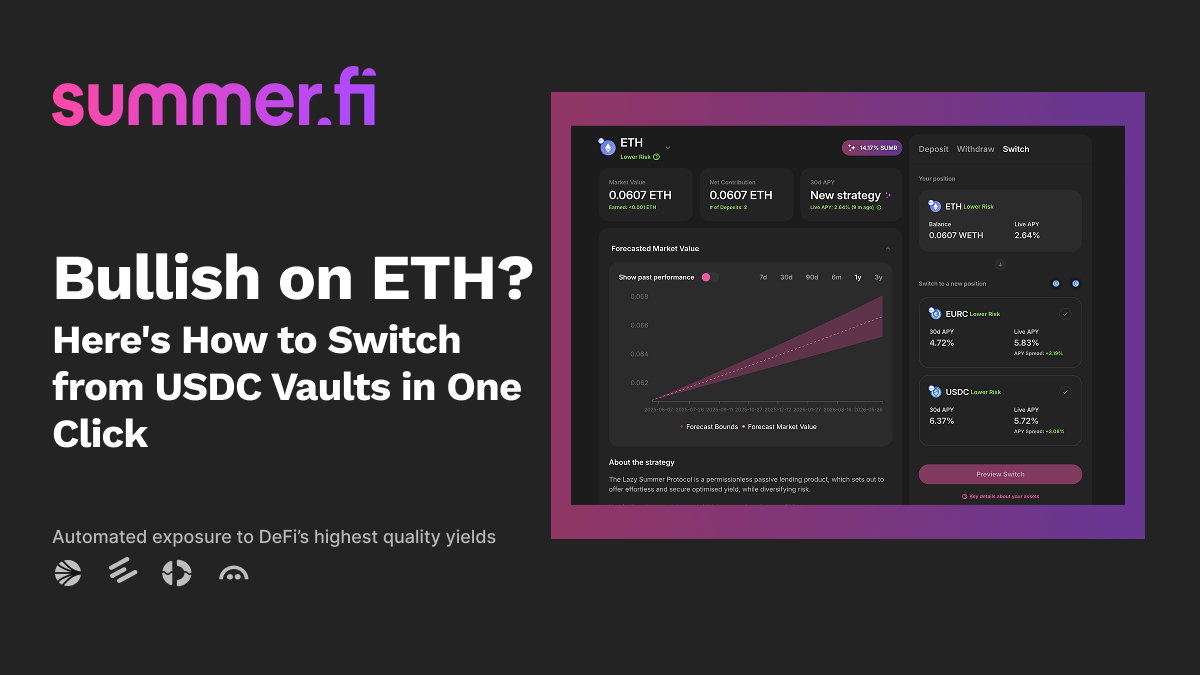

Bullish on ETH? Here's How to Switch from USDC Vaults in One Click

DeFi markets move rapidly, requiring sophisticated positioning strategies for experienced investors. Consider this scenario: You're monitoring a USDC vault position when ETH shows strong momentum $2418. As an experienced DeFi user, you recognize the opportunity to adjust your risk exposure, but traditional repositioning involves multiple transactions, approvals, and gas fees that can delay execution. For sophisticated investors who are familiar with yield optimisation, the new Vault Switch was launched, allowing experienced users to switch between Lazy Summer vaults without leaving the protocol.

What's Vault Switching and Why Now?

Vault Switch enables experienced users to move positions between different Lazy Summer vaults in a single transaction. This allows sophisticated investors to adjust their risk exposure shifting from ETH to stablecoins during risk-off periods, or rotating into different yield strategies based on market conditions.

Important: Vault Switch facilitates user-initiated position changes. Users must manually assess market conditions, evaluate risks, and execute switches themselves. The protocol does not automatically rebalance.

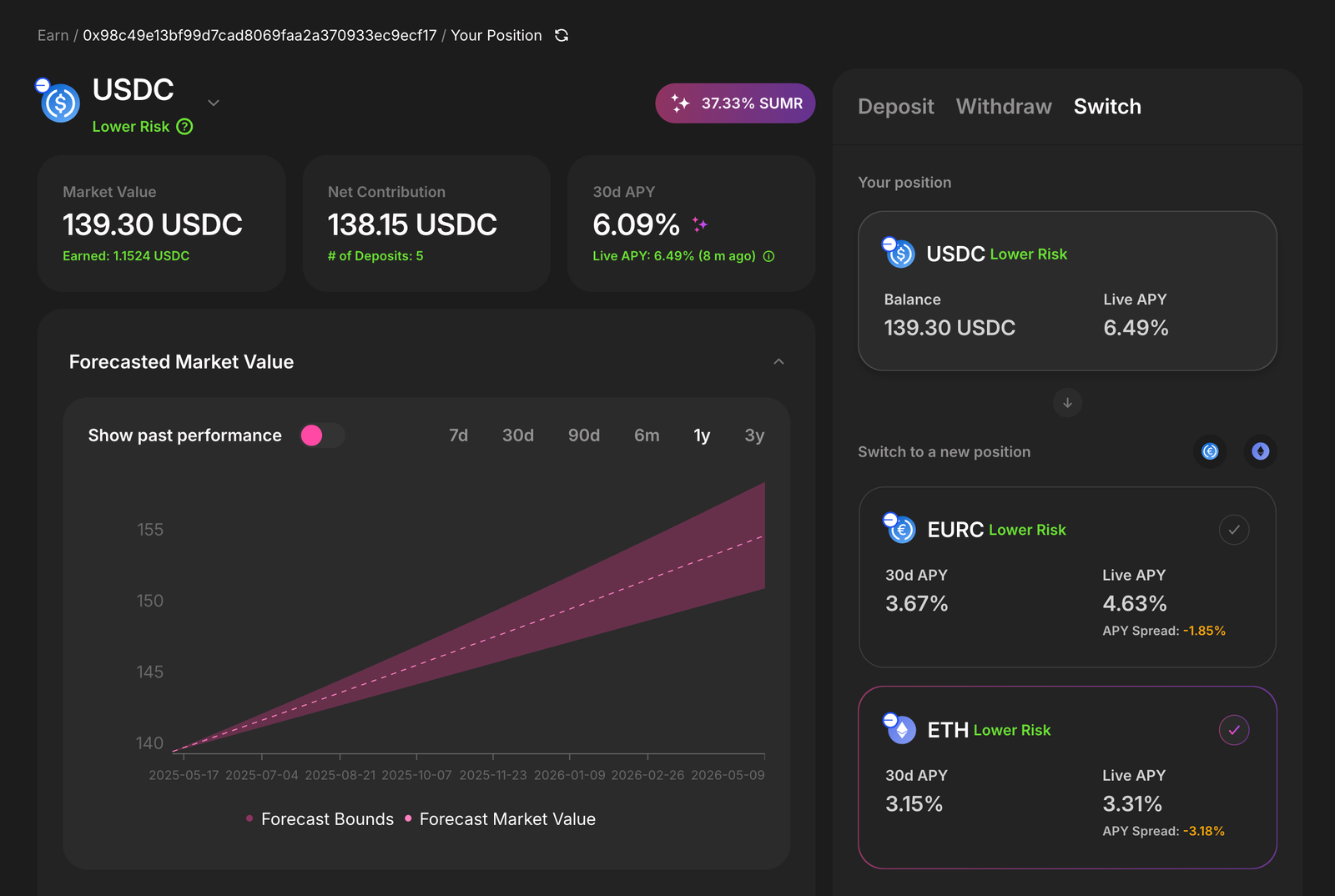

How to use switch vault

- Open your Lazy Summer position

- Go to Vault Switch tab on the deposit box

- Select the target vault; review APY & SUMR rewards.

- Verify all the details on

- Edit the amount if you’re moving less than 100 %.

- Approve the token, then confirm.

- Watch the confirmation toast—your strategy just evolved.

Who Should Be Using Vault Switch?

- Yield farmers seeking optimisation without micromanagement. Your strategy can evolve with market conditions while you focus on the bigger picture.

- ETH bulls with stable capital who need flexibility to rotate between risk-off positioning and conviction plays when opportunities arise.

- Anyone building a responsive DeFi strategy that adapts with their outlook rather than forcing them into static positions.

- Sophisticated investors who understand that the best opportunities require quick execution and hate missing them due to operational friction.

Your Strategy, Evolved

Vault Switch transforms Lazy Summer from a set of individual yield strategies into a dynamic, all-weather DeFi portfolio. As new assets and strategy tiers are continuously onboarded, this single-transaction flexibility becomes your competitive advantage in an increasingly fast-moving market.

The next time the urge strikes whether it's rotating into ETH, cutting back to stables, or chasing higher yields you'll be ready to act instantly.

Ready to make your first switch?

Try Vault Switch now → https://summer.fi/earn

Already using Lazy Summer? Maximize your DeFi automation by joining the Beach Club and earning $SUMR for referring friends to smarter yield strategies. https://summer.fi/beach-club

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.