2026 Will be the year of onchain vaults

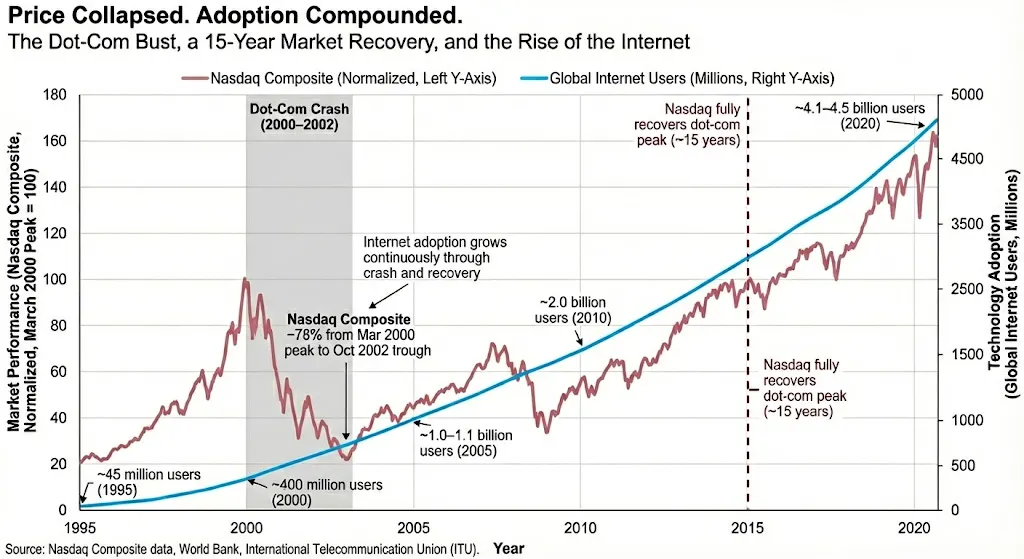

A clear pattern of how crypto grows has emerged, and it’s not that different from how other technologies have reached the mainstream.

https://a16zcrypto.com/posts/article/product-cycles-vs-financial-cycles/

Price cycles are driven by psychology and liquidity. Adoption cycles are driven by utility and infrastructure.They are related, but they are not the same. Historically, prices led adoption. That is common in early technological revolutions. Now, adoption is leading and prices are lagging.

Source: https://obviously.substack.com/p/the-most-uncomfortable-phase-of-crypto

Crypto’s adoption playbook looks like this:

1. A new onchain primitive emerges.

- It starts as something only power users understand

- The experience gets abstracted and packaged

- Distribution explodes

We’ve already seen this sequence twice:

- 2014 → Smart Contracts: programmable rules + programmable ownership.

- 2017–2025 → Stablecoins: programmable dollars become the first truly global onchain product-market fit.

- 2026 → Onchain Vaults: programmable asset management becomes the next mainstream product layer in finance.

The thesis of this essay is simple:

Stablecoins proved onchain money. Onchain vaults will prove onchain asset management.And 2026 is the year vaults grow up from “niche DeFi yield strategies for crypto people” into institutional grade infrastructure that powers consumer finance, fintech distribution, and onchain capital markets at scale.

From Smart Contracts → Stablecoins → Vaults

In 2014 the world was introduced to the smart contract: digital assets directly controlled by code implementing arbitrary rules.

This matters because it permanently changes the “physics” of finance. Traditional finance relies on layers of intermediaries, business hours, and reconciliation across siloed databases. Smart contracts replace much of that with 24/7 execution, shared settlement, and enforceable rules that can be audited in real time.

The team behind Summer.fi is intimately familiar with this trajectory. Many of us. including CEO and Founder Chris Bradbury, helped build one of Ethereum’s earliest major smart-contract applications: MakerDAO (now Sky Ecosystem).

Fittingly, the most successful smart-contract use case to date is the same category Maker helped pioneer: stablecoins.

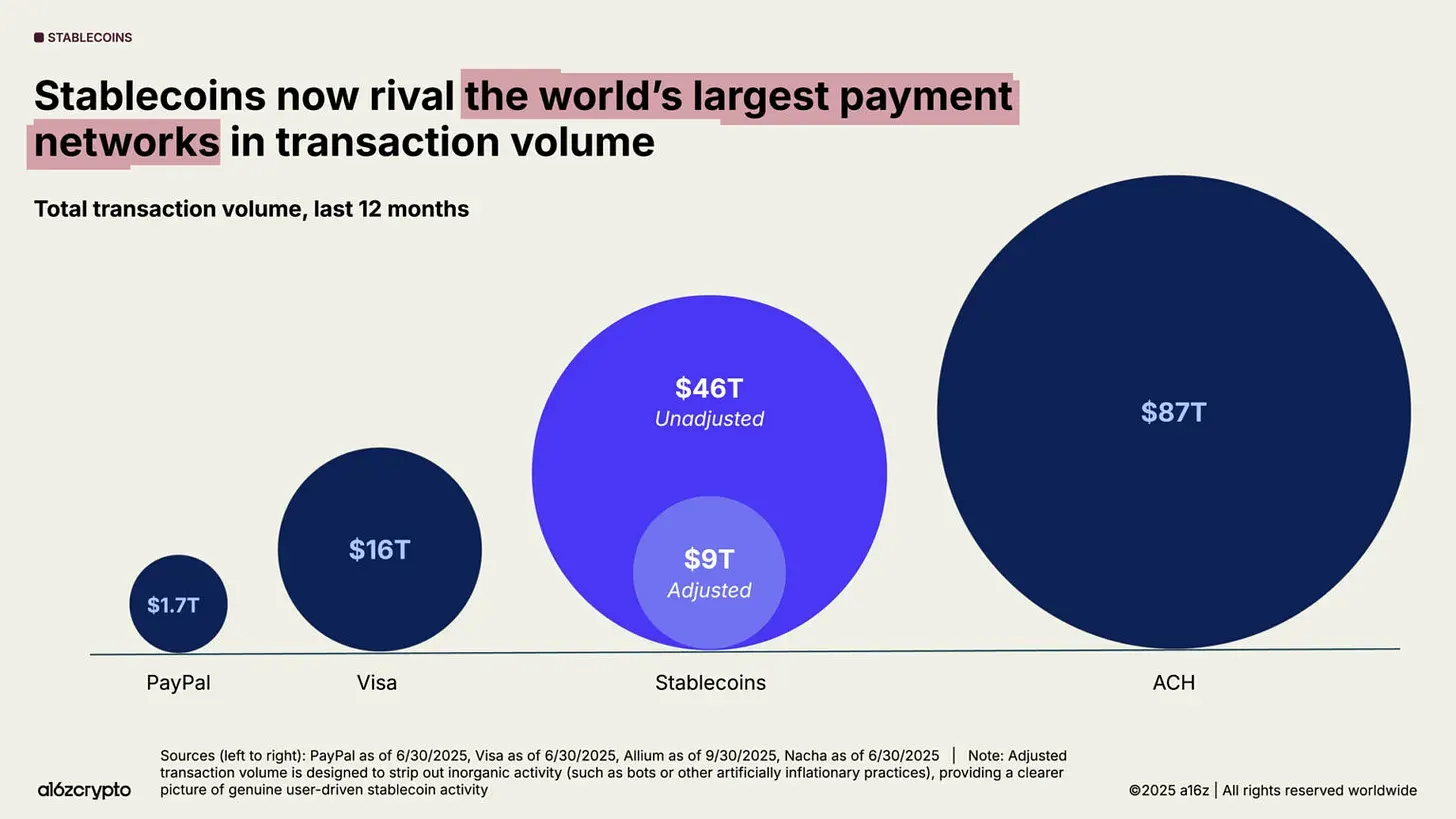

Stablecoins are the first mainstream answer to: “What happens when dollars become programmable and global?”

https://a16zcrypto.com/posts/article/state-of-crypto-report-2025/#stablecoins-went-mainstream

You can really feel it in the broader conversation as well, stablecoins aren’t a “crypto thing” anymore, they’re becoming a global financial rail that incumbents recognize and regulators are increasingly forced to define. In the U.S., the GENIUS Act was signed into law on July 18, 2025, establishing a framework for payment stablecoins.

https://www.whitehouse.gov/fact-sheets/2025/07/fact-sheet-president-donald-j-trump-signs-genius-act-into-law/ So the question becomes: what comes after stablecoins? All signs point to: onchain vaults.

Why vaults, and why now?

Vaults aren’t growing because non crypto native people suddenly love “yield farming.” They’re growing because they sit at the intersection of two massive forces:

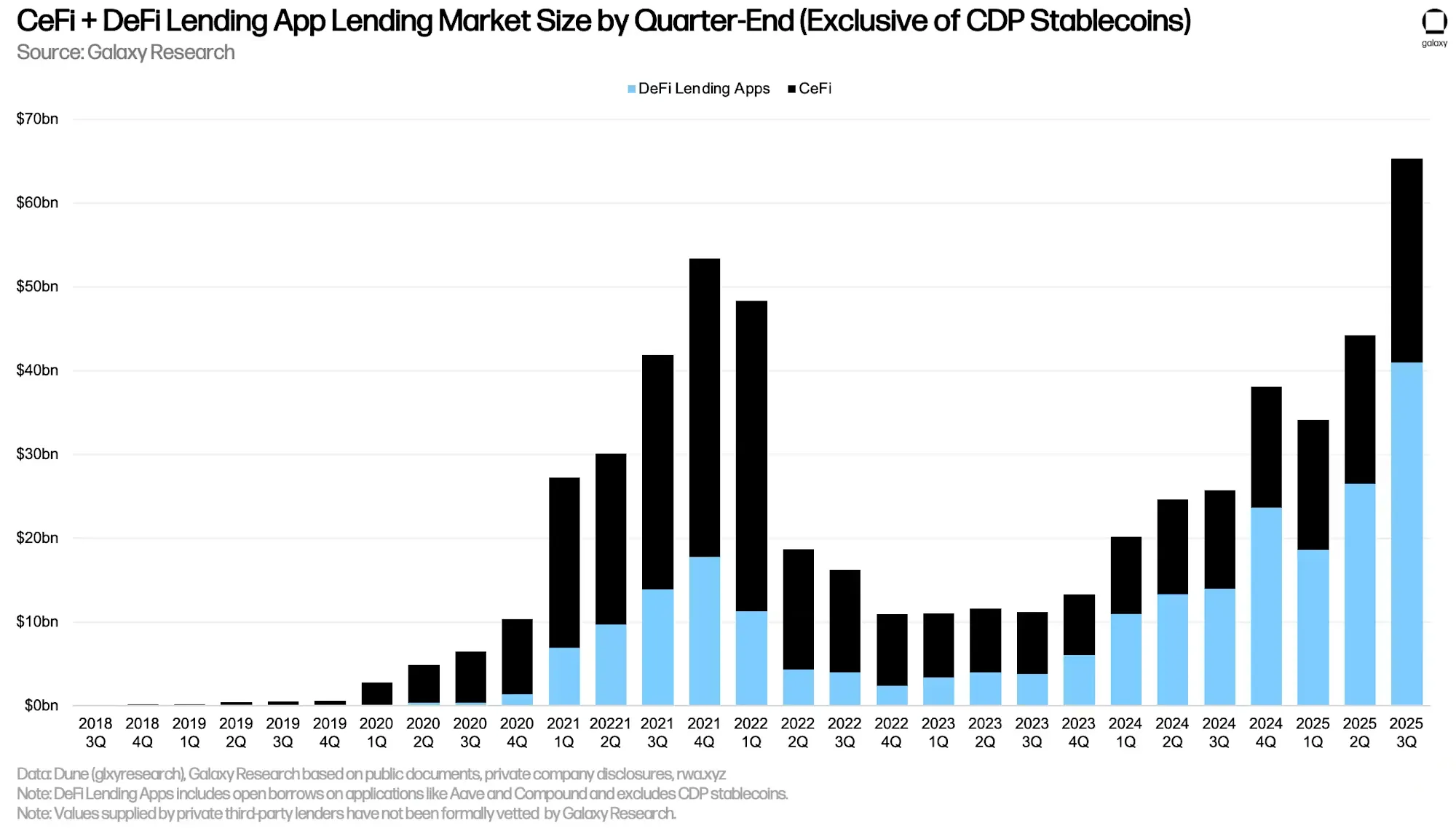

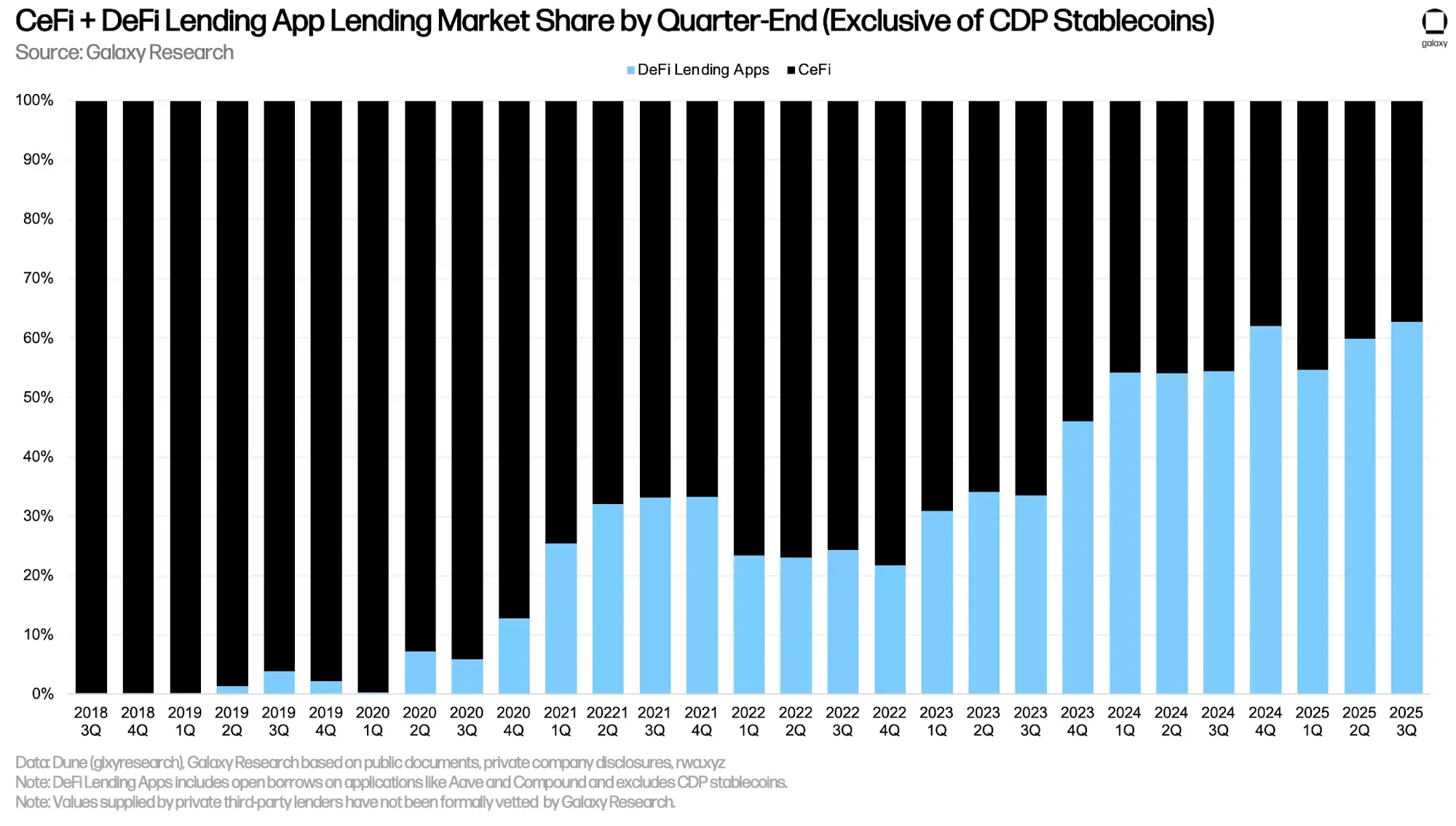

1) DeFi lending and leverage are scaling into real capital markets

DeFi borrowing and lending has matured into a core onchain market structure, one that already supports large-scale demand for credit, leverage, liquidity, and hedging.

Source: https://www.galaxy.com/insights/research/the-state-of-onchain-yield

In fact, DeFi borrow lend is growing at such a rapid clip that even the incumbent CeFi platforms like Coinbase are tapping into DeFi infrastructure to better serve their customers.

https://x.com/brian_armstrong/status/1973035974168097081

Vaults become the natural product wrapper for this world because lending markets (and leverage demand) create a significant amount of the yield opportunities that vaults package for end users.

2) There is a growing appetite for higher quality yield onchain

ETF adoption and regulatory unlocks in 2025 helped expand the set of sophisticated allocators willing to engage with crypto markets, but increasingly, they want more than spot exposure.

https://www.paradigm.xyz/2025/03/tradfi-tomorrow-defi-and-the-rise-of-extensible-finance

Because of these huge unlocks, more sophisticated users increasingly want:

- Stablecoins onchain

- Tokeneized assets

- Access to onchain yield

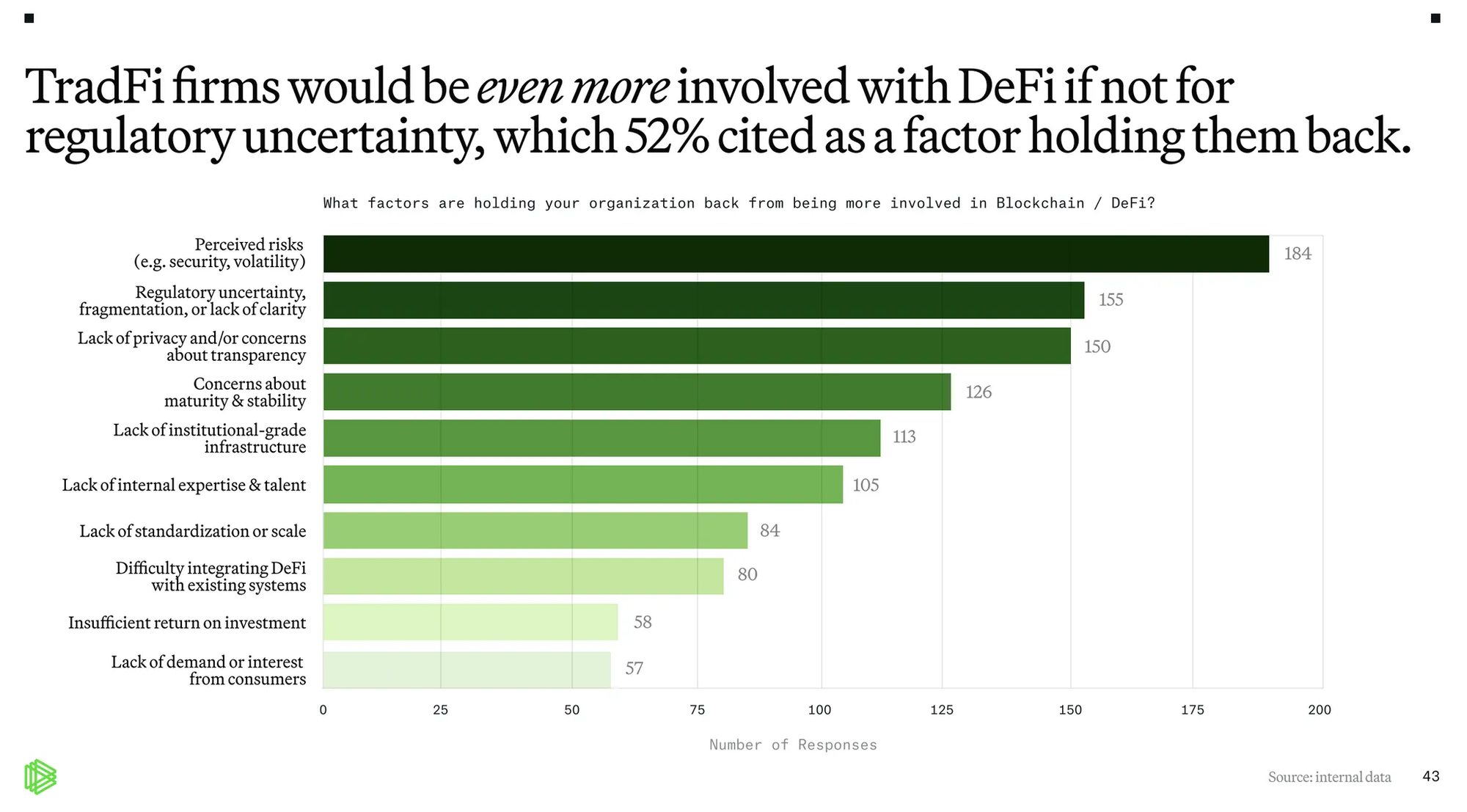

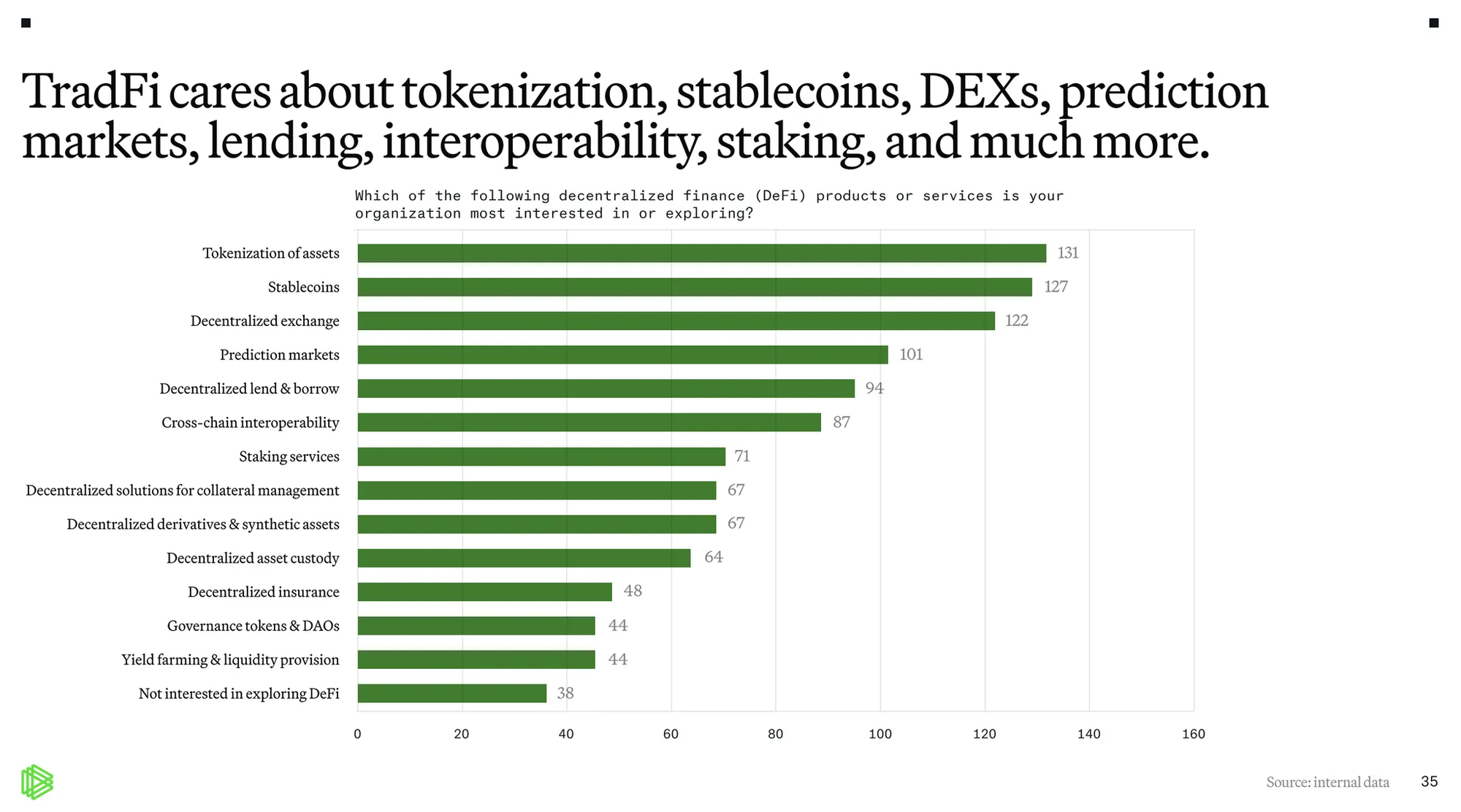

Paradigm and Allium’s “TradFi Tomorrow” survey frames this shift clearly: a large portion of TradFi professionals are already engaged with DeFi or want clearer rails to access it, and many see DeFi as a path to better efficiency and cost structure.

https://www.paradigm.xyz/2025/03/tradfi-tomorrow-defi-and-the-rise-of-extensible-finance

The big unlock here is that stablecoins created the foundation, vaults monetize and extend that foundation. Stablecoins put dollars onchain, vaults turn those dollars into outcome driven financial products ready for mass scale.

Vaults 101

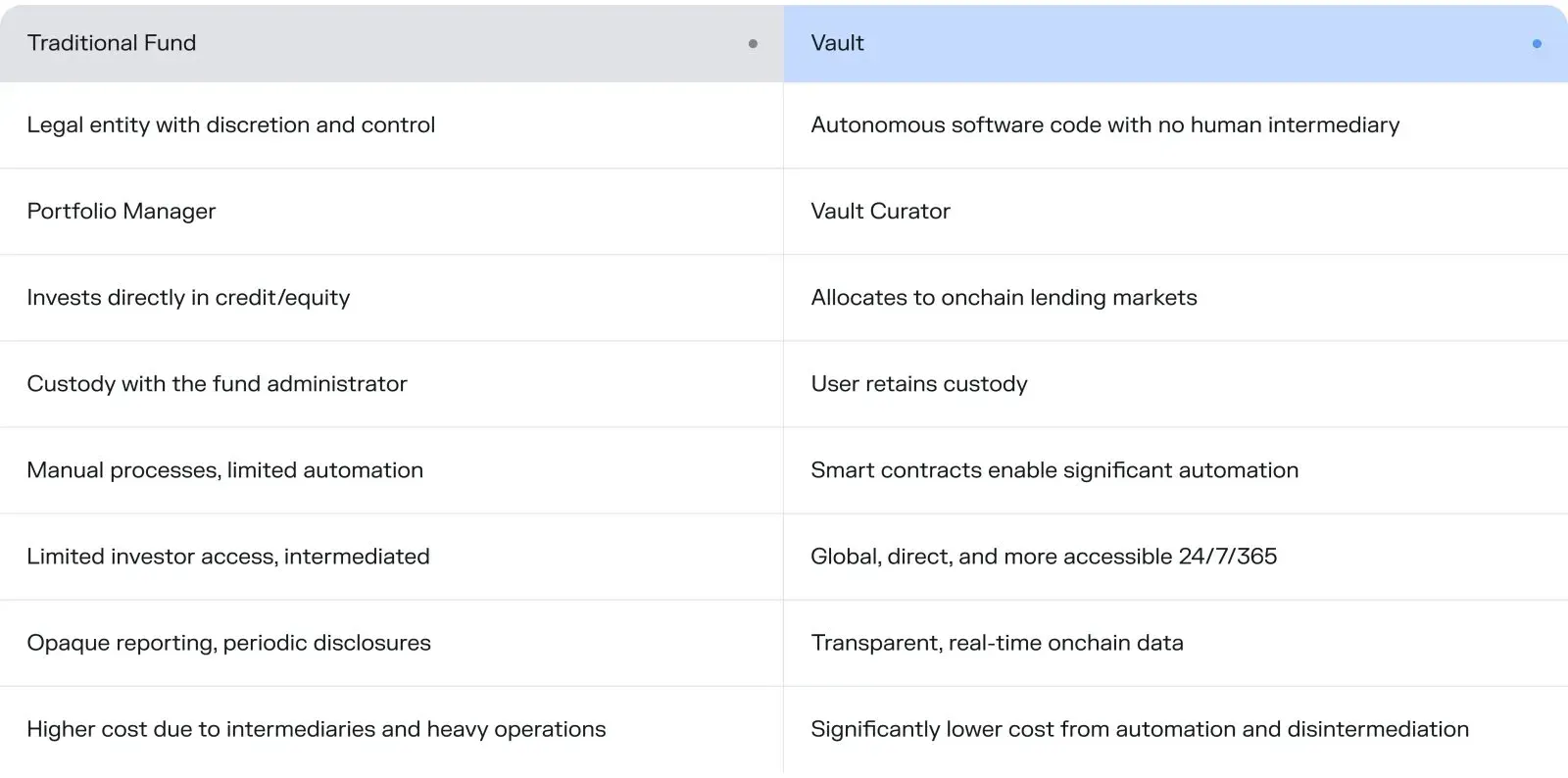

A vault is an onchain fund.You deposit once, software allocates across strategies under constraints and yield accrues into a rising share price, depositors can exit based on transparent rules. That’s the concept, but the structure matters, because vault architecture is what makes vaults structurally superior to many traditional asset-management wrappers.

Source:https://x.com/MerlinEgalite/status/2001301902189867354

Why vaults are structurally different

Vaults combine three properties that are hard to combine in TradFi:

- Noncustodial infrastructure: users don’t hand assets to a manager; assets live in contracts

- Programmability: guardrails can be enforced onchain (not “policy,” but code)

- Composable integration: any wallet/app can integrate vault exposure through a standard interfac

This creates a sort of “hybrid transparency model:

- Custody and balances are public and verifiable.

- Strategy logic can be partially private (so the vault isn’t trivially front-run).

The “Right to Exit”

Tarun Chitra has highlighted one of the most important vault properties: the right to exit.

In many traditional products:

- withdrawals are delayed

- there are gates

- there are lock-ups

- there are “manager discretion” clauses

Onchain vaults, at their best, invert this power dynamic:

- users can exit based on transparent rules

- managers can’t “touch” funds

- the product behaves like software, not a relationship

More than just a technical feature of onchain vaults, it’s a fundamental shift in trust and control.

Onchain vaults are the maturation phase of DeFi

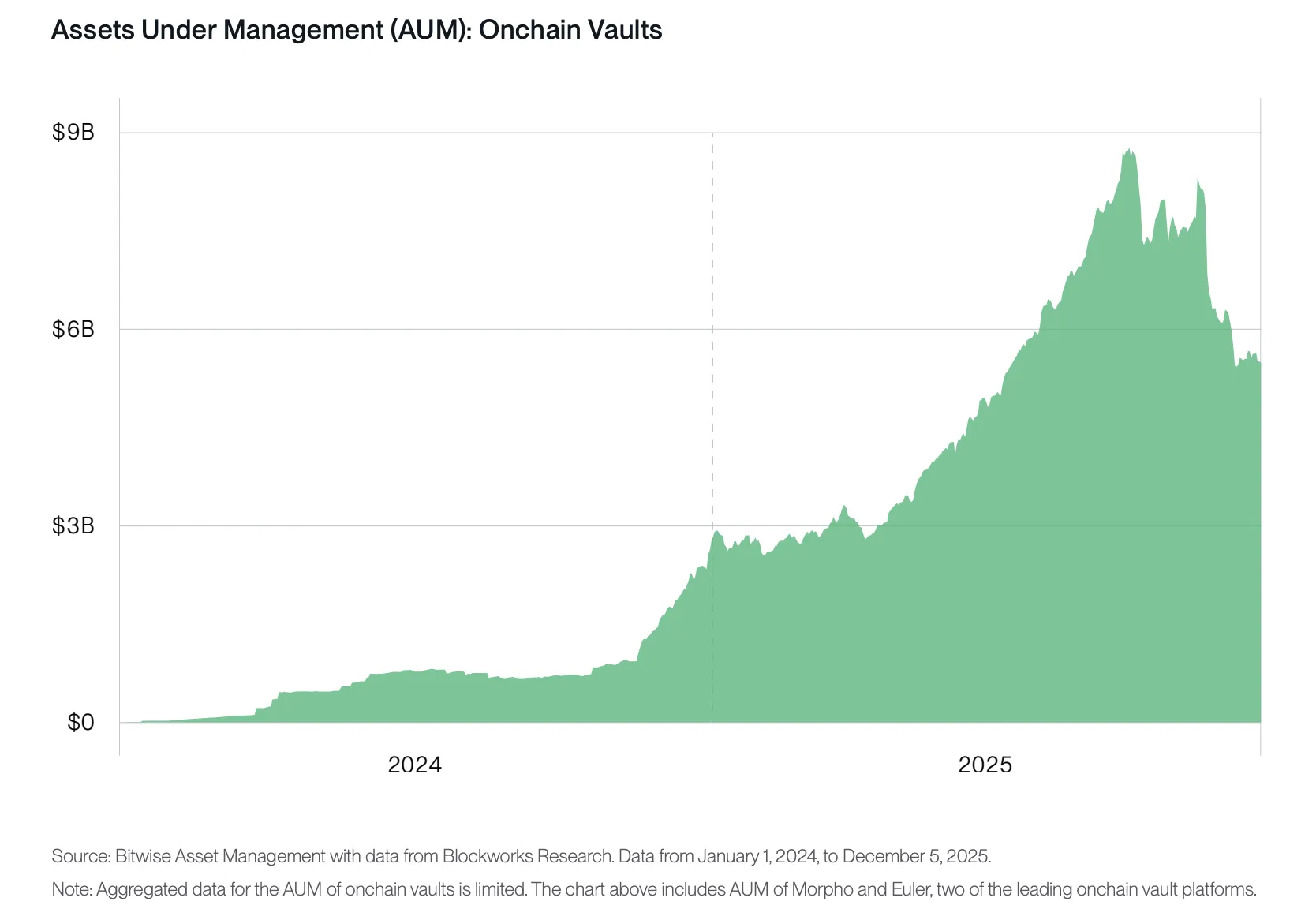

As Matt Hougan (CIO of Bitwise) argues: ETFs replaced mutual funds because their structure was superior. Vaults may eventually replace large parts of asset management because their structure is also superior.

Bitwise’s 2026 predictions put it bluntly:

“A wave of high-quality curators will enter the market in 2026, drawing billions of dollars of capital into the vaults they manage. The space will grow so fast it’ll catch the attention of major financial publications. One of them Bloomberg, The Wall Street Journal, or the

Financial Times—will label vaults “ETFs 2.0."

- Source, Bitwise

That sounds bold until you break it down. Vaults solve the same category of problem ETFs solved: s

- tandardize access to complex markets

- reduce friction and cost

- make distribution easy

- abstract away operational complexity

But to reach that future, vaults must mature. Institutional-grade risk management becomes table stakes, and that’s exactly what’s happening now.

Old generation vs new generation vaults

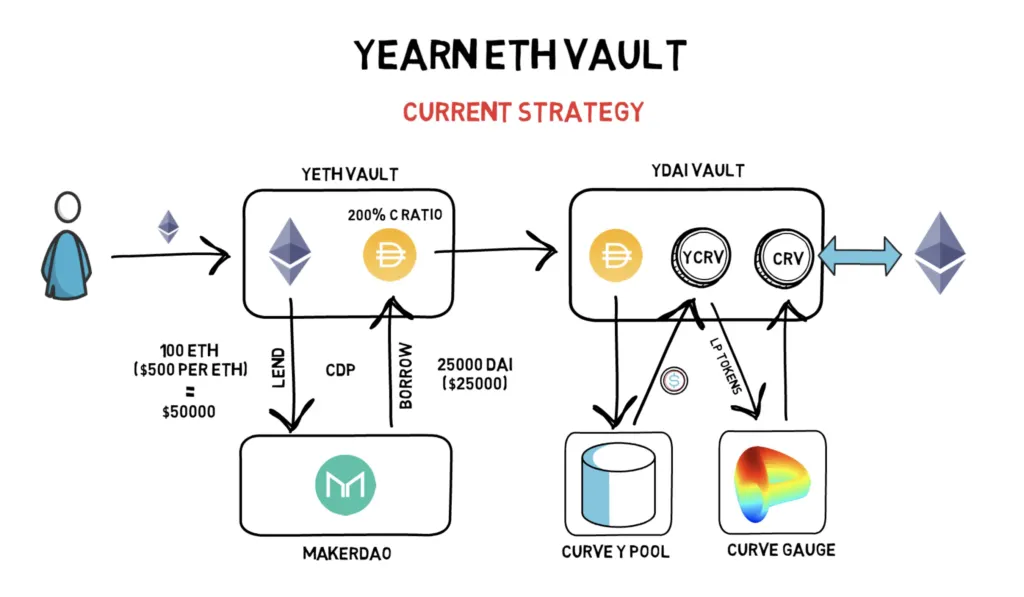

The Old Generation (2020): Vaults like Yearn were often “pure aggregators”:

- they routed capital to external yield sources

- strategies were often static or lightly managed

- they struggled with liquidity/duration risk

- they weren’t built for institutional-grade risk management

The New Generation (2025+): Modern vaults increasingly become primitives, the actual source of yield:

- matching lenders/borrowers directly

- structured strategies with tighter risk systems

- sophisticated liquidity management that prevents “death spiral” runs

As vaults become primitives, they stop being “just wrappers.” They become core market infrastructure.

Why 2026 specifically Is the year vaults Grow up

If 2024–2025 was the era where vaults proved they work, 2026 is where vaults become the default wrapper for yield exposure, because three catalysts are converging:

Catalyst #1: clearer regulatory footing for stablecoins in key jurisdictions

Stablecoin’s are the foundation. Regulatory clarity increases comfort and distribution, which increases aggregate demand, which increases demand for yield bearing wrappers. The U.S. GENIUS Act framework is a milestone in that direction.

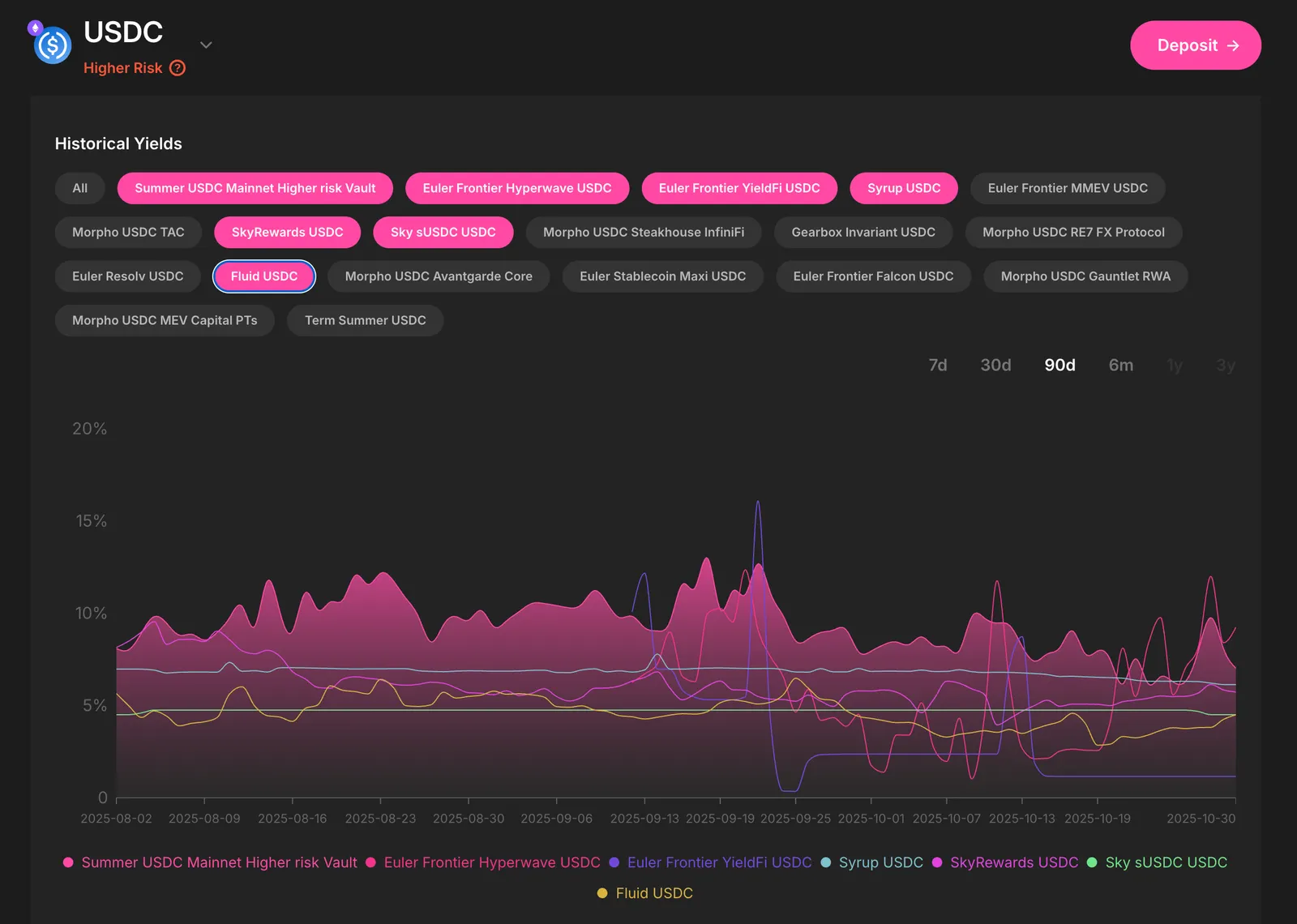

Catalyst #2: stablecoin yield is “left on the table” at scaleGalaxy’s onchain yield report makes the tension explicit: USDT pays zero wherever it’s held, and USDC yield sharing is narrow, meaning most balances in major stablecoins still earn 0% while issuers retain most T-bill income. Vaults are the product category designed to close that gap.

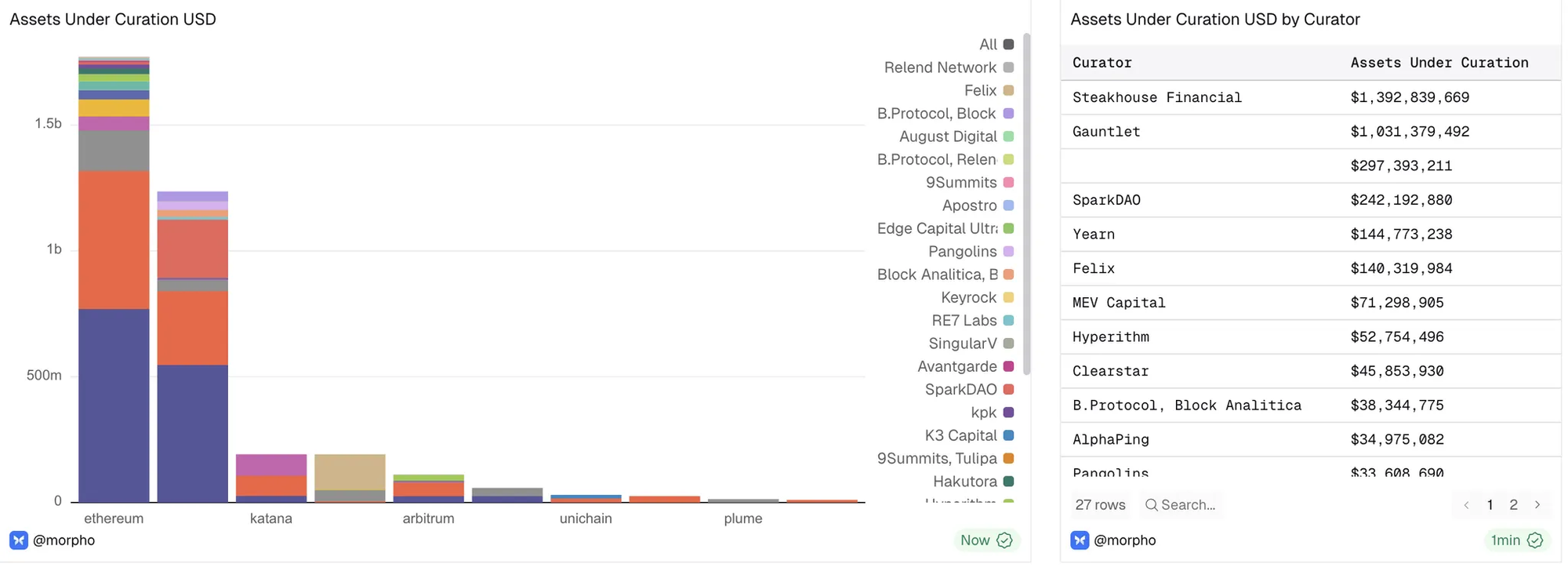

Catalyst #3: the curator market becomes a real marketIn 2026, the market for curators shifts from “a few good curators on morpho and euler” to “a professional curator ecosystem,” where:Performance is ruthlessly evaluated Clear and communicated robust risk frameworks will matter more Differentiation will become clear in the types of strategies curators make accessible

That’s the “ETF 2.0” moment Bitwise is pointing at, and its already started with tremendous momentum from Midas vaults.

Other drivers huge growth in 2026 for onchain vaults

1) More, higher-quality, diverse yield sources

Previously, yield was mostly:

- token emissions

- basic lending

- basic LPing

In 2026, yield will increasingly be from newer, more sophistiacted sources, we have already started to see inklings of this in 2025:

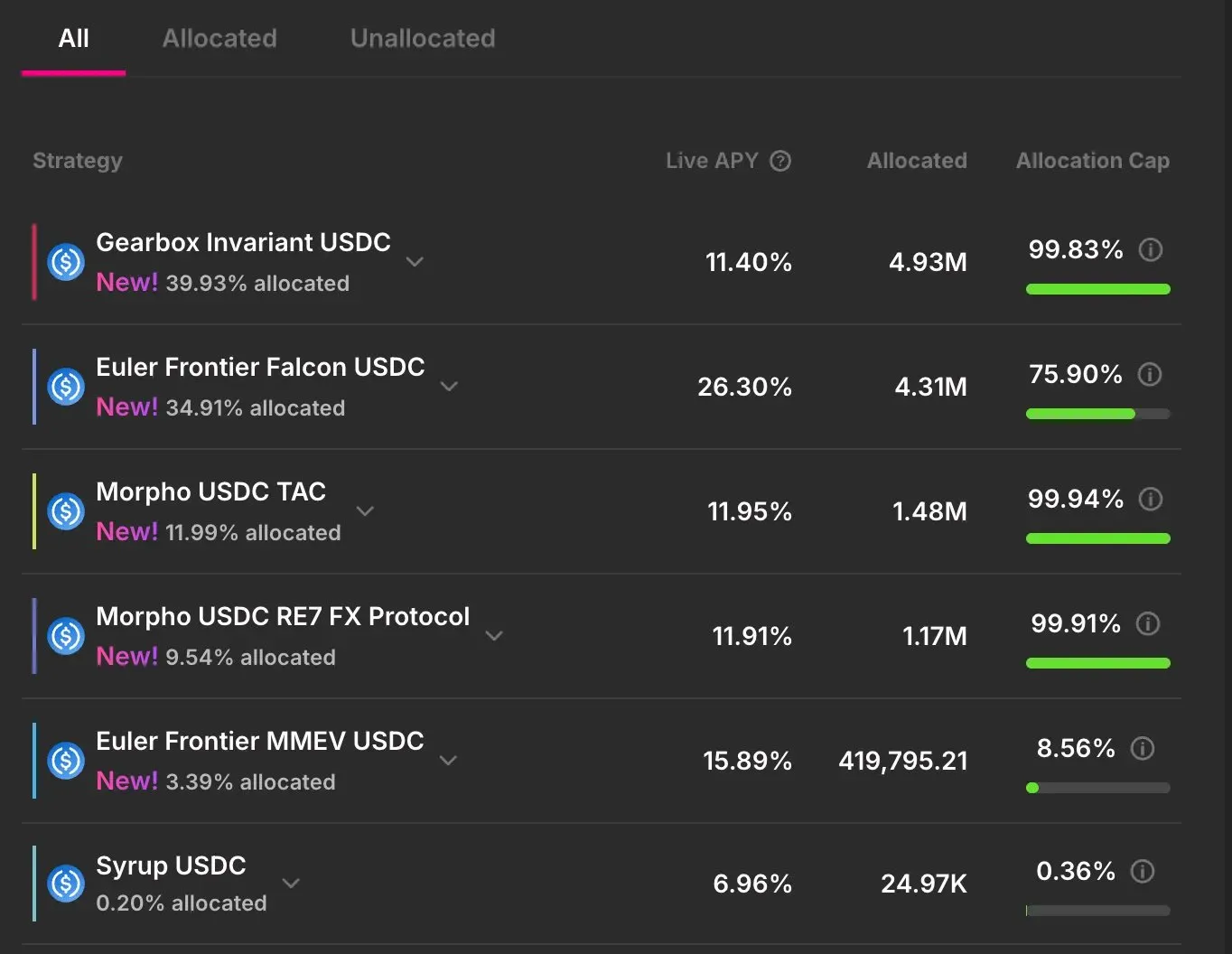

- Institutional on chain credit (Syrup)

- structured basis trades (Staked USDe)

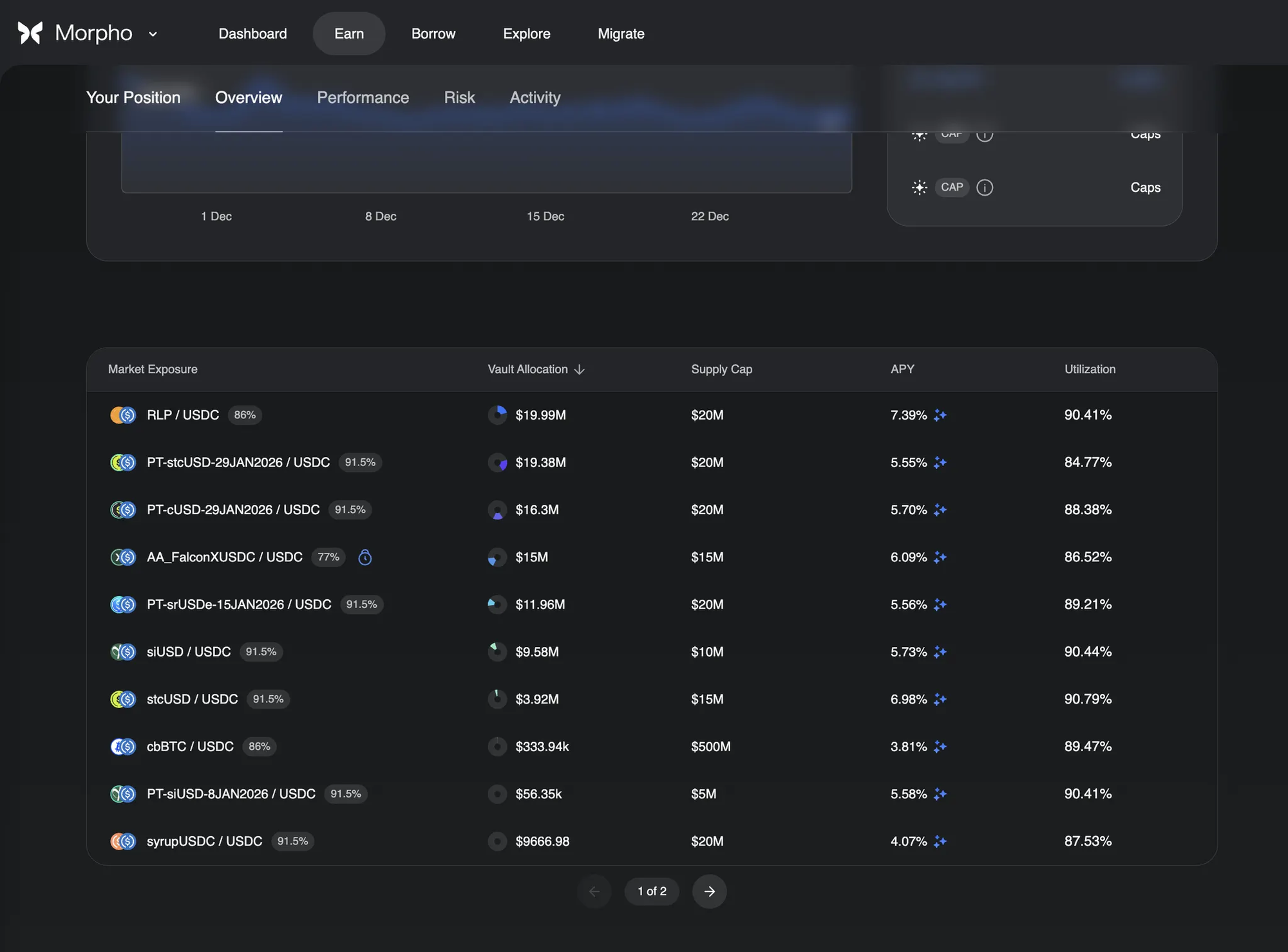

- risk-curated lending markets (Morpho and Euler)

- fixed-term lending / duration products (Pendle and Morpho v2)

- Tokenized credit / permissioned onchain credit primitives (Ondo, BUIDL…)

2) Continued stablecoin growth will create even more demand

Stablecoin growth will be propelled by new issuers who will want their own stablecoins, this doesn’t just create “more money onchain. It creates more stablecoin management need, more institutional appetite for “yield with rules and more distribution partners who want a vault backend.

3) Yield curves and duration management become mainstream

Right now, most DeFi is short duration by default, but sophisticated capital want, term structure, fixed-term lending and predictable cashflows. As fixed-rate / fixed-term lending grows, vaults become the natural packaging layer to reduction friction in access.

4) “Neo-banks” and consumer fintech adopt vaults on the backend

This is how vaults go from $10B → $100B. Not only through DeFi-native users but through new forms of distribution. Fintech frontends are perfectly placed to hide the complexity and offer outcomes that are an order of magniturde better for their customers, and lower cost for them.

5) Rate compression pushes curators out the risk curve

As the “easy yield” compresses, performance will increasingly come from better risk selection, better collateral underwriting. better liquidation modeling, better duration and liquidity management and ultimately: better curators who will be forced out on the risk curve to produce more attractive yields.

The next problem: fragmentation (In a different form)

Vaults reduce traditional finance fragmentation (intermediaries, systems, custody rails) but introduce a new kind of fragmentation because DeFi is simply not a monolith.

Many protocols take different approaches their vault ecosystems (Sky, Maple, Morpho, Euler, etc.), each ecosystem evolves at different speeds, strategies and curators become more sophisticated and vary greatly, new networks come online sporadically.

So the hard depositor problem becomes: How do I get started, and how do I get diversified exposure across the best ecosystems, without becoming a full-time risk manager?

Source: https://www.galaxy.com/insights/research/the-state-of-onchain-yield

On a protocol-by-protocol basis, curator quality becomes the defining factor, but it still leaves the depositor with endless decision-making. Morpho itself describes curators as independent teams who design and manage portfolios packaged into vaults, which is powerful, but also implies a lot of choice.

Morpho v1 alone there are more than 25 curators to choose from. https://dune.com/morpho/vaults-curators-analysis Even if the underlying vaults are automated, staying on top of the vault market becomes the new full-time job.

Do Less: Lazy Summer Protocol is how to benefit from onchain vaults in 2026

As vaults proliferate, many individual vaults, protocols, and curators will perform exceptionally well.

But understanding:

- when to deposit

- where to allocate

- how to manage rotations

- how to interpret risk changes

- and how to stay diversified across ecosystems

…will be almost impossible for manual depositors to keep up with, for both institutional and DeFi natives.

For users of Lazy Summer, this is not the case. In 2026, if you are a depositor in Lazy Summer you can simply: Do Less.

For DeFi natives:

Lazy Summer is an automation engine that captures yields across a broad set of sources that are:

- too fast-moving

- too far-reaching across chains

- too gas-intensive to chase manually

Instead of micromanaging protocols, you get outcome-driven exposure with a simple UX.

For institutional allocators:

Lazy Summer is the risk-adjusted entry point into DeFi yield.

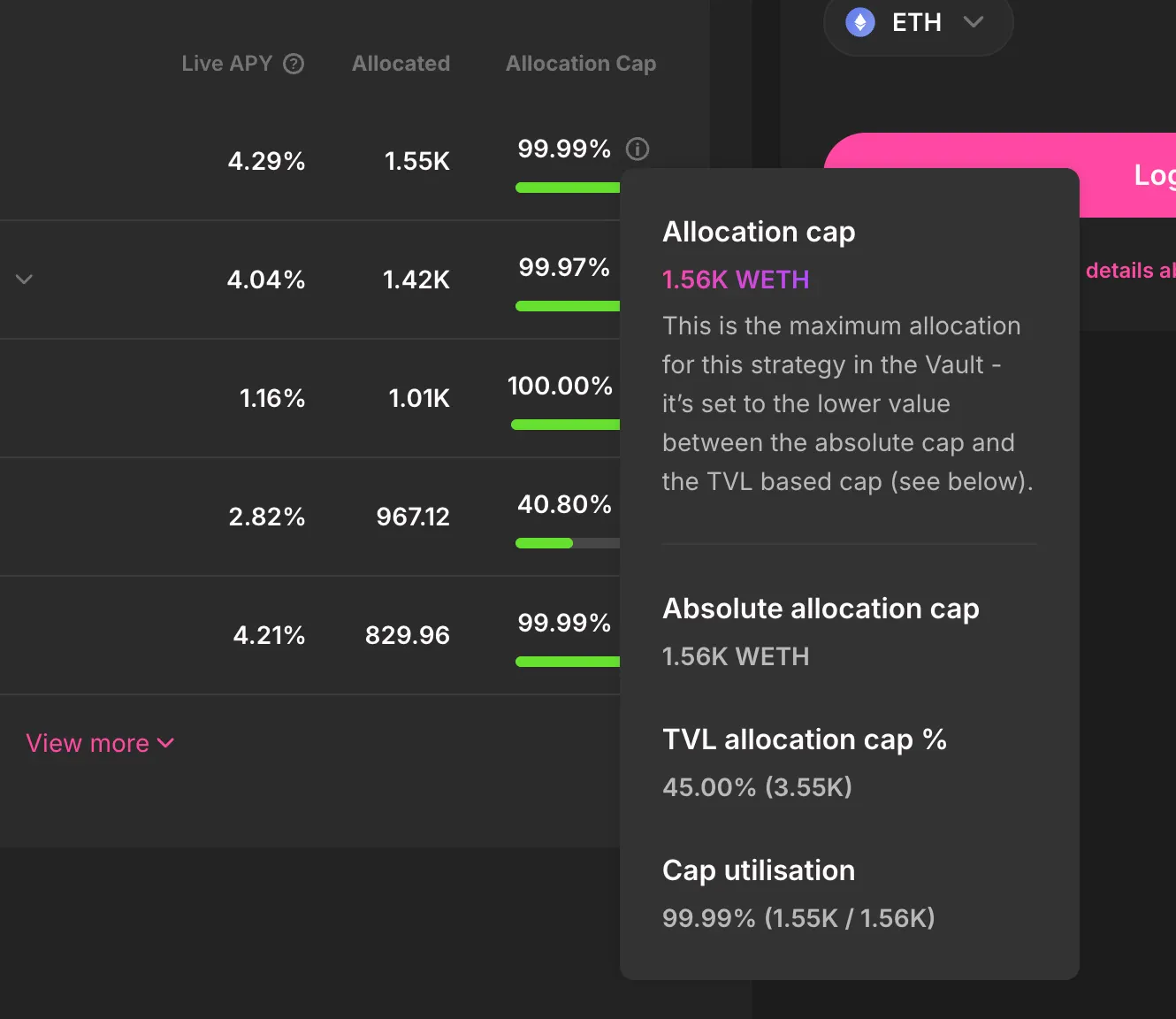

Every rotation is governed by an independent, explicit risk framework and expressed through protocol defined constraints (caps, offboarding, exposure limits).

You don’t have to:

- vet hundreds of vaults across protocols

- learn which curators to avoid

- constantly rotate “new shiny objects”

You just have to use Lazy Summer, which does the heavy lifting.

Lazy Summer will keep delivering on its promises in 2026

In 2026, the protocol will compound on three promises

Benchmark Yield: diversified exposure that consistently beats static deposits

Risk Curation: access to new yield sources inside a strict, governed framework

No Yield Chasing: governance + risk experts handle rotation discipline so users don’t have to

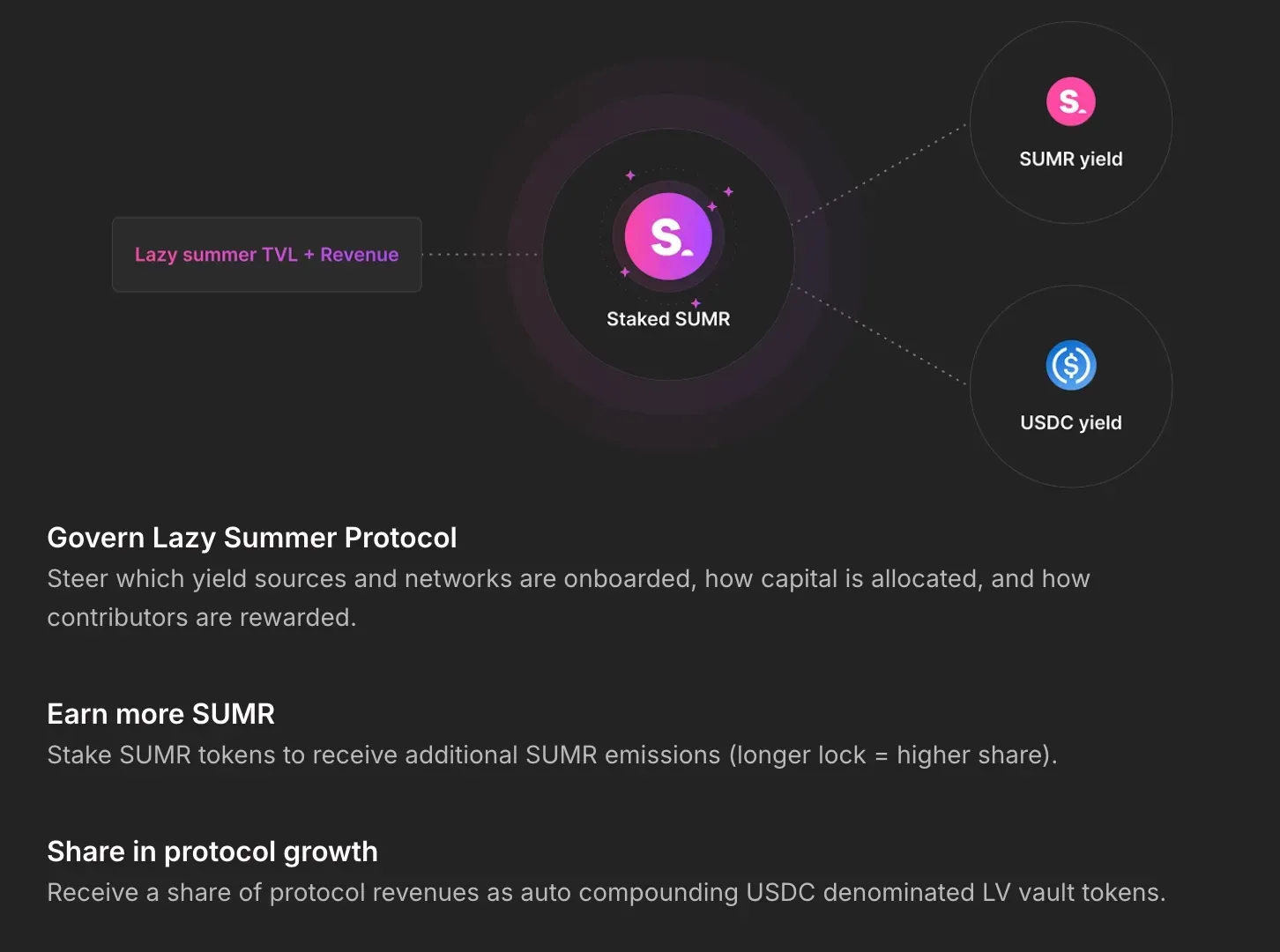

SUMR: alignment + distribution

One of the most important dates on our calendar is January 21, 2026, when SUMR becomes liquid (TGE).

In the context of this essay, the point isn’t to preach the SUMR token, it’s make clear how it creates alignment with those who seek to earn SUMR within Lazy Summer vaults:

Risks - what could convince us otherwise of onchain vault growth?

Vaults reduce certain risks (custodial and discretionary manager risk) but concentrate others:

- smart contract risk

- oracle / pricing risk

- liquidity stress in tail events

- governance and parameter risk

- yield sustainability / “risk curve creep”

The winners in 2026 won’t be “who can launch a vault and grow it the fastest with the loosest risk practices”. They’ll be who can deliver trustworthy liquidity to exit, disciplined risk, and repeatable performance through volatility.

We believe Lazy Summer is in the best position to do just that.

2026 is when vaults stop being a niche DeFi power tool and start becoming the default wrapper for yield exposure, and as that happens, fragmentation becomes the new tax.

Lazy Summer exists so users don’t have to pay that tax.

Keep it simple in 2026.