A Smarter Way to Earn on ETH

The ETH Lower-Risk Vault on Base in the Lazy Summer protocol changes that. It automates everything, continuously reallocating ETH across the most efficient lending and staking markets.

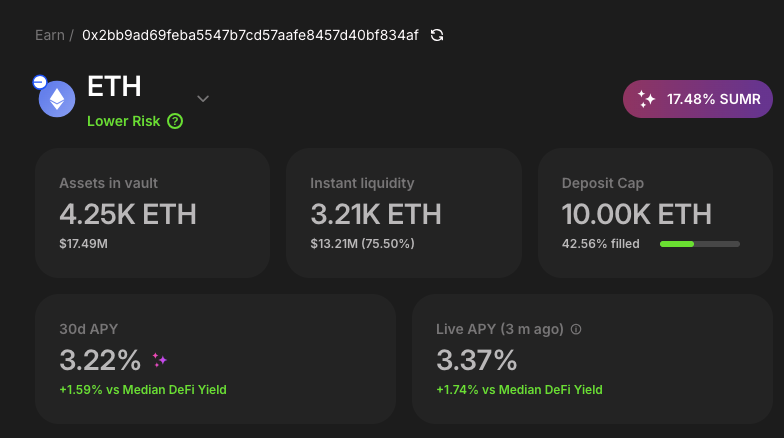

Inside the ETH Lower-Risk Vault on Base - optimized daily

ETH remains the heartbeat of DeFi but its yields rarely stay still.

Rates on Aave, Morpho, or staking pools shift constantly, making it almost impossible to keep ETH positioned for the best return without daily effort.

The ETH Lower-Risk Vault on Base in the Lazy Summer protocol changes that. It automates everything, continuously reallocating ETH across the most efficient lending and staking markets.

Instead of chasing APYs or moving assets manually, depositors get an always-on strategy that’s transparent, diversified, and managed entirely on-chain.

What follows is a look inside how it works and why it represents a smarter, safer way to earn on ETH.

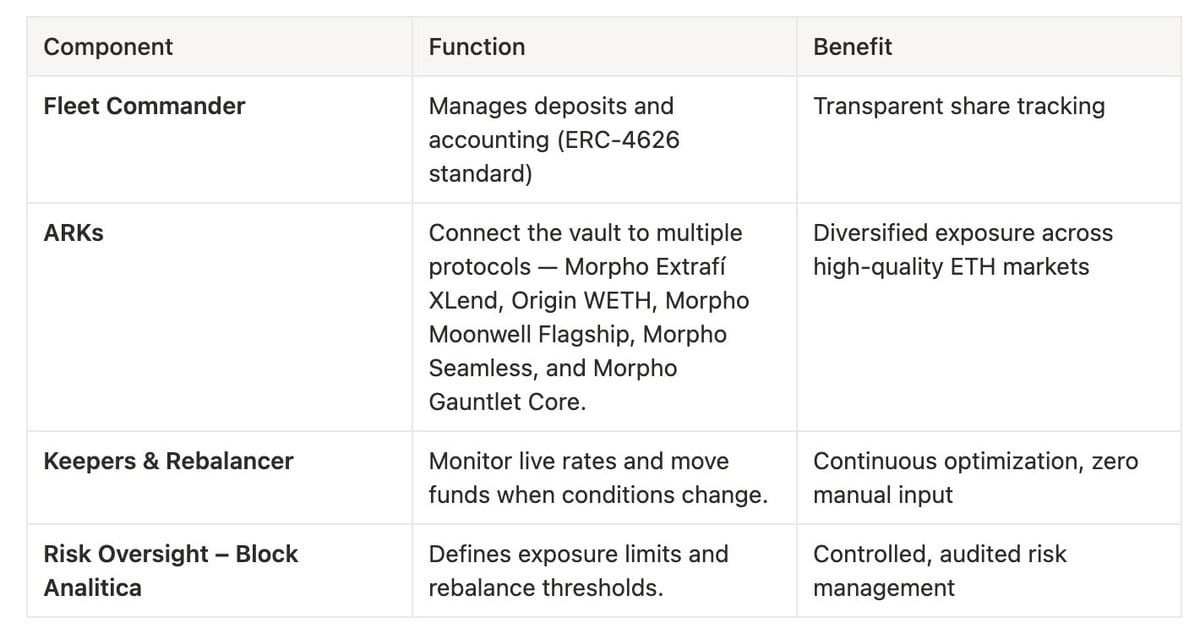

Built for Intelligent Automation

The vault runs on a powerful engine that monitors yield markets in real time. When one protocol’s rate falls and another improves, keepers trigger an on-chain rebalance, shifting capital automatically.

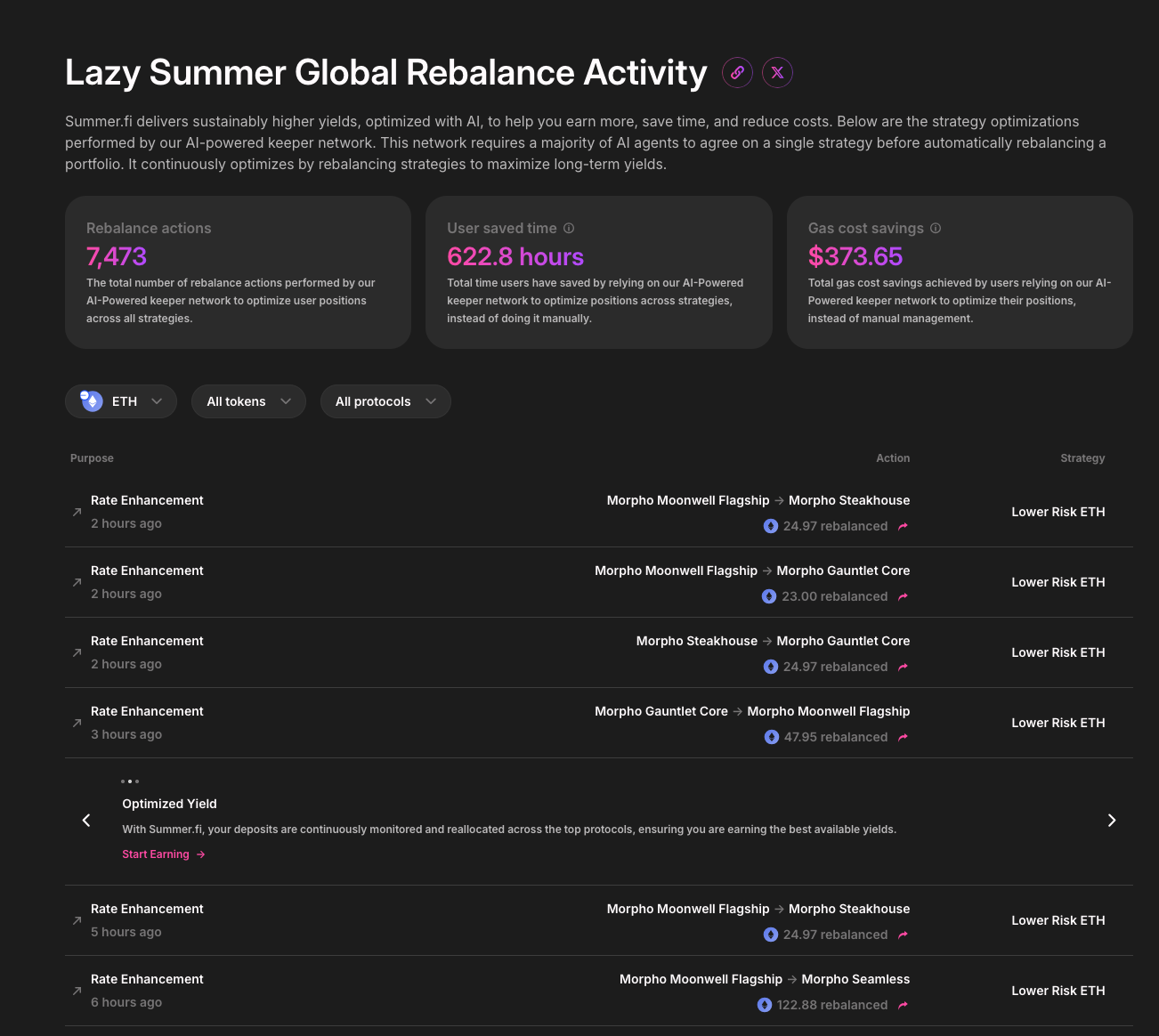

Each move is transparent and verifiable. Every transaction is visible on the Rebalance Activity Dashboard, giving users data rather than promises.

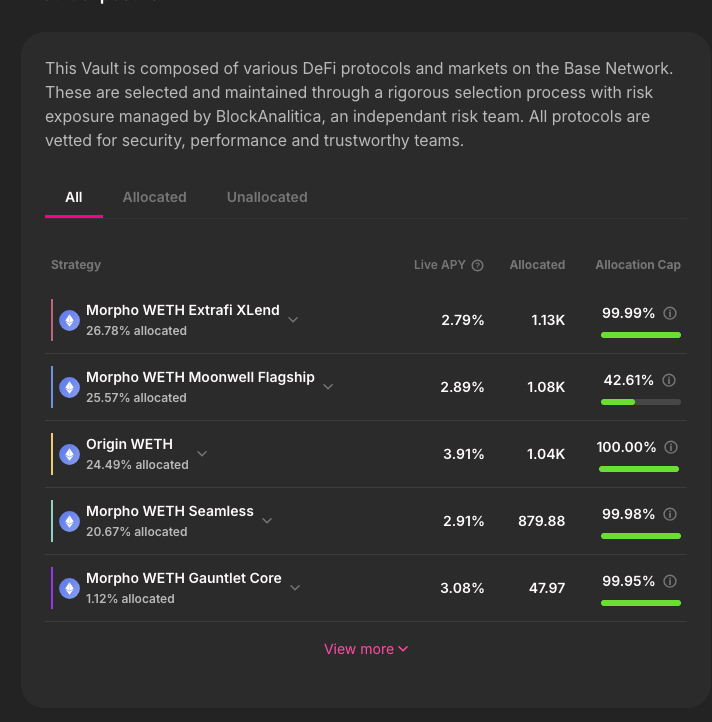

How It Works: Diversified, Automated, On-Chain

The ETH Lower-Risk Vault is composed of several DeFi strategies on the Base Network, but also available on Mainnet.

Each strategy is vetted by Block Analitica, an independent risk team, for security, performance, and team reliability. Allocations are continuously monitored and adjusted through the Lazy Summer Protocol’s automated rebalancer.

These proportions evolve automatically as yields change, ensuring that the vault remains balanced and aligned with its lower-risk mandate.

Live Proof: Automation in Action

The ETH Lower-Risk Vault’s activity log speaks for itself:

Each line is a real-time decision made by the Lazy Summer keeper network not speculation.

The system acts the moment the data shows a better opportunity.

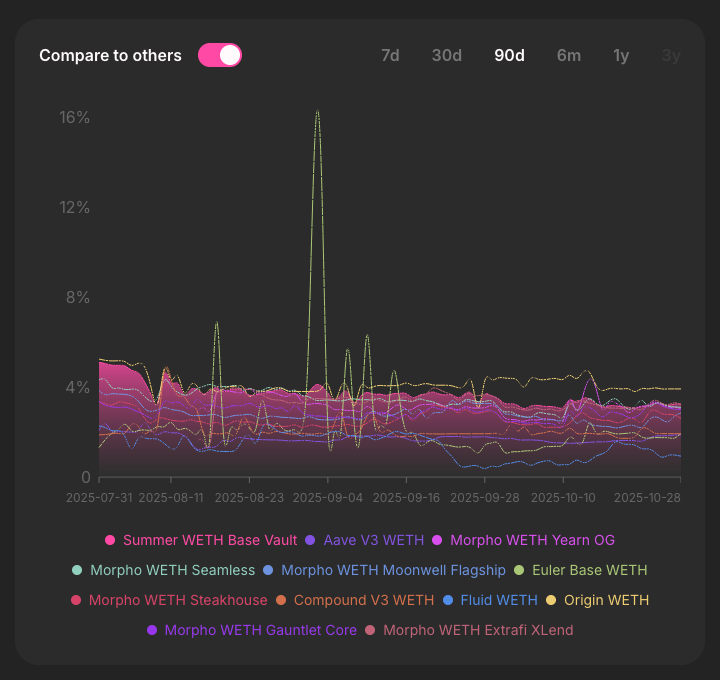

Results: Consistency Over Chasing

Instead of chasing short-term yield spikes, the ETH Lower-Risk Vault focuses on balance. It spreads exposure across proven protocols and rebalances as conditions change, producing smoother, more reliable ETH performance. Automation keeps the vault aligned with the best risk-adjusted opportunities not just the loudest numbers.

Why It Matters

The ETH Lower-Risk Vault exemplifies how DeFi automation can balance security, transparency, and efficiency key elements for scalable, institutional-grade yield access.

It operates continuously, reallocating liquidity across protocols with no idle periods, ensuring that user ETH remains productive within defined, risk-aware limits.

This is DeFi’s next evolution: yield strategies that are intelligent, transparent, and composable are available to anyone, anywhere, at any time.

Why It’s a Smarter Way to Earn on ETH

The ETH Lower-Risk Vault represents what automated DeFi yield should be:

- Always optimized: AI-powered keepers work around the clock.

- Completely transparent: every allocation is visible on-chain.

- Diversified by design: multiple protocols, one unified position.

- Risk-aware: parameters set by independent experts.

It’s a living example of Summer.fi’s goal making yield intelligent, autonomous, and verifiable.

Start Earning Smarter

See how automation can make your ETH work harder without the effort.

Explore the ETH Lower-Risk Vault on Base → summer.fi/earn/base/position/0x2bb9ad69feba5547b7cd57aafe8457d40bf834af

Or browse all available strategies at summer.fi/earn

Join us

Discord | Telegram | X/Twitter | Linktree

Disclaimer: Oazo Apps Limited functions solely as a front-end interface (Summer.fi) provider and it does not act on behalf of any user. Oazo Apps Limited did not launch nor does it operate or control the Lazy Summer Protocol. The Lazy Summer Protocol is accessed through Summer.fi. The information provided herein is provided on behalf of the Lazy Summer Foundation which launched the Protocol for informational purposes only and it does not constitute investment advice. Oazo Apps Limited and the Lazy Summer Foundation are not soliciting or recommending any transaction or guaranteeing any specific returns. Users interact with the Protocol at their own risk. T&C for the use of Summer.fi apply.