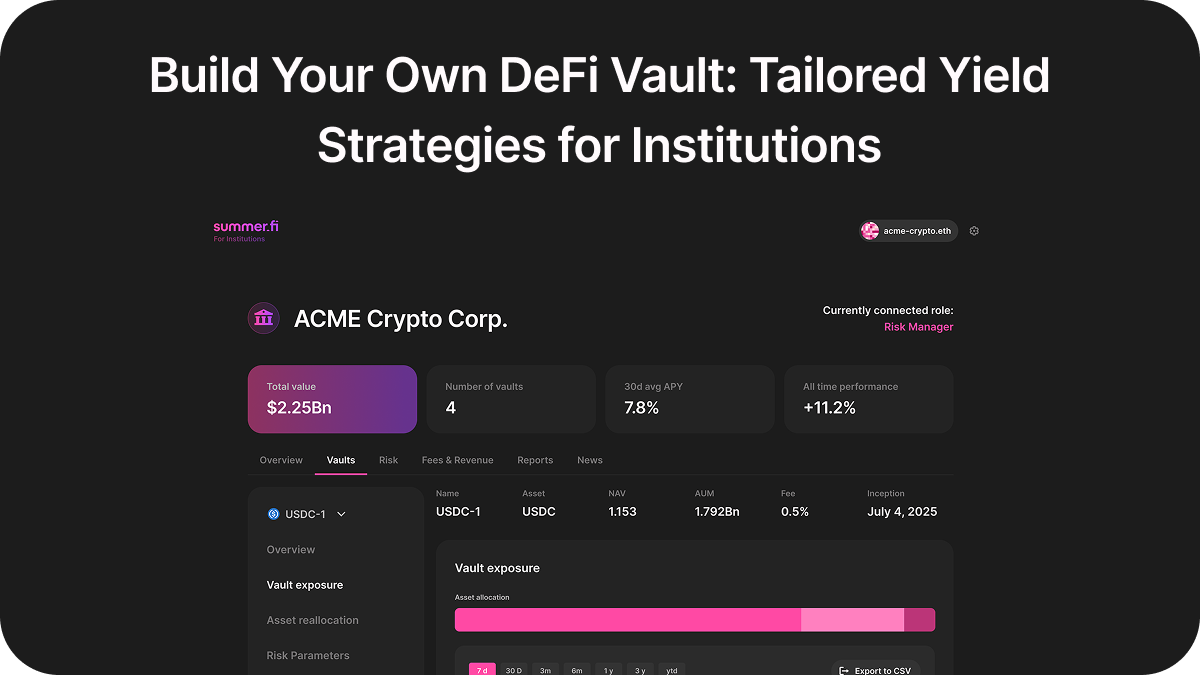

Build Your Own DeFi Vault: Tailored Yield Strategies for Institutions

Institutions don’t want “another yield product.” They want a vault they can shape: pick the chain, the asset, and the underlying yield markets; lock down who can touch it; and automate the boring (and error-prone) parts under a risk mandate.

That’s the point of Summer.fi Institutional self-managed vaults—a single integration that exposes curated public or private yield sources across EVM chains, with policy controls and reporting built in.

Choose your chain, asset, market and risk framework

- Chain. Self-managed vaults are chain-agnostic across EVM. You integrate once, then allow (or restrict) which networks the vault can deploy to. This keeps custody flows simple while still giving access to multiple venues.

- Asset. Define which base assets a vault is allowed to hold (e.g., USDC, ETH). For each asset you can apply per-venue caps, diversification rules, and reallocation logic enforced by the vault.

- Market. Point the vault at specific, risk-vetted venues (e.g., lending protocols). Summer.fi’s institutional pages position the Lazy Summer Protocol as a single entry point that automatically rotates capital among high-quality strategies using AI keepers, targeting superior risk-adjusted outcomes without you micromanaging bridges or rebalances.

- Automation. Under the hood, a network of AI keeper agents monitors venues and rebalances within constraints you set (caps, frequency, triggers). Cross-chain rebalancing/bridging is handled for you deposit once, hold the vault shares on the hub chain, and the system moves capital when net spreads justify it.

Example configuration: USDC on Base → Morpho + Compound

Here’s a concrete (and realistic) example of how an institution might spec a vault:

- Chain scope: Allow Base for deployments; keep Ethereum read-enabled for data.

- Asset scope: USDC only (stablecoin mandate).

- Eligible venues:

- Morpho (Blue) USDC markets on Base. Evidence: Morpho runs on Ethereum and Base; there’s active infra (subgraph) tracking Morpho Blue on Base.

- Compound v3 USDC market on Base. Compound’s markets page lists USDC on Base.

- Risk parameters (illustrative):

- Per-venue cap: 45% each; residual dry powder 10%.

- Rebalance trigger: when expected net APY delta > execution costs by N bps (vault-level).

- Oracle/upgrade allow-lists per venue; pause list for out-of-policy changes.

- Ops rules:

- Keepers can rebalance intra-day within thresholds; larger reallocations require multisig sign-off (role based).

- Daily NAV file to back-office; immutable transaction logs. Summer

This spec keeps USDC concentrated in two tier-one venues on Base, while your caps + automation prevent drift into single-protocol dependency and remove manual bridge “click-ops.

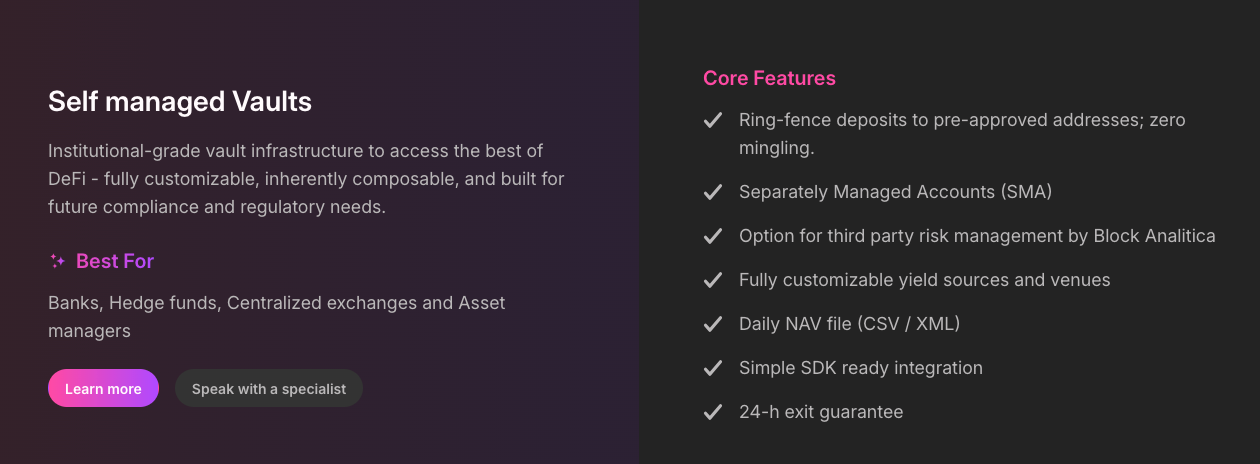

Permissioned access & operational control (what institutions actually need)

- Closed access / ring-fenced funds. Restrict deposits/withdrawals to approved counterparties and addresses; avoid co-mingling entirely. The institutional page spells out closed-access functionality and role-based controls.

- Role-based permissions + audit trail. Segment control by desk or legal entity; export daily NAV (CSV/XML) and leverage audit-ready transaction logs for compliance.

- Non-custodial by design. The vault is a shell powered by the Lazy Summer Protocol; funds move only with your multisig/MPC (e.g., Fireblocks/Anchorage/Gnosis Safe integrations referenced on the site).

- Independent risk oversight (optional). Delegate risk curation to Block Analitica, which sets parameters and deposit caps for general vaults, or run risk in-house—your choice.

Operationally, this is the stuff that kills spreadsheet DeFi: a single integration to EVM yield sources, continuous automated enforcement of your policy, and clean reporting for finance, risk, and audit.

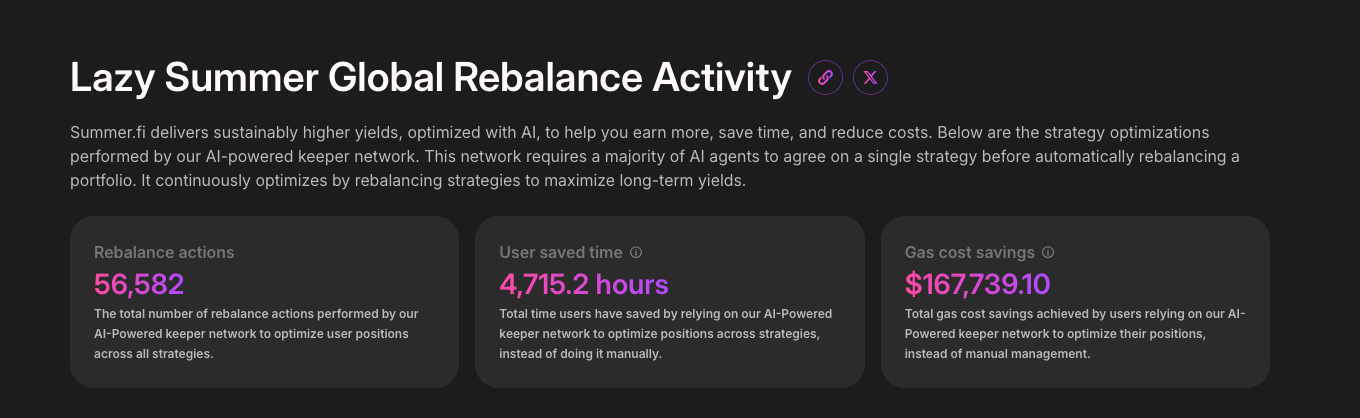

4) How it runs day to day (and why the headcount tax drops)

- Monitoring & rebalances: AI keepers watch yields/liquidity and rotate capital when thresholds hit, visible in “Rebalance Activity” logs and monthly trends on the blog. You’re reviewing exceptions, not chasing dashboards. Rebalancing logic can be set to yield seeking mode, allocating capital to the highest yielding underlying market, or risk off mode, allocating capital based on risk parameters.

- Venue quality filter: Public pages emphasize top-tier venues and transparent curation, again reducing your need to constantly re-verify markets.

Quick build checklist (copy/paste for your RFP)

- Mandate: Asset(s), chain(s), allowed venues, per-venue caps, and reallocation rules.

- Access: Whitelisted entities/addresses; roles; withdrawal rules; custody provider. https://summer.fi/institutions/self-managed-vaults

- Risk: In-house vs Block Analitica; deposit caps; pause conditions; oracle/upgrade policy.

- Reporting: Daily NAV format, frequency; transaction log export; SLA for data delivery.

Interested in integrating?

Getting access to on-chain yield no longer needs to be complicated. If you’re interested to discover how Summer.fi Institutional would work for you and your clients, get in touch with a member of the team.

🌐 Website: https://summer.fi/institutions

📅 Book a call: https://calendly.com/summer-fi/summer-institutional

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.