August - Rebalance Trends -How did capital flow within Lazy Summer Protocol during August?

Lazy Summer Protocol gives you automated exposure to DeFi’s highest-quality yields. Deposit once, and the protocol’s network of AI keepers continuously rotates your funds into the best risk-adjusted strategies. The result: you earn more while doing nothing.

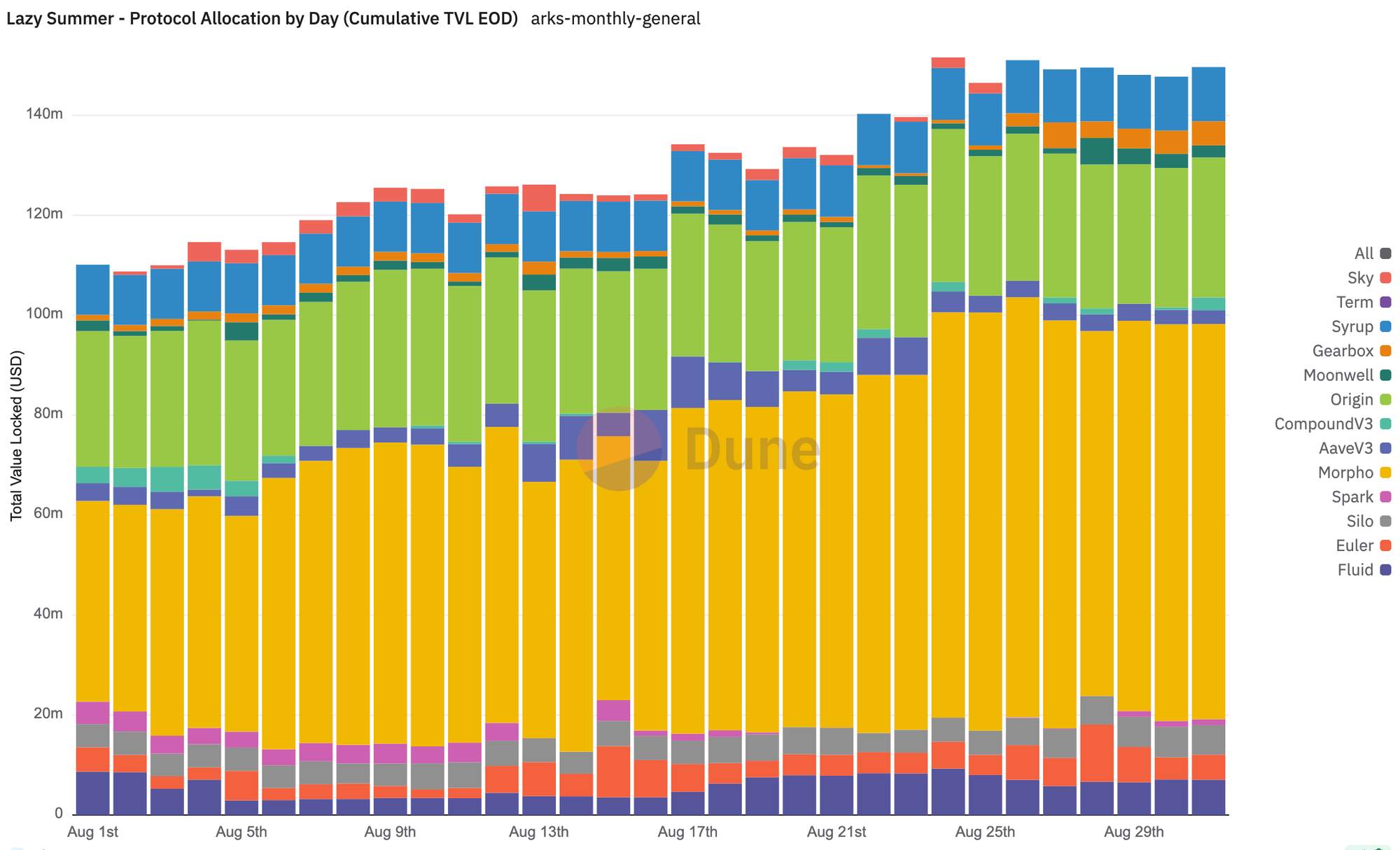

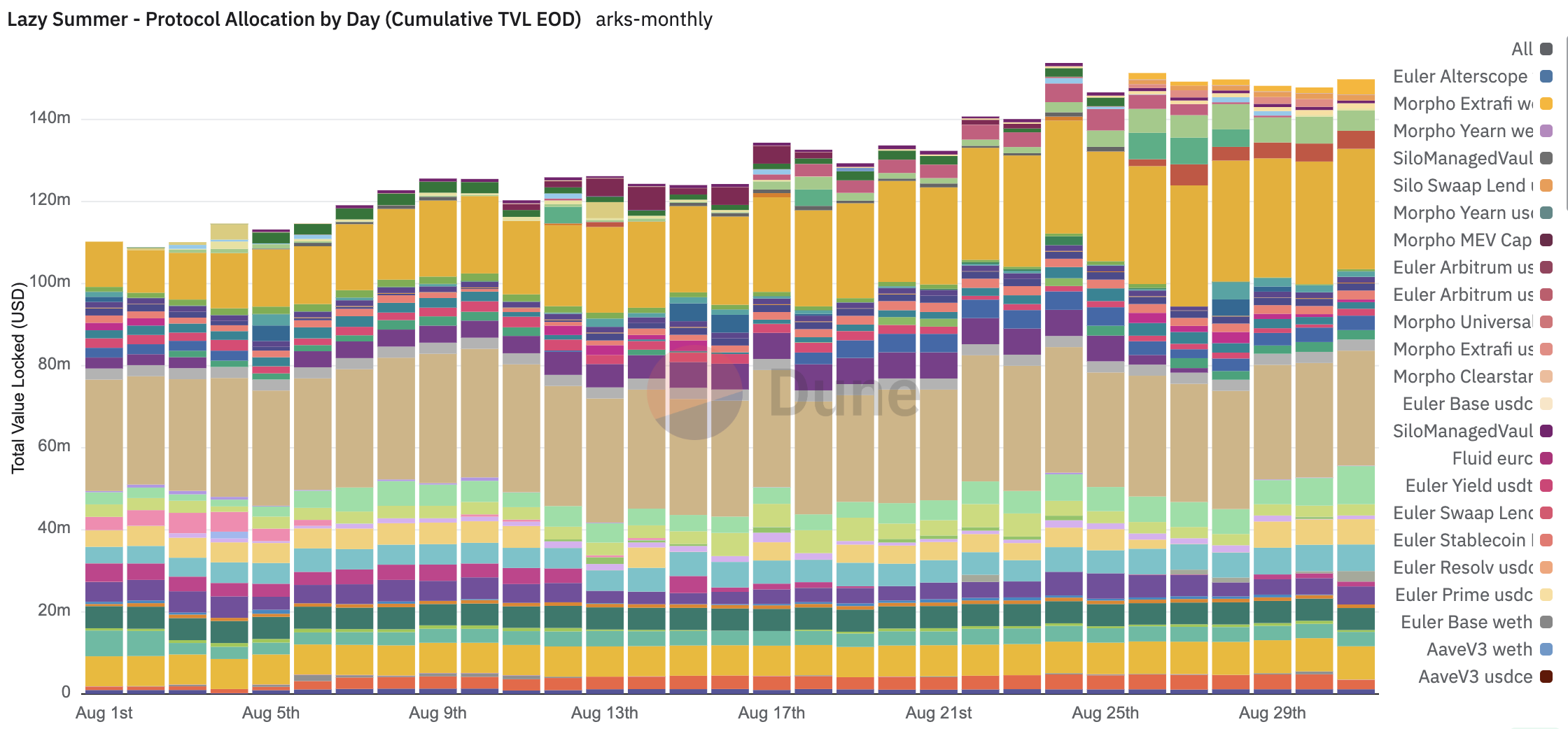

In August, over $150M of TVL moved through Lazy Summer Protocol vaults across Ethereum Mainnet, Base, and Arbitrum. Let’s break down where capital flowed and why.

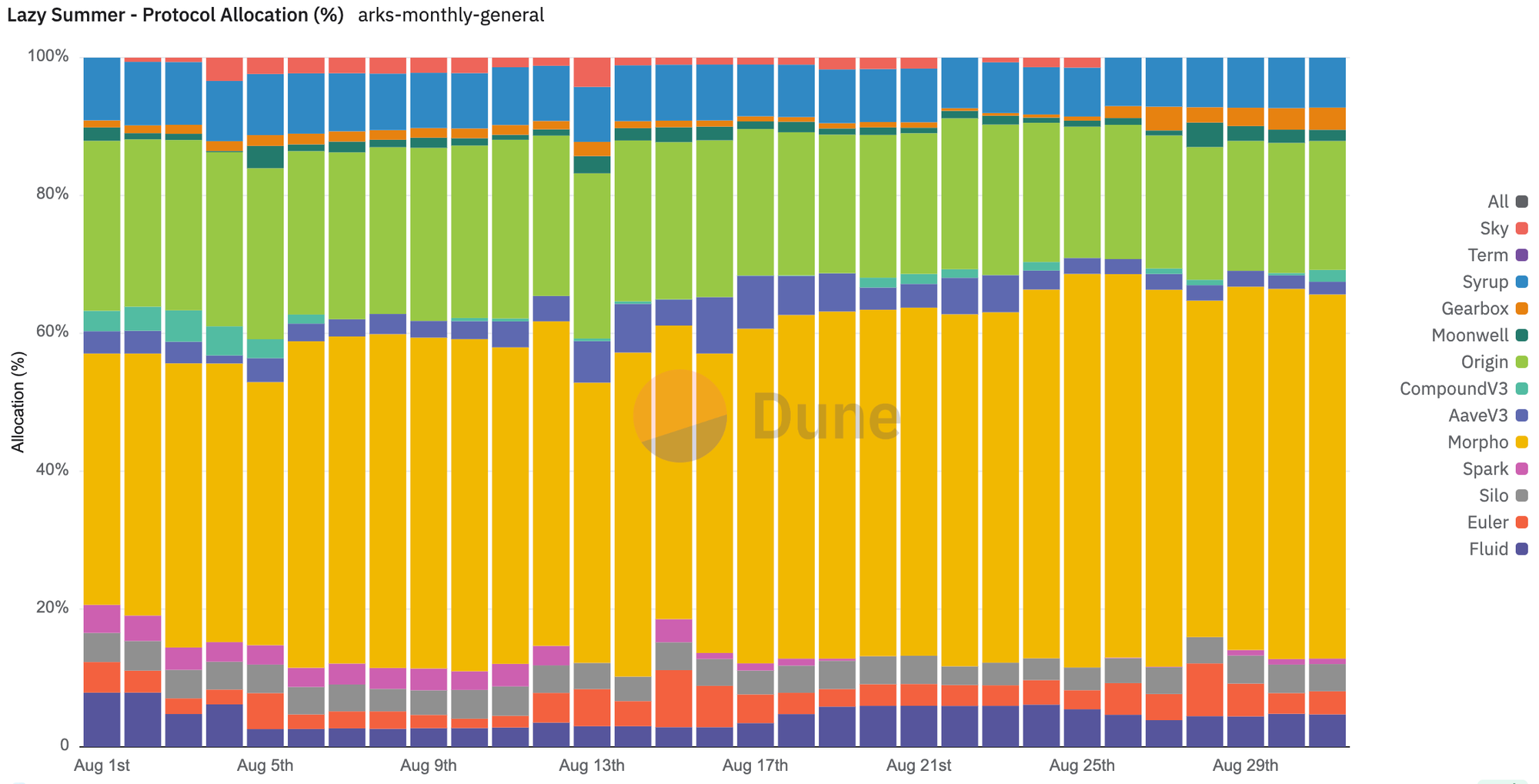

How capital was rebalanced (Past 30 Days)

In the Lazy Summer Protocol level, August showed consolidation into blue-chip markets while tactical allocation shifts captured emerging opportunities.

- Morpho dominated allocations, growing from ~36% at the start of the month to ~53% by month-end.

- Origin ETH remained a steady anchor at ~19–25% throughout the month.

- Syrup (Maple Finance) held a consistent ~7–9%, reinforcing its role as the institutional credit sleeve.

- Fluid & Silo rotated in the mid-single digits.

- Euler & Gearbox saw tactical inflows mid-month, particularly around attractive ETH borrow demand.

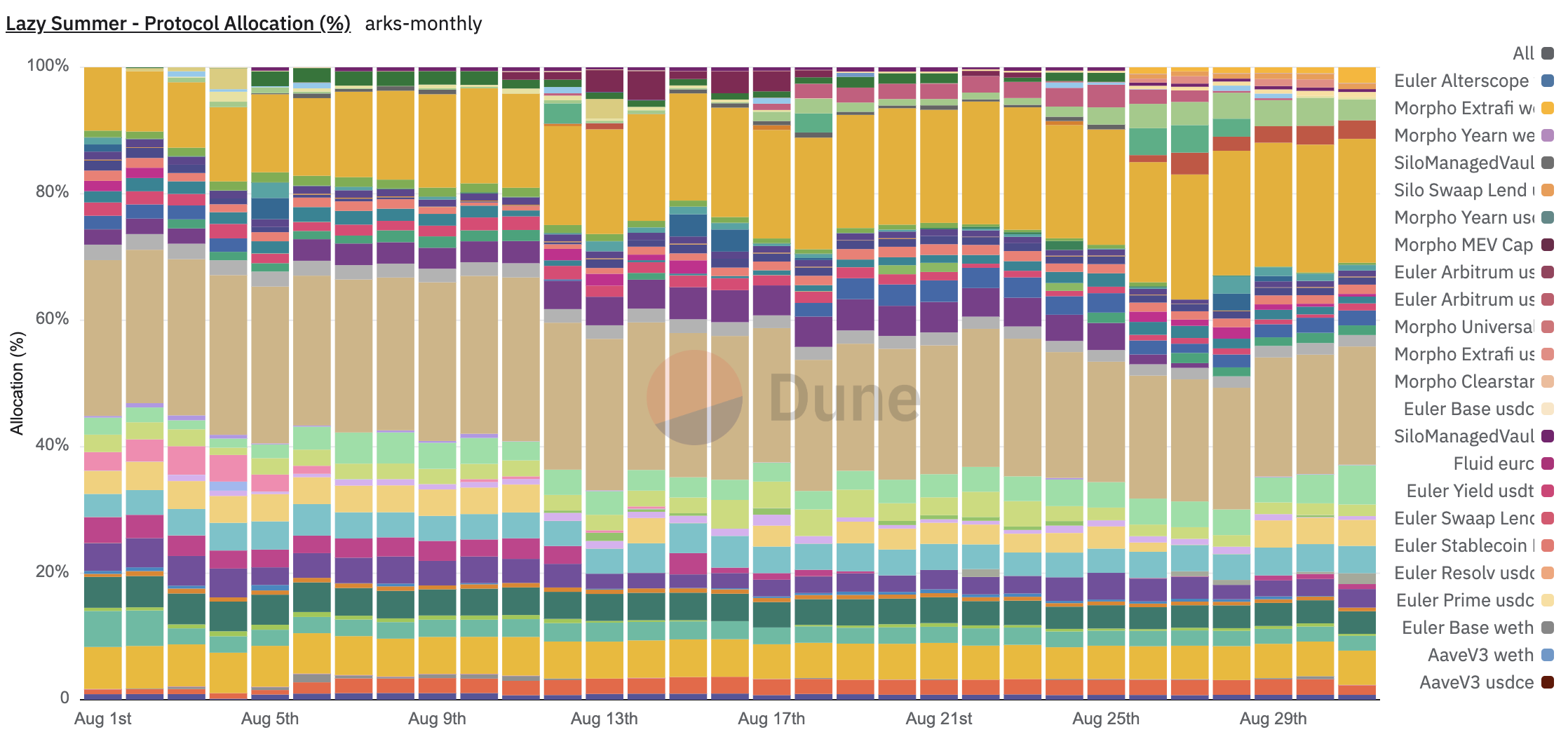

At the yield-source level, Lazy Summer’s AI keepers leaned into Morpho’s Gauntlet, Steakhouse, and MEV Capital vaults, alongside Origin ETH and Syrup USDC, which consistently ranked as top allocations.

Protocol Level Overview & Insight

- Morpho: The month’s clear gainer. Its share of f Protocol TVL rose by ~17 percentage points, as keeper models pushed more capital into diversified Morpho vaults with strong borrower activity and curated risk.

- Origin ETH: Stable anchor exposure (~20–25%) providing consistent, predictable ETH yield.

- Syrup: Sticky 7–9% allocation across USDC and USDT institutional credit pools, highlighting the role of Maple’s vetted borrowers in the Lazy Summer Protocol mix.

- Fluid, Silo, AaveV3: Rotating allocations in the 3–6% range. Keepers opportunistically moved into/out of these as relative rates shifted.

- Euler & Gearbox: Both captured bursts of inflows mid-to-late August, when borrow rates spiked.

Yield Source Deep Dive

- Top 3 Gainers by % of Lazy Summer Protocol TVL

- Morpho vaults (+17%) – Driven by strong Gauntlet & Steakhouse allocations, backed by deep borrow demand.

- Euler (+5%) – Tactical late-month spike as ETH borrow activity picked up.

- Gearbox (+2%) – Similar story: mid-month liquidity needs drove inflows.

- Top 3 Gainers by Absolute TVL ($)

- Morpho vaults (~+$25M equivalent) – Consistent keeper rebalances pushed deposits here.

- Origin ETH (~+$3–5M) – Maintained steady inflows as the ETH base layer strategy.

- Syrup (~+$2–3M) – Institutional borrowers soaked up credit, with Maple’s pools capturing steady Lazy Summer Protocol flow.

- Biggest Outflows

- Silo & Spark saw relative reductions, as yields failed to keep pace with Morpho and Euler.

- Compound V3 allocations trended toward zero by mid-month, reflecting low incremental yield.

Key Takeaways

- Morpho dominance: Keepers are clearly favoring Morpho vaults, cementing it as Lazy Summer’s largest protocol allocation.

- Origin ETH is the ballast: Steady ~20% exposure provides consistency for ETH depositors.

- AI-driven rotations work: Tactical flows into Euler, Gearbox, and Fluid captured yield spikes—exactly what Lazy Summer Protocol is designed to do.

- Institutional credit is sticky: Syrup allocations held firm, showing how DeFi credit markets can complement blue-chip ETH and stablecoin lending.

Lazy Summer Protocol continues to do what it was built for: automated, risk-managed exposure to the best of DeFi yield.

🌴 Why It Matters for You

Lazy Summer Protocol was built for one thing: making DeFi yield effortless.

- No more chasing rates across protocols.

- No more monitoring risk dashboards.

- No more missed opportunities.

You deposit once, and Lazy Summer protocol network of AI keepers + independent risk curators takes care of the rest. Capital rotates automatically to wherever it earns the most on a risk-adjusted basis.

In August, that meant $150M+ of deposits quietly shifted across Morpho, Origin ETH, Syrup, Euler, Gearbox, and more — without a single user needing to lift a finger.

That’s Lazy Summer Protocol. Yield, without the work.

👉 Ready to earn the best of DeFi?

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.