Better than benchmarks: January 13 2026

Welcome to the latest instalment of our "Better than benchmarks" series. At its core, Lazy Summer protocol exists to help DeFi users, whether DeFi natives or newcomers, beat the benchmark yields they've come to expect in both ETH and stablecoins.

ETH and Stablecoin benchmarks

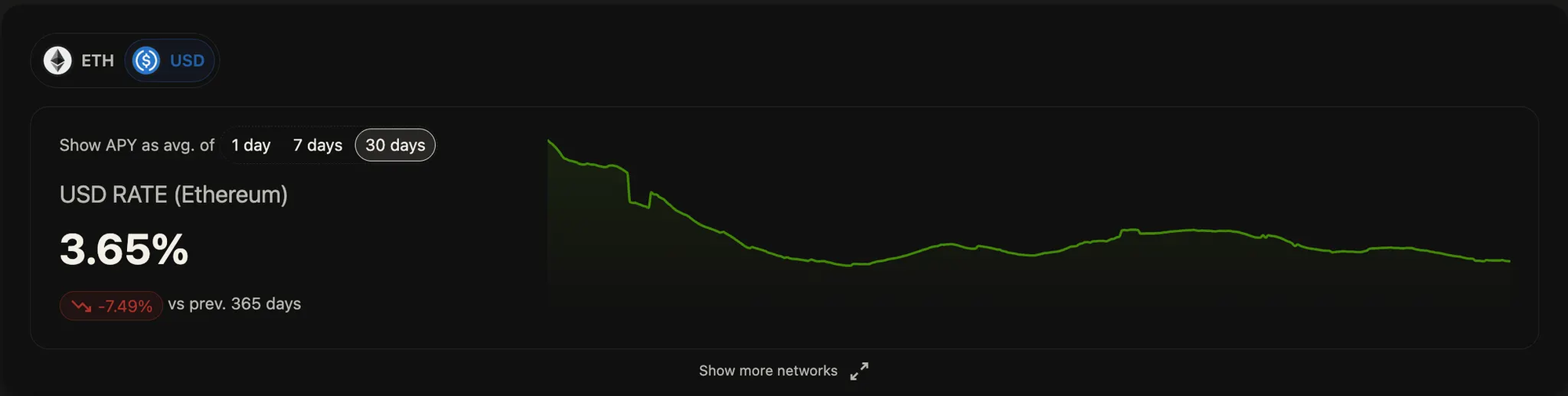

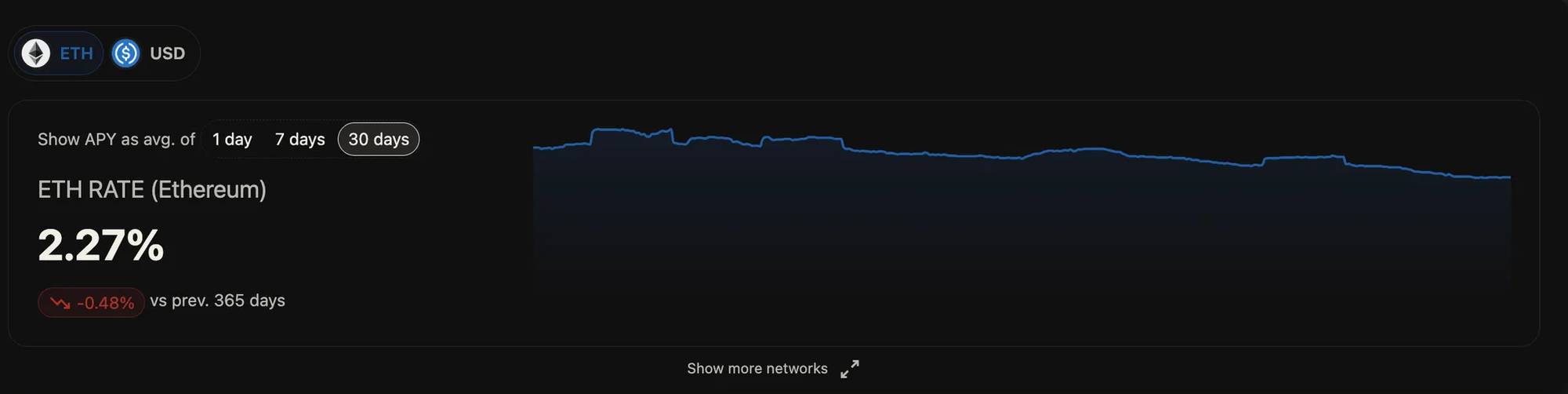

Current benchmark rates show:

- USD/Stablecoin’s (USDC): 3.65% APY

- ETH: 2.27% APY

https://app.vaults.fyi/analytics

These benchmarks represent what users should reasonably expect from low-risk DeFi, the protocols and yield sources with a bare minimum of risk assumptions. They also raise an important question:

If you can achieve 3.65% as a base rate, why look elsewhere? The answer lies in understanding risk-adjusted returns and the true accessibility of different yield sources.

How Lazy Summer stacks up - the best of all worlds

Stablecoin Strategies

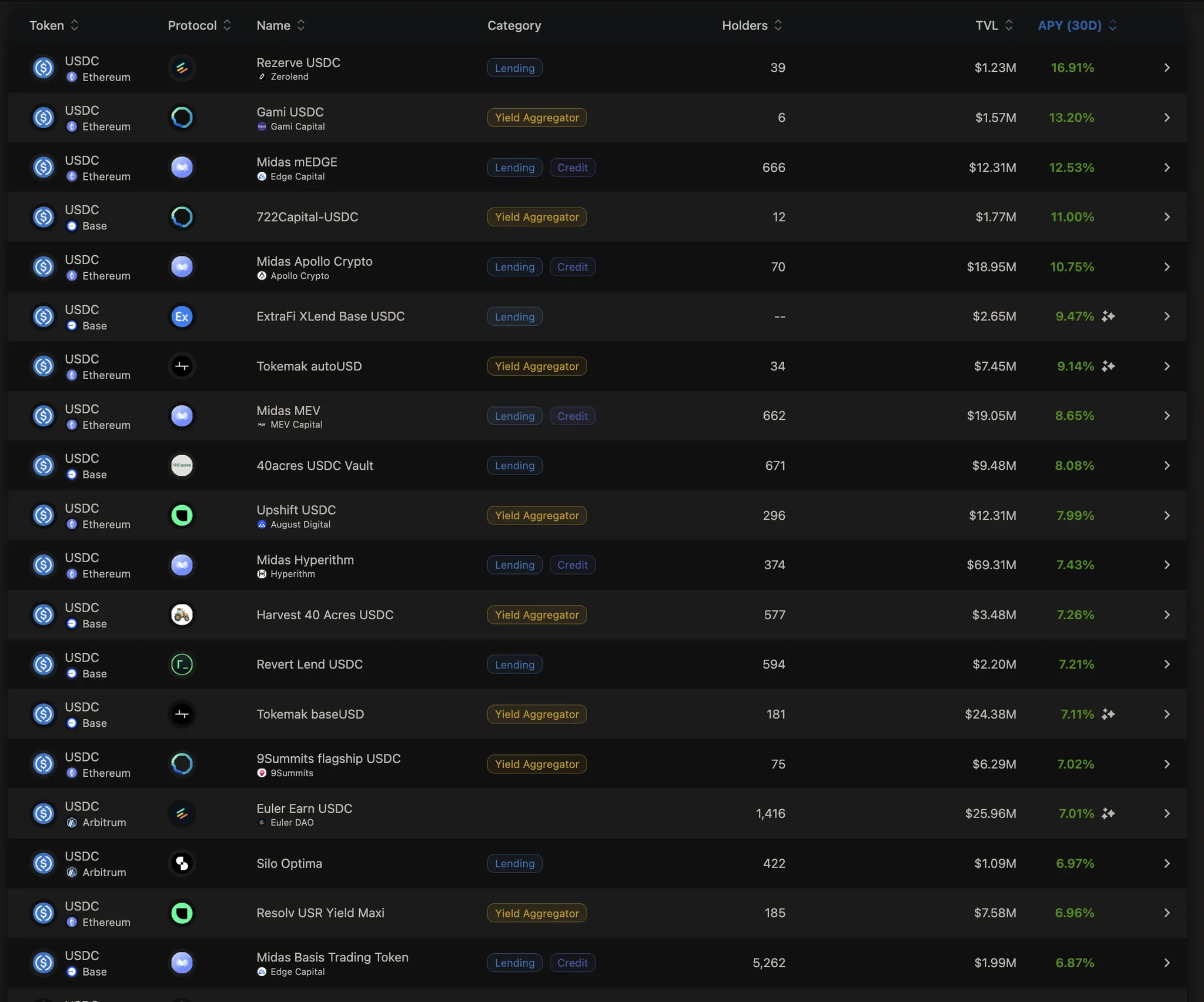

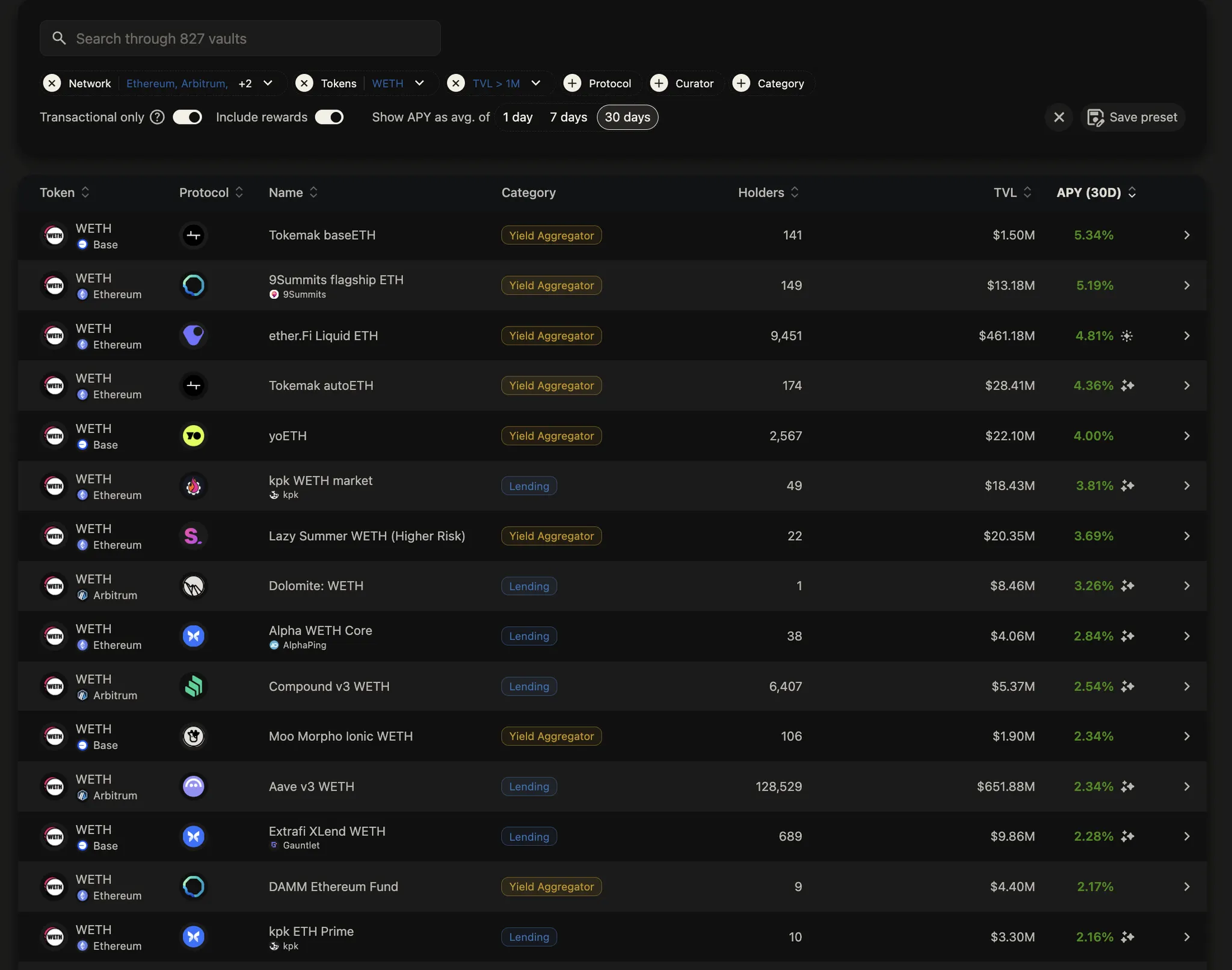

When browsing platforms like Vaults.fyi or DeFi Twitter, it is easy to find stablecoin yields well above the benchmark yield of 3.65%. Specialized lending markets on Euler or Morpho enable risk curators to offer strategies that produce higher yields. This is also true for onchain hedge fund enablers like Midas. The problem is that these lists do not account for risks. Just yield.

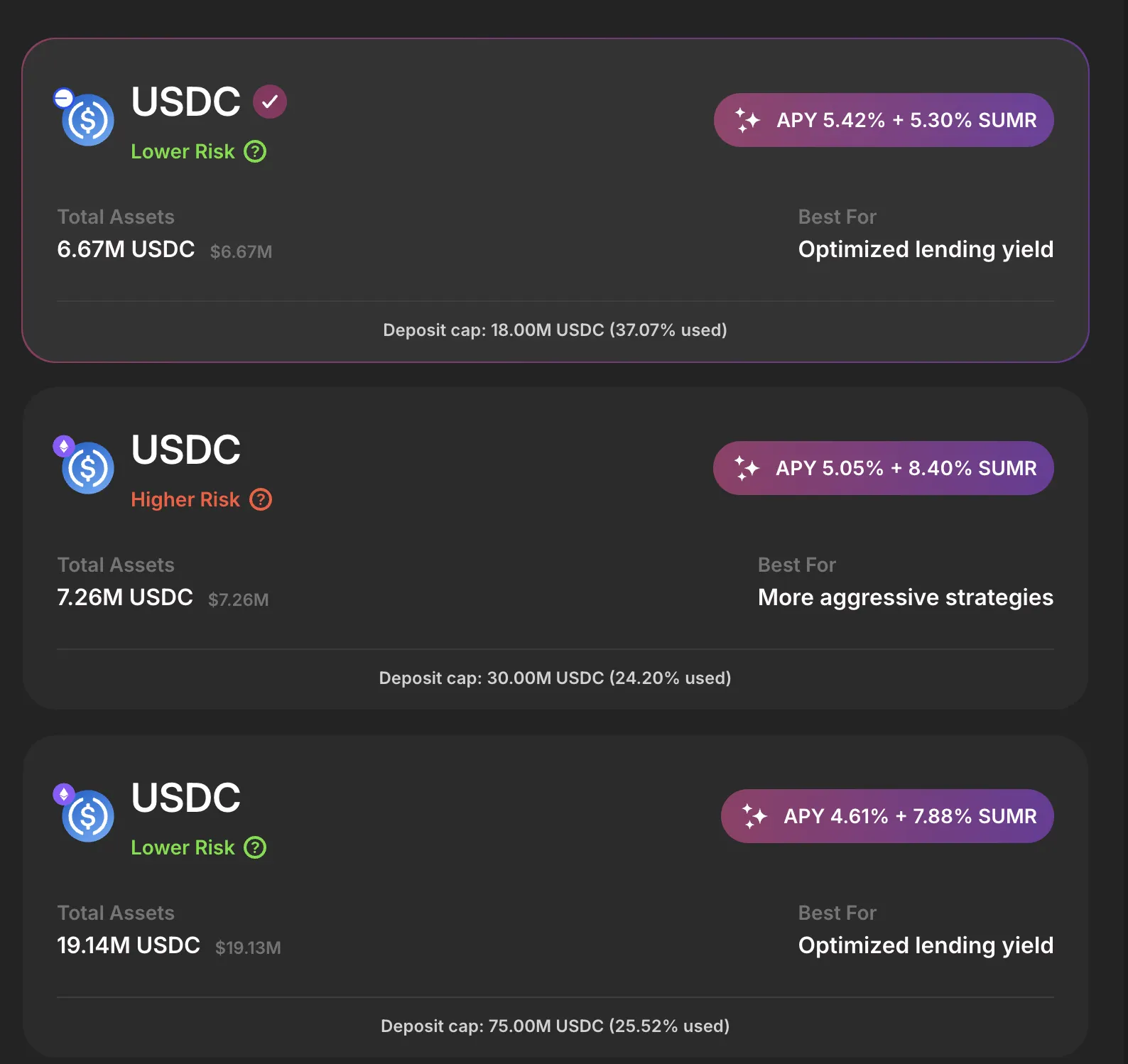

Lazy Summer Stablecoin strategies

Currently, Lazy Summer Stablecoin strategies produce between 4.5% - 5.5%, placing it on the second to third page of vaults.fyi.

High yields often rely on three things: leverage, illiquidity, or opacity. Lazy Summer explicitly rejects strategies that score poorly on these metrics, even if it means "missing out" on a higher headline number.

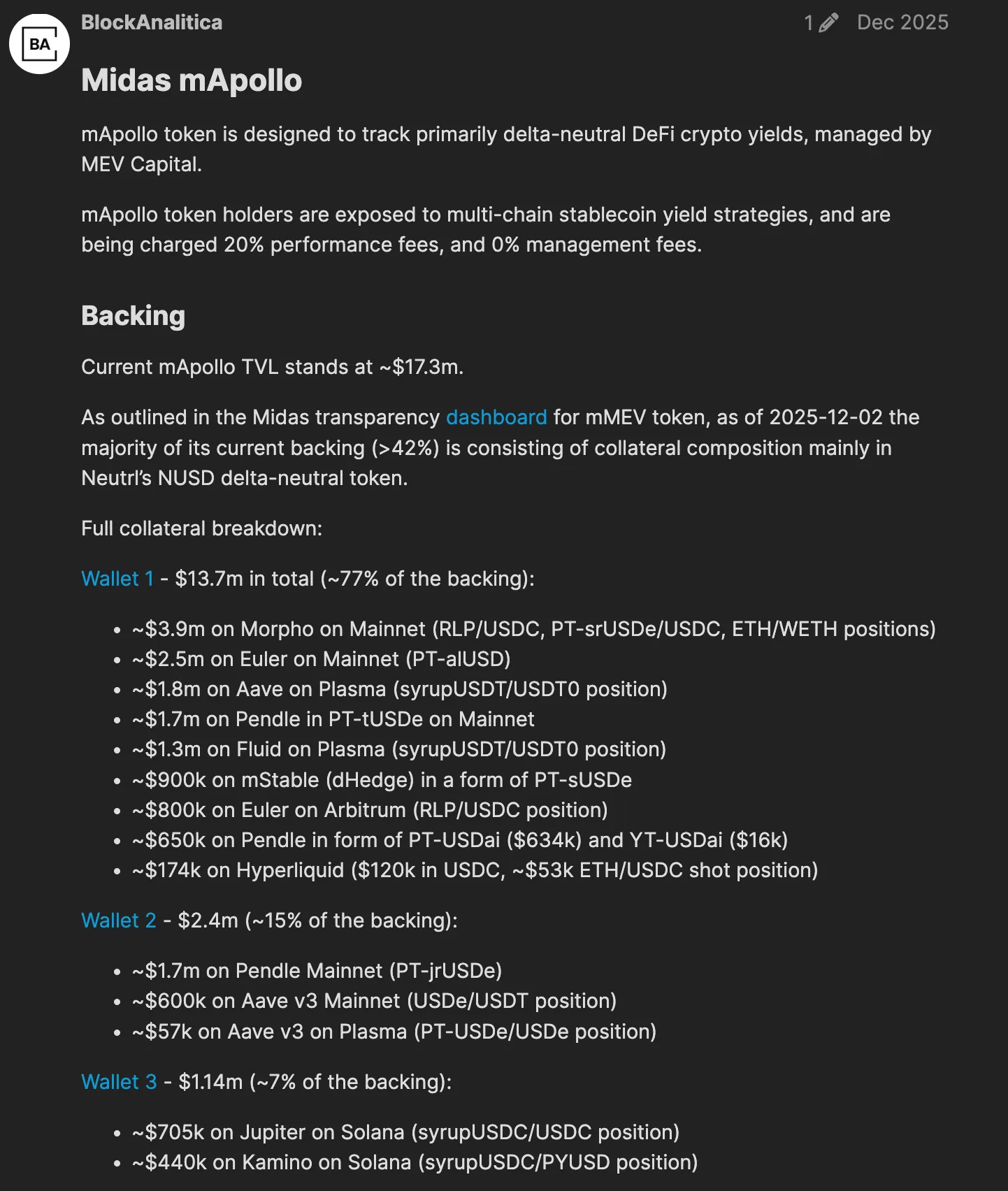

A perfect example is the protocols recent evaluation of Midas. While both Midas Apollo and Midas MEV offered attractive returns on the same underlying infrastructure, risk manager Block Analitica made decisive split:

- Midas Apollo was approved and onboarded because its yield source was transparent and auditable.

- Midas MEV was rejected. Despite the higher yield, the "black box" nature of its MEV strategies meant we couldn't verify how funds were being used or if liquidity would be available during a crunch.

The benefit of risk caps

Lazy Summer doesn’t just pick "safe" or "risky." The protocol uses Risk Caps. If a high-yield opportunity like a specific Morpho market is attractive but new, the cap might be set at 5% of the total vault. You get exposure to the upside, but if that protocol fails, 95% of your portfolio remains untouched. This gives you the best of both worlds: a blended yield that beats the benchmark, with the safety profile of a conservative portfolio.

ETH Strategies

The same above benchmark yields can also be found for ETH strategies. Though once again, these strategies generally only consider APYs, and not the underlying risks.

These represent carefully selected opportunities that balance yield with security and liquidity.

Lazy Summer ETH strategies

Currently, Lazy Summer ETH strategies remain well above the benchmark yield of 2.27%

Lazy Summer is about automated access

Lazy Summer is about giving users access to DeFi’s highest quality yields. Sometimes that means there is room for improvement with respect to the yield sources that Lazy Summer onboards.

While risk and risk caps are non-negotiable, caps will only be adjusted in line with market conditions. A major benefit of Lazy Summer is the ability for the protocol to onboard new yield sources.

When looking at the Stablecoin and ETH strategies above, it is obvious that some could be proposed to be added to the protocol. In Lazy Summer, that's as simple as a proposal to SUMR token holders.

The deeper story of headline APY

When scanning the DeFi landscape for yields, it's tempting to chase the highest APY numbers. However, two critical factors often go unmentioned: opacity and liquidity.

The liquidity problem

Consider protocols like EtherFi Liquid and YoETH, which advertise attractive yields. The crucial question: if you deposit 100 ETH today, can you withdraw it tomorrow? For many of these strategies, the answer is no.

Take YoETH as an example, instant redemptions on Mainnet are limited to just 14 ETH. If you've deposited 100 ETH, you can only access 14 ETH immediately. This liquidity constraint is a massive consideration that isn't always clearly communicated to users.

The Opacity Challenge

Beyond liquidity, many high-yield strategies lack transparency about what's actually happening behind the scenes. Without clarity on how funds are being deployed, users are taking on risks they may not fully understand.

Lazy Summer Protocol: Do Less

Lazy Summer addresses these challenges through several key principles:

1. Curated yield sources

Not all yield sources are created equal. While platforms like Vaults.fyi provide excellent lists of available yields, Lazy Summer goes further by actively vetting strategies. For instance:

- Midas Apollo was approved and added to the protocol

- Midas MEV was rejected due to lack of clarity around fund usage and liquidity concerns

This curation process ensures that only thoroughly vetted strategies make it into the protocol, even when they share the same underlying infrastructure.

2. Instant liquidity

Lazy Summer prioritizes strategies that offer immediate access to your funds. On Mainnet, users can access instant liquidity without the withdrawal delays that plague other platforms.

3. Comprehensive exposure

The vault exposure breakdown reveals access to numerous underlying strategies. It's simply a matter of adjusting risk caps to give users exposure to these vetted opportunities. New yield sources can be added seamlessly as they prove themselves worthy.

4. Active risk management

Block Analitica continuously monitors the market and provides ongoing risk assessments. During critical events, like the Stream incident around November 6th, they can make immediate decisions to set risk caps to zero, protecting users from exposure to compromised yield sources.

What to look forward to in Lazy Summer land

Token Generation Event (TGE)

The Summer token TGE is confirmed for January 21st. This means users can soon earn not just native yields but also liquid token rewards with real market value, adding another layer of return to your DeFi strategy.

Expansion to Hyperliquid

Lazy Summer is expanding to Hyperliquid, one of the emerging DeFi ecosystems that could rival Base or even Mainnet in scale. This integration will bring Lazy Summer's risk-managed approach to an exciting new network.

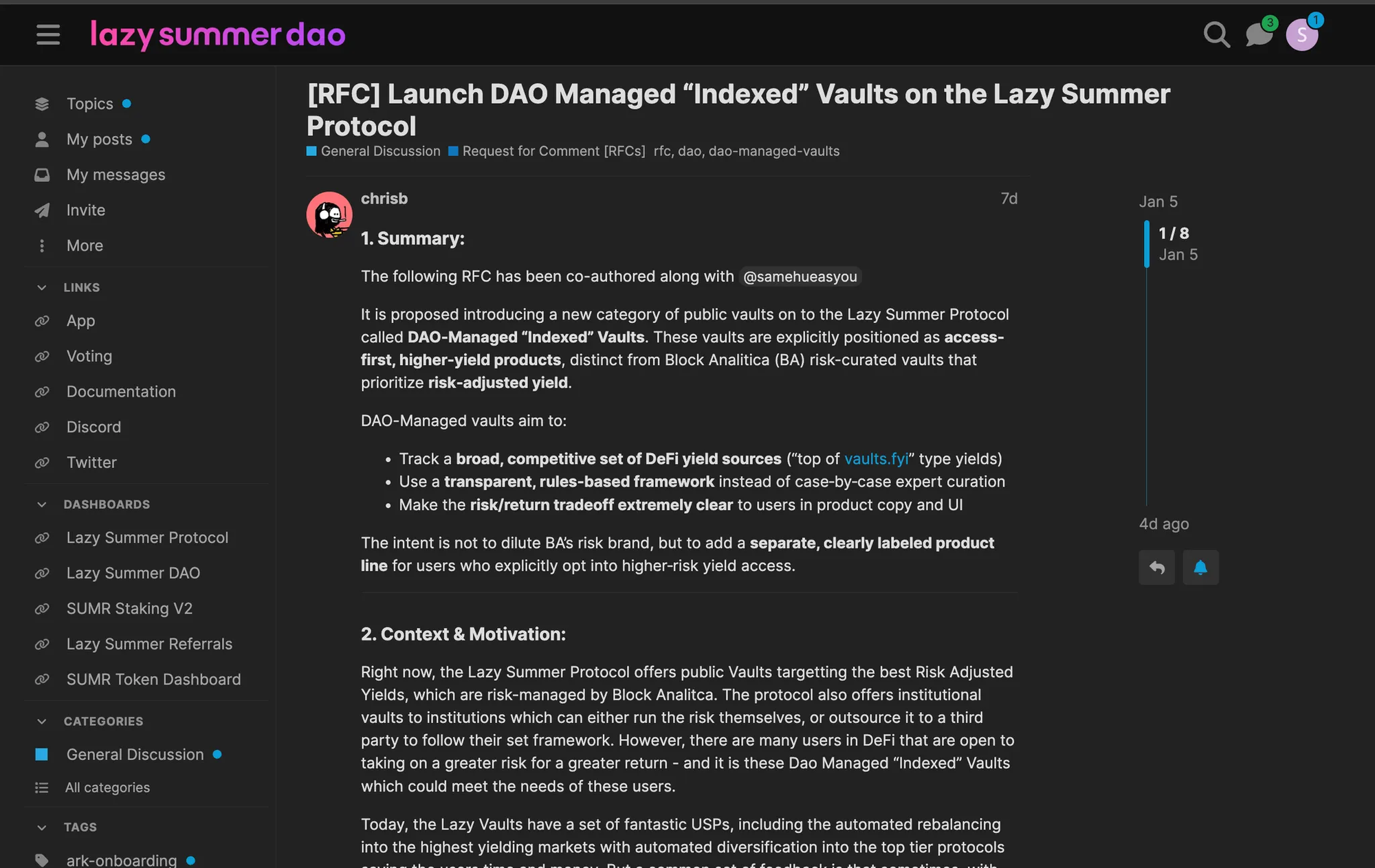

DAO - Managed Vaults coming soon

For users with higher risk appetites who want maximum exposure to available yields, down-managed (or index) vaults are launching soon, likely before the TGE. These vaults will:

- Apply Block Analitica's heuristics and rules of thumb in a static framework

- Provide broader access to yield sources across the ecosystem

- Rebalance according to a defined risk framework and yield optimization

- Offer higher potential returns for users comfortable with increased risk

https://forum.summer.fi/t/rfc-launch-dao-managed-indexed-vaults-on-the-lazy-summer-protocol/601

This creates a clear distinction: Lazy Summer protocol core focuses on risk-adjusted yields with active management and deep peace of mind, while the new index vaults serve users seeking maximum yield exposure within a coherent risk framework.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.