Why to Earn on Summer.fi?

If you are not compounding, you are decaying. But sometimes it can be hard to know what to do with the assets in your wallet. Thus, the path of least resistance is to just do nothing and HODL.

Too much management

Opening positions that you have to manage and monitor extensively can be risky and time-consuming, but on the other hand, just keeping assets sitting in your wallet is not only boring but also not in your best economic interest.

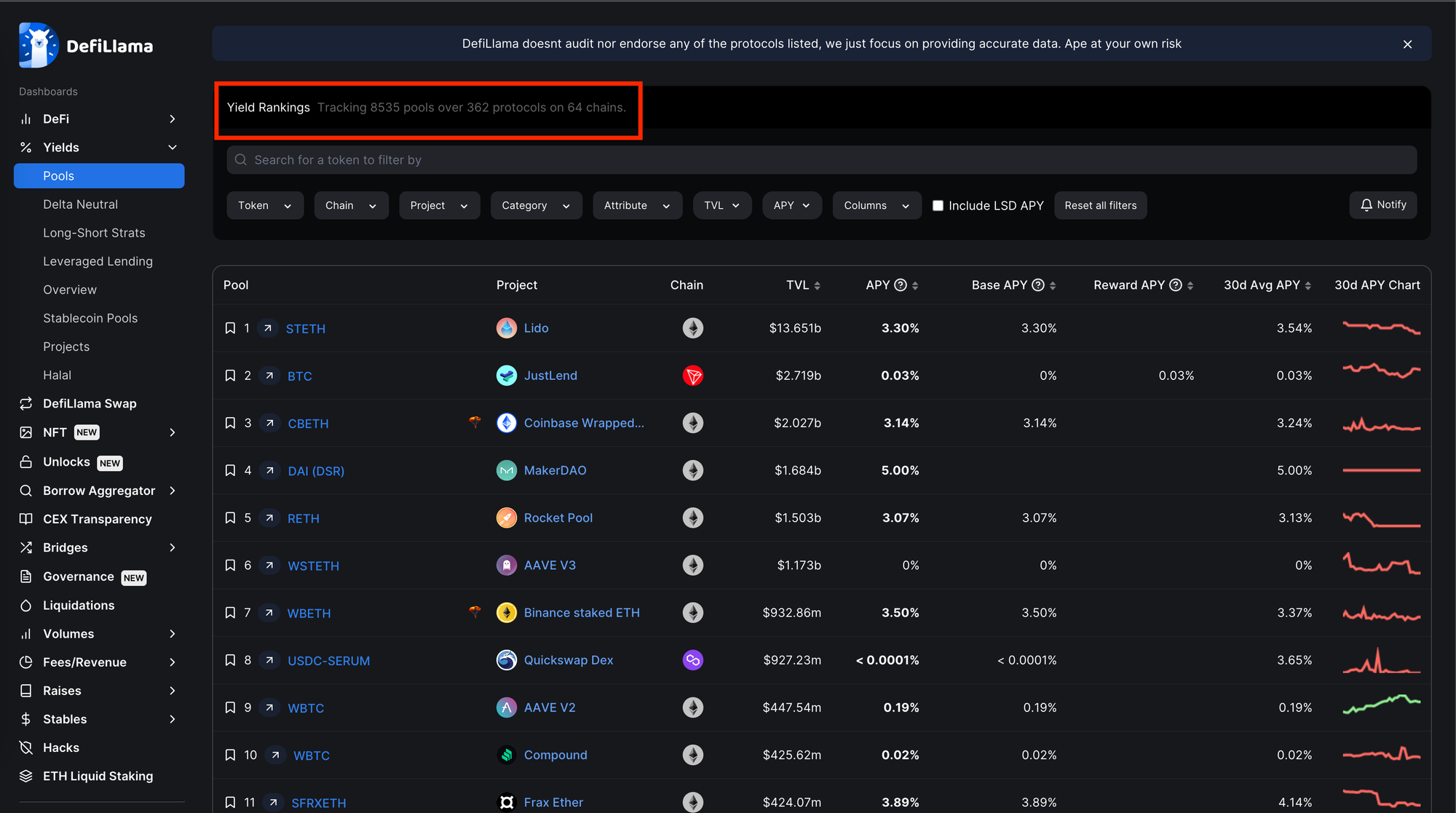

Too time-consuming to find sustainable yield

If you go to DeFillama or any other DeFi dashboard, you are met with a barrage of options. Staking or Liquidity Providing? High APY or High TVL? It’s all very cumbersome, so many resorts to just holding.

Finding the balance between risk and reward

Even if you find the right yield strategy, you are confronted with DeFi’s most frequent and essential question. What are the risks? The reality of the answer to this question really is if you don’t have a technical or economic scenario background. It's just really hard to know.

Finding the correct type of strategy for your portfolio

The holistic view of your portfolio is an important one, something that many DeFi dashboards, apps, and wallets can’t take into account. Thus, they can recommend or surface options for an asset you own that simply does not make sense in your entire portfolio.

Accessing and Earning Sustainable Yield with Summer.fi

With Summer.fi, all the above problems no longer exist; why?

- Summer.fi offers sustainable products that require zero management and those that you can actively manage.

- Summer.fi has a dedicated team that searches for and evaluates the best DeFi Yields so that you don’t have to.

- Summer.fi has a technical team that diligences all of our strategies, though we also offer a range of strategies from passive to active.

- Last but not least, Summer.fi offers a range of products beyond just yield, so that you can construct not just your yield strategy, but your entire portfolio. Which you can then view and monitor on our wholistic portfolio page.

But Why Summer.fi?

On Summer.fi we believe there are four reasons Why you should start depositing your assets to earn.

Getting paid to be patient

No management is required with Summer.fi passive earn strategies. Open a Summer.fi passive earn strategy with your favorite stablecoin and get paid to sit in stables and be patient.

The big why here is super simple. Just sit back and watch your assets compound.

Stacking ETH with Yield Loops

Beyond just hodling, users can stack their ETH without the risk of multiplying their ETH against a stablecoin which can create a real risk of liquidation if not timed correctly.

Summer.fi Yield Loop strategies enable you to enhance your staking yield and manage your position in one transaction, as well as see all the core information about your position that you can’t access on protocol front ends.

That means you get to have full exposure to ETH, whilst earning additional ETH beyond the staking yield rate. This is the perfect crab market strategy.

Stacking Stables with Yield Loops

Not everyone wants ETH or other volatile asset exposure, but at the same time, not everyone wants passive yield on stablecoins. Summer.fi enables you to apply the same yield loop strategy that enhances ETH staking yield to stablecoin yield, for example, the Dai Savings Rate or Ethena’s sUSDe.

That means you can enhance the yield you receive from the DAI savings rate by multiplying your exposure to it up to many multiples.

Getting Paid to Earn and Manage LP Positions

Having assets sit in your wallet is, not always in your economic interest, but its understandable that you might not want to stick to the low-risk, low-effort strategy. Why earn a little bit of yield when you can just hold assets you might ask?

On Summer.fi you can go beyond just a bit of yield with your assets and also get fat juicy APYs while getting paid int tokens to earn yield. What does that mean? it means that you can open an active AJNA Lend position that earns yield as a lending position, as well as earn exclusive token rewards on summer.fi for doing so.

How do I choose the proper Earn position?

Now that you know why to Earn, the question becomes which Earn position is right for you.

In short, you should decide on a pair based on 6 factors:

- Asset Selection: Which asset do you want to deposit and earn in?

- Active or Passive?: Do you want to manage the position or not?

- Protocol: Which protocols do you trust?

- Token rewards: Do you care about earning token rewards as part of the yield?

For a more in-depth guide to choosing the right position, read our full guide here.

For all other common questions and how it works, please visit our Knowledge Base in-depth.

Ready to get started compounding your crypto?

Getting in touch

If you have any questions regarding Summer.fi, contact us at support@summer.fi or our social media.