A timeline update for SUMR transferability

A timeline update for SUMR transferability: What's happening when, and how to prepare

All the key dates for SUMR transferability, what you need to do to prepare and how value accrues to SUMR holders and stakers.

A note to the community

You’ve waited a long time. We took the extra time to harden governance, test cross-chain execution, and make sure staking and rewards are built on solid ground. This post lays out the why, the when, and what it means for you clearly and without hype.

TL;DR

- What’s happening: Governance v2 → transferability vote → trading starts on Base, then expands to Mainnet/Arbitrum/Sonic.

- How to participate: Stake SUMR in v2 to receive xSUMR (voting power) and dual rewards (USDC + SUMR) weighted by your chosen lockup.

- Why it matters: SUMR becomes liquid and productive, aligning protocol growth with SUMR staker rewards.

An introduction to SUMR

The SUMR token begins its path to transferability the week of October 31 and starts trading shortly after. A liquid SUMR is a pivotal milestone for Lazy Summer: it aligns governance, rewards, and broader market participant access, kick starting the next phase for the Lazy Summer Ecosystem.

Are you prepared for SUMR transferability? And the trading of SUMR token? Here’s everything you need to know.

Protocol preparations: governance v2, the backbone of transferability

The foundations of SUMR transferability and liquid token are Governance v2. Here’s what’s changing:

- Hub & satellites: All proposals and votes happen on one hub chain using xSUMR. Passed proposals execute via a timelock and are relayed to other chains for enforcement. One vote, coordinated multi-chain outcomes.

- Staking (v2): Stake up to 3 years; longer staking periods receive higher reward weight (quadratic).

- Dual rewards: USDC (aligned with protocol revenue, if/when governance approves) + SUMR incentives.

- Voting power: stays 1:1 with Staked SUMR (no decay).

- Early withdrawal: There is a time based penalty paid to the Lazy Summer treasury.

This structure makes governance secure, scalable, and consistent across chains, and it’s what enables SUMR to become both liquid and useful.

Timeline of events (and what you’ll do)

Dates reflect the current plan and may shift based on governance outcomes and on-chain execution.

Tuesday, 4th Nov - Deploy Gov & Staking V2 Contracts.

What is happening?

The Lazy Summer Foundation deploys Governance v2 and staking contracts on the hub chain.

Why is it happening?

Sets the infrastructure for transferability and locking rewards.

What you need to do

Nothing yet, setup phase.

Wednesday, 5th Nov → First vote to whitelist new staking contracts and add the foundation as governor.

What’s happening?

- Lazy Summer Foundation → Proposes to:

- Appoint the Foundation multisig to governance roles (v1 delegates remain active).

- Whitelist the Governance v2 and Staking contracts on SUMR (Base).

- If passed by DAO governance, the Foundation will launch a MERKL campaign giving stakers the opportunity to receive an amount equivalent to 10%-20% of October protocol revenue as USDC rewards.

- Gov v1 delegates → Vote runs through Sun, Nov 2.

Why is it happening?

Authorizes the v1 → v2 transition and sets up the reward flow.

What you need to do

No action, watch for the vote result on Lazy Summer DAO.

Monday, 10th Nov - Staking V2 module goes live

What is happening?

- If the 5th Nov proposal passes, anyone can execute it to:

- Grant the Lazy Summer Foundation's multisig the required roles.

- Activate the v2 Governance + Locking contracts.

- Holders → Begin migrating from v1 staking to v2 staking and choose a lockup.

Why is it happening?

Completes the transition and turns on the new reward system.

What you need to do

- If you’re in v1, Unstake and stake in v2.

- New to this: You can now stake SUMR, choose a term, and jump on the opportunity to receive SUMR and USDC rewards.

Wednesday, 12th Nov → Foundation to add Governance V2 as Governor of the Lazy Summer Protocol, removing Governance V1 as Governor.

Thursday, 13th Nov, 2025 - Proposal put to SUMR Governors to enable SUMR token transferability.

What’s happening

A Governance v2 proposal is submitted to enable SUMR Transferability across supported chains.

Why is it happening?

Final governance step to make SUMR liquid and tradable.

What you need to do

If you hold xSUMR, vote (from locking SUMR in V2). Otherwise, await the result.

Tuesday, November 18, 2025 - Trading goes live on Base

What’s happening?

If the Nov 13 proposal passes, SUMR trading begins on Base DEXs. Execution also queues timelock actions for Mainnet, Arbitrum, and Sonic.

Why is it happening?

The phased rollout starts on Base for a smooth launch.

What you need to do

- Planning to trade? Base DEXs open today.

- Planning to LP? Aerodrome pools/rewards go live today (subject to pool creation).

- Want the opportunity to earn more SUMR and USDC? Stake SUMR in Governance v2, and/or deposit in the Lazy Summer Protocol.

Wednesday, November 19, 2025 - SUMR Transferability Expands to All Chains

What’s happening

Transferability and trading enable on Mainnet, Arbitrum, and Sonic, completing the multichain activation.

Why is it happening?

Brings SUMR liquidity to all supported networks.

What you need to do

You can now buy, sell, transfer, bridge, and stake SUMR across chains.

Why transferability is a game-changer for Lazy Summer Protocol and SUMR token holders

Utility + Liquidity, finally together.

Until now, governance utility has existed without market liquidity. Transferability pairs voting + rewards with free SUMR movement, which is essential for distribution, integrations, and pricing.

SUMR can become one of DeFi’s most productive assets.

SUMR is designed to be productive for lockersUSDC rewards (if/when governance approves), and SUMR incentives, with a reward weight that favors long-term conviction while keeping votes 1:1.

Alignment that compounds.

Staking deepens governance and stabilizes float. If TVL and integrator volume grow, revenue to the treasury also grows, and governance (you) decides what portion flows back to stakers.

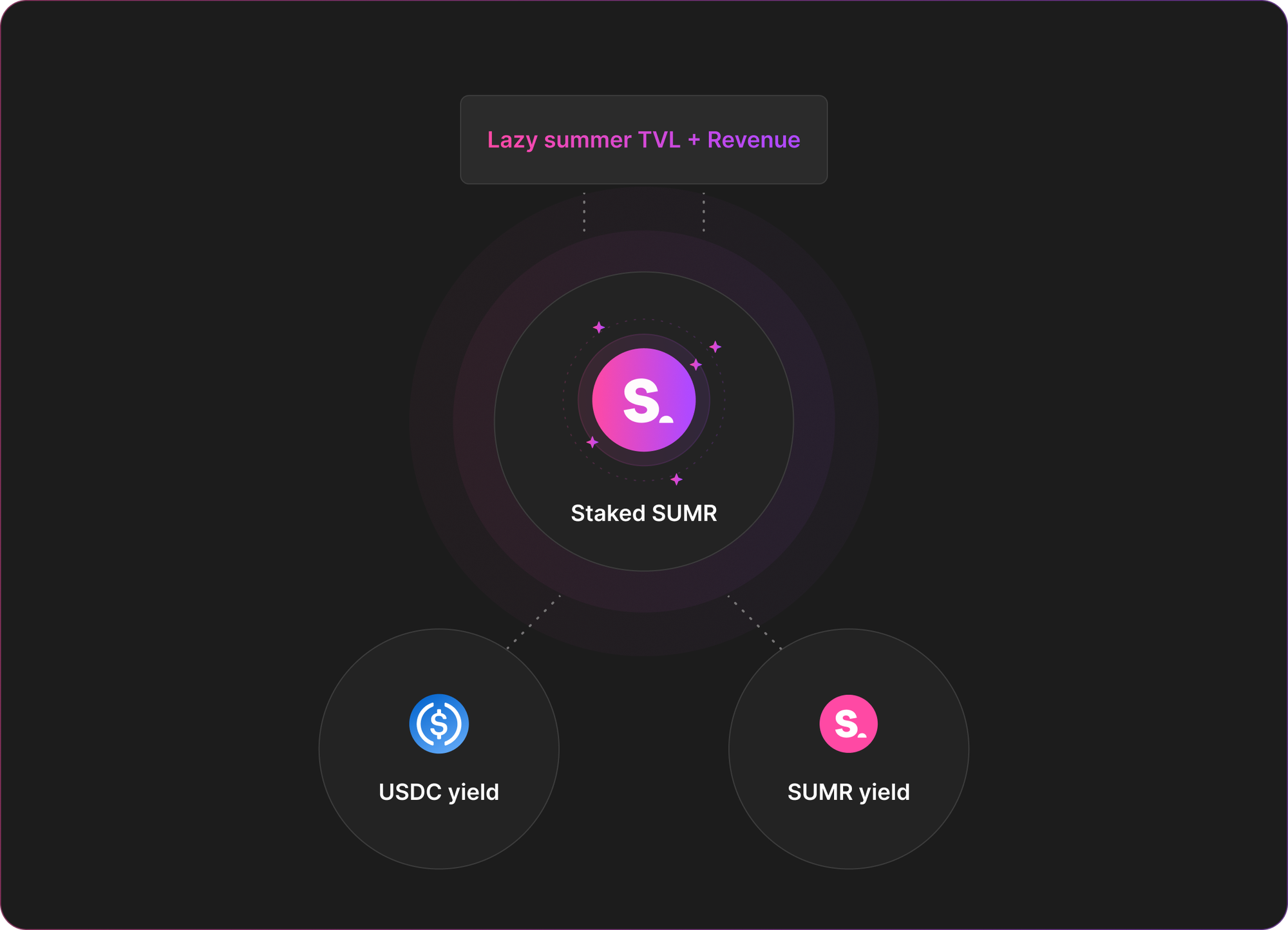

SUMR & USDC rewards: Understanding the novel dual reward token yield source design for staking SUMR.

Staking SUMR gives token stakers the opportunity to receive USDC and SUMR, combining boosted multi-asset rewards, alignment with protocol revenue, and weekly payouts (when existent) into one powerful mechanism.

Your reward is proportional to your weighted stake (amount × time², capped at 3y). Voting power remains 1:1 with staked SUMR. Early unstake incurs a time-based penalty that is sent to the treasury.

Jump-start

- USDC rewards (subject to governance votes)

- Proposed via MERKL: SUMR stakers have the opportunity to receive the equivalent of 10–20% of protocol revenue as USDC reward.

- Purpose: Aligning holders with protocol economics; rewarding long-term participation.

- SUMR incentives

- DAO governed emissions to bootstrap participation, LP depth, and early governance engagement.

- Purpose: Jump start the flywheel if TVL (and, consequently, revenue) ramps up

SUMR Tokenomics: How to conceptualize the flow of value throughout Lazy Summer Protocol

At its core, SUMR tokenomics are designed to direct vault generated fees from providing automated access to DeFi’s highest quality yield into its treasury, which SUMR holders govern and allocate. This directly links protocol success to SUMR token holder value, creating a scalable, governance-driven feedback loop.

How does value flow to SUMR?

1. Vault Revenue: The Economic Engine

Lazy Summer Protocol’s primary financial engine is vault fees:

- DAO deployed vaults: charge a blended ~0.66% annualized AUM fee.

- Self-managed / institutional vaults: charge lower fees (~0.20%), opening scalable B2B revenue streams.

- At $1B TVL, the protocol would generate approximately $6.66M in annualized revenue.

This dual stream design blends onchain, community-driven vaults with institutional volume, positioning Lazy Summer for both retail network effects and enterprise scale.

2. Lazy Summer Treasury: controlled by SUMR lockers

All vault revenue flows into the protocol treasury, which is governed by SUMR token lockers. Through governance, holders can:

- Authorize expense streams.

- Allocate distributions, such as USDC rewards to lockers, subject to governance approval.

As TVL scales, so do treasury inflows, creating a link between protocol growth and governance directed capital.

3. Summer.fi as a technology services provider: aligning incentives

Summer.fi provides technology services to the Lazy Summer Foundation in relation to the Lazy Summer Protocol. As compensation for the services, Summer.fi earns 30% of the, DAO vault's revenue (subject to continued approval by governance).

Summer.fi holds ~13% of SUMR supply. This structure aligns long-term incentives between Summer.fi as a core contributor and governance.

4. Community Distribution & Alignment

35% of SUMR supply is earmarked for the community, distributed through airdrops, farming, rewards, and grants.

Staking SUMR is the primary way users can earn governance power and yield, giving active participants, not passive speculators, the opportunity to benefit the most from protocol growth.

5. SUMR Governance: The ability to make decisions and allocate capital for growth and expansion.

Through onchain votes, SUMR governance determines how treasury revenue is allocated among:

- Operational costs ( contributors)

- Growth initiatives (vault incentives, grants, security)

- Holder rewards (e.g, USDC to stakers)

If TVL grows, treasury inflows increase, and governance decides how those flows are used, fully onchain, transparent,are and collectively governed.

What's next? A liquid SUMR is coming very soon

Stay up to date by joining the conversation on the forum.

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.